Estimated Reading Time: 34-37 minutes (6,581 words)

Introduction

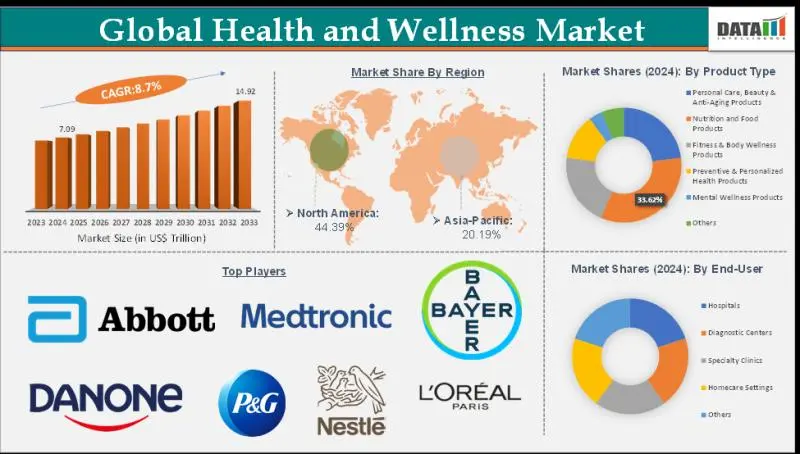

Today’s consumers aren’t just living longer — they’re living healthier, smarter, and more consciously. Across the United States, wellness is no longer a luxury; it has become a central lifestyle priority. From personalized nutrition plans and boutique fitness studios to AI-powered wellness apps and preventive healthcare programs, the U.S. health and wellness market has transformed into a multi-trillion-dollar ecosystem. In fact, the market is projected to grow from USD 939 billion in 2024 to over USD 1.56 trillion by 2033, reflecting a 5.8% CAGR (IMARC Group, 2025). This rapid expansion underscores wellness as not just an individual choice but a global economic driver influencing industries ranging from technology and nutrition to tourism and corporate benefits.

Despite this promising growth, the market faces complex challenges. Chronic diseases like diabetes, obesity, and cardiovascular conditions continue to escalate, while stress, burnout, and mental health issues reach unprecedented levels. Consumers increasingly demand personalized and preventive solutions, yet digital disruption — including AI, wearable tech, and telehealth platforms — is reshaping the delivery and accessibility of these services. The question arises: How will the U.S. health and wellness industry evolve over the next decade to meet these demands while staying profitable and inclusive? Additionally, investors and entrepreneurs are navigating a competitive, rapidly evolving market where trends can shift overnight. Understanding the interplay between consumer behavior, technological innovation, and regulatory frameworks is crucial for anyone looking to capitalize on this booming sector.

This article provides a comprehensive, data-driven roadmap to the future of U.S. health and wellness. Readers will gain insights into emerging trends, key market segments, and actionable investment opportunities. We’ll explore the role of technology, the rise of preventive care, and niche opportunities within fitness, nutrition, mental wellness, and corporate programs. By the end, entrepreneurs, investors, and health-conscious professionals will have a clear understanding of how to strategically position themselves in this rapidly expanding market. Whether you are a startup founder looking for your next big idea, an investor evaluating high-growth sectors, or a consumer navigating wellness options, this guide delivers the information, examples, and actionable steps to thrive in the U.S. health and wellness ecosystem through 2033.

United States Health & Wellness Market — Size & Forecast

The U.S. health and wellness market encompasses a broad spectrum of products, services, and solutions aimed at helping consumers achieve, maintain, and restore overall wellness. This includes core segments like fitness, nutrition, preventive healthcare, mental health services, digital health solutions, wellness tourism, and holistic therapies. Over the past decade, wellness has shifted from being a niche lifestyle choice to a mainstream economic driver, influencing industries from pharmaceuticals and food & beverage to technology and travel.

Market Size & Growth Trajectory

2024 Market Value

- The U.S. health and wellness market was valued at approximately USD 939 billion in 2024, considering core wellness segments such as fitness programs, nutritional supplements, mental wellness services, and preventive care products. (IMARC Group, 2025)

- This reflects growing consumer awareness, higher disposable incomes, and the adoption of preventive and lifestyle-focused wellness solutions.

2033 Market Forecast

- Analysts forecast the market to reach USD 1.56 trillion by 2033, representing a compound annual growth rate (CAGR) of ~5.8% from 2025–2033. (IMARC Group, 2025)

- Other research estimates an even higher figure of USD 2.19 trillion by 2033, when expanded segments like beauty and personal care, anti-aging services, lifestyle coaching, and preventive healthcare innovations are included. (US Web Wire, 2025)

📊 Why the Estimates Differ:

- Market projections vary because analysts use different segmentation frameworks. For example:

- Some consider only traditional wellness categories (fitness, nutrition, preventive care).

- Others include adjacent lifestyle and anti-aging services, corporate wellness programs, and digital health platforms.

- Regardless of segmentation differences, there is consensus on a strong upward trajectory, driven by technological innovation, lifestyle shifts, and a growing focus on holistic health.

Market Segmentation Insights

Breaking down the market by core segments provides a clearer understanding of growth drivers:

| Segment | 2024 Value | CAGR (2025–2033) | Key Drivers |

| Fitness & Activity | USD 110 B | 5.2% | Boutique studios, home workouts, hybrid memberships |

| Nutrition & Supplements | USD 150 B | 6.0% | Functional foods, plant-based nutrition, immunity products |

| Mental Wellness | USD 60 B | 7.1% | Meditation apps, teletherapy, corporate mental health programs |

| Preventive & Personalized Care | USD 180 B | 6.5% | Genetic testing, wearable devices, lifestyle interventions |

| Holistic & Alternative Therapies | USD 45 B | 5.0% | Yoga, Ayurveda-inspired therapies, wellness retreats |

| Digital Health Platforms | USD 70 B | 8.0% | AI-powered apps, virtual coaching, telehealth services |

🔑 Insight: Segments like digital health and personalized preventive care are expected to outpace traditional wellness categories, reflecting consumer demand for convenience, personalization, and technology-enabled solutions.

Factors Driving Market Expansion

- Rising Chronic Disease Awareness: With obesity, diabetes, and cardiovascular conditions on the rise, preventive health solutions are more in demand than ever.

- Technology Adoption: AI, wearables, and mobile apps have transformed self-care, creating new revenue streams.

- Consumer Lifestyle Shifts: A growing emphasis on mindfulness, mental health, and holistic wellness fuels spending across multiple wellness categories.

- Corporate Wellness Programs: Businesses investing in employee well-being have expanded demand for mental health apps, fitness subscriptions, and lifestyle interventions.

- Global Trends & Exports: U.S. wellness brands influence international markets, including India, Europe, and Asia-Pacific, increasing growth potential and investment interest.

Key Takeaway

The U.S. health and wellness market is not just growing; it is evolving. Over the next decade, the integration of technology, preventive care, and lifestyle-focused services will redefine what wellness means for consumers, investors, and businesses. Whether targeting traditional fitness, digital health platforms, or niche wellness experiences, companies entering this space can expect a lucrative market with diverse growth opportunities through 2033.

Key Growth Drivers

The United States health and wellness market is experiencing unprecedented growth, fueled by several structural and consumer-driven factors. Understanding these drivers is essential for businesses, investors, and entrepreneurs looking to capitalize on emerging opportunities.

A. Rising Focus on Preventive Healthcare

Chronic lifestyle diseases — such as diabetes, obesity, cardiovascular disease, and hypertension — are now among the leading causes of morbidity and healthcare expenditure in the U.S. (CDC, 2025).

This rising prevalence has shifted consumer behavior from reactive treatment to preventive care, which includes:

- Nutritional supplements: Vitamins, minerals, and functional foods tailored for immunity, heart health, and metabolic support.

- Fitness programs: From high-intensity interval training (HIIT) and boutique studios to home-based workout subscriptions.

- Holistic lifestyle plans: Programs combining diet, exercise, mindfulness, and sleep optimization to prevent disease before onset.

⚡ Market Insight: IMARC Group reports that preventive healthcare is now a primary driver of market growth, with wellness-focused products and services projected to see double-digit growth in certain sub-segments, particularly nutrition and fitness.

Preventive healthcare not only enhances longevity but also reduces healthcare costs over time, making it attractive to consumers, insurers, and corporates alike.

B. Increased Consumer Health Awareness

Modern American consumers are far more health-conscious and data-driven than previous generations. Mental and physical well-being is increasingly prioritized alongside, or even above, traditional disease treatment. Key trends include:

- Mindfulness & meditation apps: Headspace, Calm, and Insight Timer report over 100 million active users globally, with the U.S. representing the largest segment.

- Nutrition coaching & personalized diet plans: AI-enabled apps provide meal plans tailored to individual genetics, activity levels, and health goals.

- Sleep optimization tools: Devices and apps that track sleep cycles and provide actionable recommendations for better rest.

📊 Market Insight: According to Market Data Forecast, growing awareness of stress, burnout, and lifestyle diseases has created exponential growth in wellness services, particularly digital offerings that blend convenience with personalization.

This rising awareness is translating directly into higher spending on wellness subscriptions, functional foods, and preventive health programs.

C. Aging Population

The U.S. population aged 65 and above is projected to reach 78 million by 2033, representing nearly 20% of the total population (U.S. Census Bureau, 2025).

An aging demographic drives demand for:

- Longevity-focused wellness products: Supplements targeting joint health, immunity, and cognitive function.

- Mobility and fitness solutions: Low-impact exercises, senior-friendly fitness programs, and digital monitoring tools.

- Preventive health services: Early screenings, wearable health monitors, and telehealth check-ins.

🔑 Economic Impact: Precedence Research notes that the senior population is becoming one of the most profitable segments for wellness providers, as they are willing to invest in solutions that maintain independence and quality of life.

D. Digital Innovation & Technology Adoption

Technology is fundamentally transforming the wellness landscape. AI, wearables, and telehealth are creating unprecedented access, personalization, and engagement in wellness solutions:

- Over 1 in 3 Americans use AI tools for managing exercise routines, diet, and health tracking (New York Post, 2025).

- Wearables and smart devices: Apple Watch, Fitbit, Oura Ring, and Garmin track metrics like heart rate, sleep quality, and activity, enabling preventive interventions.

- Telehealth & virtual coaching: From digital mental health therapy to online fitness classes, consumers can access wellness programs remotely, increasing convenience and adoption.

⚡ Market Insight: Digital wellness platforms are among the fastest-growing sub-segments, driven by ease of use, real-time insights, and personalized experiences.

E. Shift Toward Holistic Wellness

Modern consumers increasingly recognize that physical, mental, and emotional health are interconnected. The market has shifted toward integrated, holistic wellness solutions, including:

- Fitness + mental health programs: Yoga studios offering mindfulness, meditation, and nutrition workshops.

- Recovery-focused solutions: Cryotherapy, infrared saunas, and biohacking tools designed for full-body wellness.

- Lifestyle coaching: Personalized programs integrating diet, exercise, stress management, and sleep optimization.

📊 Market Insight: Market Data Forecast highlights that holistic wellness is no longer a niche. Consumers expect 360-degree solutions that address all aspects of health, which in turn drives cross-segment spending on fitness, nutrition, and mental well-being.

Summary of Key Growth Drivers

| Growth Driver | Impact on Market | Examples |

| Preventive Healthcare | High | Functional foods, early diagnostics, lifestyle programs |

| Consumer Health Awareness | High | Mindfulness apps, nutrition coaching, sleep optimization tools |

| Aging Population | Medium-High | Longevity supplements, senior fitness, mobility devices |

| Digital Innovation | High | AI health apps, wearables, telehealth, virtual coaching |

| Holistic Wellness | Medium-High | Integrated fitness & mental health programs, recovery therapies |

💡 Insight: These growth drivers interact synergistically. For instance, an aging population leverages digital tools for preventive care, while holistic wellness programs benefit from increased consumer awareness and tech adoption. This combination creates a self-reinforcing cycle of market expansion.

Major Market Trends

The U.S. health and wellness market is evolving rapidly, driven by technological innovation, changing consumer behavior, and sustainability awareness. Understanding these trends is critical for businesses, investors, and entrepreneurs to stay ahead of the curve.

Trend 1: Technology Integration

The integration of digital platforms, AI-powered wellness tools, and smart wearables is revolutionizing self-care, making wellness more personalized, data-driven, and accessible than ever before.

Key developments include:

- Apps that track sleep, stress, and fitness: Platforms like Calm, Fitbit, MyFitnessPal, and Noom allow users to monitor physical activity, sleep cycles, stress levels, and even mindfulness practice, offering actionable insights.

- Wearables that monitor vitals: Devices like Apple Watch, Oura Ring, Garmin, and WHOOP track heart rate variability, oxygen saturation, activity levels, and recovery metrics — enabling users to proactively manage health.

- Tele-wellness and virtual therapy: Digital solutions offer real-time coaching, therapy, and fitness guidance, breaking geographical and logistical barriers. Examples include Peloton digital classes, Headspace therapy programs, and Teladoc Health telemedicine services.

🔹 Market Insight: According to Reuters, the digital health market in the U.S. is projected to exceed USD 150 billion by 2030, driven by the adoption of wearables and AI-powered wellness platforms (Reuters, 2025).

Impact: Technology integration accelerates engagement, promotes preventive care, and creates new revenue streams through subscriptions, in-app purchases, and data-driven personalized services.

Trend 2: Mental Health & Mindfulness

The pandemic era amplified awareness of mental health, making it a central aspect of wellness. Stress, anxiety, and burnout are increasingly normalized challenges, driving demand for digital and offline mental health solutions.

Key developments:

- Therapy & mindfulness apps: Platforms like Headspace, Calm, BetterHelp, and Talkspace have experienced exponential growth, with Calm alone recording over 150 million downloads worldwide, the U.S being the largest market.

- Corporate wellness programs: Companies are integrating mental health benefits, including virtual therapy, meditation sessions, and stress management programs, to enhance employee productivity and satisfaction.

- Holistic stress management: Sleep improvement, journaling apps, and mindfulness coaching are becoming integral to preventive wellness plans.

🔹 Market Insight: Market Data Forecast projects the mental wellness market segment to grow at 7–8% CAGR through 2033, reflecting sustained consumer demand for stress management and emotional well-being.

Impact: Mental health integration is expanding wellness beyond physical fitness, opening new service categories and monetization opportunities.

Trend 3: Personalized Nutrition & Preventive Lifestyle

Consumers now demand tailored solutions that align with their genetics, health data, and lifestyle choices.

Key developments:

- Personalized diet plans: AI and nutrition apps recommend meals based on activity levels, allergies, metabolic rates, and health goals.

- Genomic and biomarker-based wellness: Companies like 23andMe and DNAfit offer insights into nutrition, metabolism, and disease risk, creating highly personalized preventive strategies.

- Nutrient tracking & subscription services: Personalized vitamin packs and meal-kit subscriptions (e.g., Care/of, Persona Nutrition) are experiencing double-digit growth as consumers value convenience and customization.

🔹 Market Insight: Reddit discussions and industry reports highlight growing adoption of subscription-based nutrition solutions, particularly among millennials and Gen Z who prioritize convenience, sustainability, and personalization.

Impact: Personalized nutrition drives loyalty, recurring revenue, and opportunities for cross-selling complementary products like fitness apps and supplements.

Trend 4: Eco-Friendly & Clean Label Demand

Sustainability and transparency have become critical purchasing drivers for U.S. wellness consumers. Ethical sourcing, natural ingredients, and eco-friendly packaging now influence brand choice.

Key developments:

- Clean label foods & beverages: Consumers increasingly prefer organic, plant-based, and additive-free products. Brands like Huel, RXBar, and Vital Proteins lead in this segment.

- Sustainable packaging: Biodegradable, recyclable, and minimalistic packaging is a significant brand differentiator.

- Ethical and green branding: Socially responsible companies enjoy higher consumer trust and willingness to pay a premium.

🔹 Market Insight: Market.us reports that eco-conscious wellness products are growing at a faster pace than traditional offerings, with millennials and Gen Z driving this trend (Market.us, 2025).

Impact: Sustainability is no longer optional — it directly affects sales, brand loyalty, and investor interest in wellness ventures.

Trend 5: Wellness as a Service (WaaS)

The industry is shifting toward subscription-based models, enabling continuous engagement and predictable revenue.

Examples of WaaS models include:

- Digital fitness classes: Platforms like Peloton, FitOn, and Daily Burn offer monthly memberships with on-demand workouts.

- Tele-nutrition coaching: AI-powered diet consultations and meal planning services with recurring subscriptions.

- Continuous monitoring subscriptions: Wearables and health apps providing ongoing insights, alerts, and coaching.

🔹 Market Insight: Recurring revenue models are attractive for investors, as they provide predictable cash flow and higher customer lifetime value (CLV).

Impact: WaaS creates scalable business models, encourages consumer loyalty, and promotes long-term engagement in wellness ecosystems.

Summary of Key Market Trends

| Trend | Key Drivers | Examples | Market Impact |

| Technology Integration | AI, wearables, telehealth | Apple Watch, Fitbit, Teladoc, Headspace | High engagement, new revenue streams |

| Mental Health & Mindfulness | Stress, anxiety, burnout | Calm, BetterHelp, corporate wellness | Expands wellness beyond fitness |

| Personalized Nutrition | Genomic data, biometrics | Care/of, Persona Nutrition | Recurring revenue, consumer loyalty |

| Eco-Friendly & Clean Label | Sustainability, ethical sourcing | Huel, RXBar, Vital Proteins | Brand trust, premium pricing |

| Wellness as a Service | Subscription models | Peloton, FitOn, tele-nutrition apps | Predictable revenue, long-term engagement |

💡 Insight: These trends are interconnected — technology enables personalization, which aligns with consumer awareness, mental health focus, and eco-conscious preferences, creating a multi-dimensional growth landscape for the U.S. wellness market.

Segment Analysis & Hot Niches

The U.S. health and wellness market is highly diverse, with multiple sub-segments catering to different consumer needs. Understanding these segments is essential for businesses and investors to identify high-growth niches and maximize ROI. Here’s a detailed breakdown of the key categories:

A. Fitness & Activity

The fitness segment remains one of the largest and most dynamic components of the wellness market, fueled by a shift toward personalized, accessible, and experiential workouts.

Key Developments:

- Boutique Studios: Small, specialized gyms and studios focusing on Pilates, barre, functional training, and spin classes are thriving. They offer personalized attention, community engagement, and premium experiences, attracting high-income consumers.

- Home Training: Home gyms, online classes, and subscription-based platforms (e.g., Peloton, Mirror, Tonal) have surged post-pandemic, reflecting demand for convenience.

- Functional Fitness & Hybrid Classes: Mobility training, zone 2 cardio, HIIT, and hybrid in-person/online classes are gaining traction. These programs are designed for strength, endurance, and overall wellness.

📊 Market Insight: According to The Times of India, functional fitness and hybrid training models are expected to grow at 6–7% CAGR through 2033, driven by younger consumers and tech adoption.

Opportunities:

- Fitness apps with AI-driven coaching

- Gamified workouts for engagement

- Corporate wellness partnerships

B. Nutrition & Supplements

Nutrition and dietary supplements form a rapidly expanding segment of the wellness market, driven by health-conscious consumers seeking functional and preventive nutrition.

Key Trends:

- Functional Foods: Foods fortified with probiotics, vitamins, antioxidants, or adaptogens are experiencing high demand. Examples include kombucha, plant-based protein, and superfood powders.

- Protein Snacks & Plant-Based Alternatives: On-the-go protein bars, shakes, and plant-based alternatives are increasingly popular, especially among millennials and Gen Z.

- Dietary Supplements: Vitamins, minerals, and personalized supplement packs (e.g., Care/of, Persona Nutrition) are growing rapidly, leveraging subscription models.

📊 Market Insight: Business Insider reports that protein snacks and functional nutrition are among the fastest-growing segments, projected to reach USD 45–50 billion by 2030, reflecting consumers’ preference for convenience, immunity-boosting foods, and preventive health.

Opportunities:

- Personalized nutrition apps with subscription plans

- Direct-to-consumer nutraceutical brands

- International exports of U.S. functional foods

C. Digital Wellness

Digital wellness is redefining the health market, blending mental, physical, and preventive health solutions through technology.

Key Innovations:

- AI Self-Care Apps: Applications provide personalized recommendations on fitness, nutrition, and mental wellness, often leveraging user data and wearable integration.

- Teletherapy & Mental Health Platforms: Virtual therapy services, mindfulness coaching, and stress management apps are experiencing rapid adoption, particularly in corporate wellness programs.

- Sleep Programs & Recovery Apps: Tools track sleep cycles, recovery metrics, and suggest actionable interventions for better sleep and holistic wellness.

🔹 Market Insight: According to IMARC Group, digital wellness is growing at 8–10% CAGR, with scalability and low operational costs making it highly attractive to startups and investors.

Opportunities:

- Subscription-based digital wellness platforms

- AI-driven personalized health recommendations

- Partnerships with wearables for continuous monitoring

D. Preventive Diagnostics

Preventive diagnostics is emerging as a high-potential niche, moving beyond traditional clinical settings into direct-to-consumer (DTC) healthcare solutions.

Key Developments:

- Wearable Health Monitors: Continuous glucose monitors, heart-rate trackers, and blood pressure devices enable real-time monitoring without visiting a clinic.

- Home Testing Kits: COVID-19 accelerated adoption of at-home testing; now, tests for cholesterol, hormone levels, and vitamin deficiencies are increasingly common.

- Integration with Digital Health: Data from diagnostics is integrated into wellness apps to provide personalized lifestyle recommendations, bridging preventive care and consumer engagement.

📊 Market Insight: IMARC Group highlights that the preventive diagnostics segment is projected to grow at 9% CAGR, reflecting increasing consumer interest in self-managed health and early detection.

Opportunities:

- Subscription-based monitoring services

- Data-driven personalized wellness programs

- Integration with corporate wellness packages

Summary Table: Segment Analysis & Hot Niches

| Segment | Key Drivers | Popular Products/Services | Growth Opportunity |

| Fitness & Activity | Personalization, hybrid models | Boutique studios, online classes, HIIT, mobility training | 6–7% CAGR; corporate & AI-driven workouts |

| Nutrition & Supplements | Functional foods, immunity, convenience | Protein bars, plant-based snacks, vitamins, nutraceuticals | 7–8% CAGR; subscription nutrition |

| Digital Wellness | AI, teletherapy, mental health focus | Wellness apps, sleep programs, virtual coaching | 8–10% CAGR; scalable SaaS models |

| Preventive Diagnostics | Self-monitoring, early detection | Wearables, home testing kits, integrated health dashboards | 9% CAGR; DTC & corporate partnerships |

💡 Insight: These segments often overlap — e.g., digital wellness apps integrate fitness, nutrition, and preventive diagnostics — creating multi-revenue, cross-functional business opportunities.

Top Players & Competitive Landscape

The U.S. health and wellness market is highly competitive, featuring a mix of legacy multinational corporations, specialized wellness brands, and disruptive digital platforms. Companies that combine innovation, digital adoption, personalization, and sustainability are best positioned to capture the rapidly growing market.

A. Key Industry Players (U.S. & Global)

- Abbott Laboratories – Health Tech & Monitoring Devices

- Abbott specializes in diagnostics, wearable health monitors, and preventive care devices, such as FreeStyle Libre for continuous glucose monitoring.

- Competitive Edge: Strong R&D capabilities and FDA-approved technologies give Abbott a leadership position in preventive diagnostics and personalized health.

- Market Insight: Abbott’s health tech segment has experienced >8% CAGR in the past five years, driven by rising chronic disease awareness (IMARC Group, 2025).

- Procter & Gamble (P&G) – Wellness Brands & Personal Care

- P&G owns wellness-oriented personal care brands such as Olay, Vicks, and Oral-B, focusing on skincare, respiratory wellness, and oral health.

- Competitive Edge: Global distribution networks, trusted brand equity, and innovation in clean-label and sustainable products.

- Market Insight: P&G’s wellness portfolio growth aligns with the rising consumer preference for preventive and self-care products (Market.us, 2025).

- Herbalife Nutrition – Nutrition Products

- Specializes in weight management, protein supplements, and personalized nutrition through multi-level marketing and digital platforms.

- Competitive Edge: Focus on direct-to-consumer distribution, coaching programs, and global reach in over 90 countries.

- Market Insight: Herbalife Nutrition continues to capitalize on the personalized nutrition trend, reporting consistent growth in U.S. and emerging markets (Market.us, 2025).

- Nestlé SA & Unilever Plc – Wellness & Nutrition Portfolios

- Both multinational giants have expanded into functional foods, plant-based nutrition, and immunity-boosting products.

- Competitive Edge: Extensive R&D, sustainability initiatives, and global distribution channels allow them to capture diverse consumer segments.

- Market Insight: Nestlé’s health science division and Unilever’s functional nutrition brands have significantly outperformed traditional packaged goods, reflecting changing consumer preferences (Market.us, 2025).

- Digital Wellness Platforms – Tech-Driven Personalization

- Oura Ring: Advanced wearable tracking sleep, recovery, and activity, integrating with health apps for actionable insights.

- Teladoc Health: Offers telemedicine and virtual wellness services, including mental health, chronic condition management, and preventive care.

- Calm & Headspace: Leading mental health and mindfulness apps with subscription models, corporate partnerships, and global user bases.

- Competitive Edge: Digital platforms leverage AI, real-time monitoring, personalization, and scalability to capture fast-growing wellness market segments.

📊 Market Insight: Digital wellness companies are growing at 8–12% CAGR, reflecting strong consumer adoption and lower operational costs compared to traditional wellness businesses.

B. Competitive Landscape Insights

- Digital Ecosystem Leadership:

- Companies investing in integrated digital ecosystems — combining wearables, apps, telehealth, and subscription models — are capturing the largest market share.

- Personalization & Consumer Engagement:

- Brands offering customized nutrition, fitness, and wellness plans are outperforming generic offerings. Personalization fosters higher retention, recurring revenue, and brand loyalty.

- Sustainability & Ethical Practices:

- Eco-conscious consumers increasingly prefer brands emphasizing sustainable sourcing, clean-label ingredients, and ethical production. Companies integrating ESG principles gain competitive advantage.

- Corporate Wellness & B2B Opportunities:

- Partnerships with employers for employee wellness programs are expanding market penetration, creating long-term, high-value contracts.

C. Market Share Snapshot (Illustrative)

| Company | Segment Focus | Competitive Edge | Estimated U.S. Market Share |

| Abbott Laboratories | Diagnostics & Preventive Care | FDA-approved wearables & monitoring devices | ~8% |

| Procter & Gamble | Personal Care & Wellness | Brand trust, sustainability | ~6% |

| Herbalife Nutrition | Nutrition & Supplements | D2C distribution, coaching programs | ~5% |

| Nestlé SA | Nutrition & Functional Foods | Global R&D, plant-based nutrition | ~4% |

| Unilever Plc | Wellness & Nutrition | Sustainability, functional food portfolio | ~3% |

| Oura, Teladoc, Calm, Headspace | Digital Wellness | Personalization, AI-driven solutions | ~6–7% combined |

💡 Insight: Traditional wellness brands retain strong presence, but digital-first platforms are rapidly gaining share, particularly among younger, tech-savvy consumers. The companies that blend physical products, digital tools, and personalized services are best positioned for long-term growth.

Investment Opportunities in the U.S. Health & Wellness Market

The U.S. health and wellness market is one of the most attractive sectors for investors, offering opportunities across technology, preventive care, nutrition, and experiential services. With projected growth to USD 1.56–2.19 trillion by 2033, the market provides both high-growth returns and diversification across sub-sectors.

Opportunity 1: AI & Digital Health Platforms

Why it’s attractive:

- Over 35% of Americans now use AI-driven tools to manage their health, from fitness routines to meal planning (New York Post, 2025).

- Digital wellness platforms can scale quickly, offering subscription-based models with high customer retention.

Key segments for investment:

- Telemedicine & virtual health: Companies like Teladoc Health and MDLIVE are redefining preventive and chronic care management.

- AI-driven self-care apps: Platforms offering personalized fitness, nutrition, and mental wellness recommendations.

- Wearables & monitoring integration: Startups integrating data from smart watches, rings, and IoT devices to deliver actionable health insights.

Investor Takeaway:

Digital health startups offer high scalability, lower overhead, and data monetization opportunities, making them a top choice for venture capital, private equity, and strategic corporate investments.

Opportunity 2: Preventive Diagnostics

Why it’s attractive:

- Increasing consumer awareness of chronic conditions is driving adoption of at-home and wearable diagnostics.

- Direct-to-consumer (DTC) monitoring tools, including continuous glucose monitors, blood pressure trackers, and wearable ECG monitors, allow for personalized preventive care outside traditional clinical settings (IMARC Group, 2025).

Key segments for investment:

- Wearable diagnostics: Products like Abbott’s FreeStyle Libre and Withings health monitors are expanding rapidly.

- Genomic & biomarker testing: Companies offering home-based DNA tests for nutrition, disease risk, and fitness optimization.

- Integration with wellness apps: Diagnostics combined with AI-driven coaching can generate recurring subscription revenue.

Investor Takeaway:

Preventive diagnostics provides a high-growth market niche, particularly for tech-enabled health solutions, with strong appeal for investors focused on long-term trends in personalized medicine.

Opportunity 3: Wellness Tourism & Retreats

Why it’s attractive:

- The U.S. wellness tourism industry is booming, combining luxury travel, holistic health services, and experiential retreats.

- Wellness-focused experiences, including yoga retreats, detox programs, and mindfulness resorts, are increasingly popular among affluent millennials and Gen Z travelers.

Key segments for investment:

- High-end wellness resorts & retreats: Resorts offering integrated nutrition, fitness, mental wellness, and spa services.

- Experiential programs: Packages combining adventure travel, mindfulness workshops, and fitness boot camps.

- Corporate wellness travel: Retreats and workshops designed for team-building, stress reduction, and employee productivity.

Investor Takeaway:

Wellness tourism allows for premium pricing, brand differentiation, and cross-sector revenue (hospitality + wellness services), making it a lucrative niche for investors seeking both lifestyle alignment and profitability.

Opportunity 4: Nutrition & Functional Foods

Why it’s attractive:

- Consumers are increasingly seeking functional, nutrient-dense, and convenience-oriented foods, reflecting a focus on preventive and holistic health.

- The functional foods and nutraceuticals market in the U.S. is projected to grow at 6–8% CAGR, driven by immunity, protein, and plant-based trends (Business Insider, 2025).

Key segments for investment:

- Protein-rich snacks and meal replacements: Brands like RXBar, Huel, and Quest Nutrition have strong traction.

- Nutraceuticals & supplements: Personalized vitamin subscriptions (e.g., Care/of, Persona Nutrition) meet demand for customized wellness solutions.

- Plant-based & clean-label foods: Products with organic, non-GMO, and sustainably sourced ingredients appeal to eco-conscious consumers.

Investor Takeaway:

Functional nutrition offers recurring revenue potential, brand loyalty, and opportunities for cross-border expansion, particularly into markets like India, where wellness and preventive nutrition trends are growing rapidly.

Additional Emerging Investment Niches

- Corporate Wellness Programs: B2B opportunities for subscription-based mental health, fitness, and nutrition services.

- Holistic & Integrative Wellness: Yoga studios, recovery therapies, cryotherapy, and wellness coaching.

- Sleep & Recovery Solutions: Smart mattresses, sleep tracking, and recovery-focused technologies.

- Eco-Conscious Products & Services: Sustainable packaging, zero-waste brands, and plant-based solutions.

💡 Insight: The most successful investments will combine technology, personalization, recurring revenue models, and sustainability, creating multi-layered growth opportunities across both B2C and B2B channels.

Challenges & Risks in the U.S. Health & Wellness Market

While the U.S. health and wellness market offers enormous growth potential, investors, entrepreneurs, and consumers must navigate a range of regulatory, economic, and market challenges. Understanding these risks is critical to building sustainable and profitable wellness ventures.

A. Regulatory Hurdles

Overview:

The regulatory environment for wellness products in the U.S. is complex. While the FDA (Food & Drug Administration) has eased oversight for low-risk wellness tools, products making explicit medical claims—such as disease prevention or treatment—must undergo rigorous approval processes (Reuters, 2025).

Key challenges:

- Medical Claims Compliance: Wearables, supplements, and health apps must avoid unverified claims about curing or preventing disease. Non-compliance can lead to recalls, fines, and reputational damage.

- Data Privacy & HIPAA Regulations: Digital wellness platforms handling sensitive health data must comply with HIPAA and other privacy laws, which can increase operational costs and limit data monetization.

- FDA Approval Timelines: Clinical-grade diagnostic tools (e.g., at-home glucose monitors or heart monitors) require lengthy validation, slowing time-to-market.

Investor Implication:

Investors should evaluate regulatory risk early, partner with compliant manufacturers, and focus on products/services classified as “general wellness” to mitigate potential legal exposure.

B. Accessibility Gaps

Overview:

Wellness services often disproportionately favor higher-income consumers, creating a gap in access for middle- and lower-income populations.

Key challenges:

- High Cost of Premium Services: Boutique fitness studios, personalized nutrition programs, and luxury wellness retreats are often prohibitively expensive for many Americans.

- Digital Divide: Access to wearable devices, telehealth, and wellness apps requires smartphones, reliable internet, and tech literacy, limiting adoption among underserved communities.

- Insurance Coverage Limitations: Many wellness services are not covered by insurance, further restricting accessibility.

Market Implication:

Brands that develop affordable, scalable wellness solutions—such as subscription-based apps, community gyms, or tele-nutrition programs—can capture untapped segments, increasing both impact and market share.

C. Market Saturation & Competition

Overview:

The U.S. wellness market has low barriers to entry in some segments, leading to intense competition, especially in supplements, fitness apps, and digital wellness platforms.

Key challenges:

- Product Differentiation: Standing out in a crowded market is critical. Generic supplements or standard fitness apps struggle to build loyalty without unique value propositions, such as AI personalization, integrated ecosystems, or sustainability branding.

- Customer Retention: Subscription-based wellness services face churn risks if consumers perceive limited value or inadequate results.

- Price Wars: High competition can drive down margins, especially in commoditized areas like protein supplements, vitamins, and general wellness apps.

Market Implication:

Successful players differentiate through innovation, personalization, high-quality content, and brand trust. Strategic partnerships, influencer marketing, and integrated wellness ecosystems are key strategies to reduce saturation risks.

D. Other Emerging Risks

- Economic Volatility: Recessions or inflation can impact discretionary spending on wellness services. Premium gyms, retreats, and high-cost nutrition subscriptions may see temporary declines in demand.

- Technological Disruption: Rapid tech advances can render devices or apps obsolete if companies fail to continuously innovate.

- Consumer Skepticism: Increasing awareness of false claims and low-quality products means companies must invest in transparency, certifications, and evidence-based solutions.

E. Mitigation Strategies for Investors & Entrepreneurs

| Challenge | Mitigation Strategy |

| Regulatory Hurdles | Partner with FDA-compliant manufacturers, focus on general wellness, hire regulatory experts |

| Accessibility Gaps | Develop scalable, affordable digital solutions, offer tiered pricing, collaborate with insurers |

| Market Saturation | Innovate with AI, personalization, and integrated services; leverage branding and social proof |

| Economic Volatility | Diversify product/service portfolio, focus on subscription models with recurring revenue |

| Technological Obsolescence | Continuous R&D, adopt modular tech platforms, stay ahead of digital wellness trends |

| Consumer Skepticism | Provide clinical evidence, transparent labeling, and third-party certifications |

💡 Insight: While challenges exist, companies that proactively address regulation, accessibility, differentiation, and technology adoption can thrive in the highly competitive U.S. wellness market, delivering both financial returns and consumer impact.

FAQs Section

1. What is the U.S. health and wellness market size in 2025?

The U.S. health and wellness market is one of the largest globally, encompassing fitness, nutrition, preventive care, digital health, mental wellness, and holistic services. Core wellness segments alone were valued at approximately USD 939 billion in 2024, according to IMARC Group.

Breakdown of major components:

- Fitness & Activity: ~USD 100–120 billion, including gyms, boutique studios, and digital fitness platforms.

- Nutrition & Supplements: ~USD 60–80 billion, driven by protein products, nutraceuticals, and plant-based diets.

- Digital Wellness: ~USD 50 billion, fueled by AI apps, mental health platforms, and telehealth services.

- Preventive Diagnostics: ~USD 25–30 billion, including home-based monitoring tools and wearables.

⚡ Insight: The market has consistently grown at ~5–6% CAGR over the past five years, reflecting rising consumer awareness, technological adoption, and demand for preventive and holistic solutions.

2. What’s the projected market value by 2033?

Forecasts suggest that the U.S. wellness market could reach:

- USD 1.56 trillion according to IMARC Group (focusing on core segments).

- USD 2.19 trillion when including expanded sub-segments such as anti-aging, beauty, lifestyle services, and eco-friendly products (US Web Wire).

Key drivers behind this growth:

- Aging population: Seniors (65+) projected to reach ~78 million by 2033.

- Preventive health adoption: Consumers prioritizing early intervention.

- Digital wellness expansion: AI, wearables, and telehealth apps enabling personalized and scalable solutions.

- Sustainability and clean-label demand: Increasingly influencing consumer choices.

📊 CAGR: Overall market is projected to grow at 5.8–7% CAGR between 2025 and 2033.

3. What’s driving this growth?

Several interconnected factors are fueling market expansion:

- Preventive Healthcare: Shift from reactive medical treatment to proactive wellness. Products like glucose monitors, nutrition apps, and fitness trackers exemplify this trend.

- Digital Innovation & Tech Adoption: Over 35% of Americans use AI tools to manage health, including telemedicine and digital coaching apps.

- Aging Population: Older adults drive demand for longevity-focused supplements, mobility solutions, and chronic disease prevention.

- Rising Wellness Awareness: Consumers are increasingly investing in mental health, mindfulness, and holistic well-being, not just physical fitness.

- Lifestyle & Social Influence: Social media, influencer marketing, and wellness culture amplify consumer adoption.

💡 Example: Digital wellness apps like Calm, Headspace, and Oura Ring have rapidly scaled by combining technology with holistic health offerings.

4. Are wellness apps popular in the U.S.?

Yes. The U.S. has one of the largest digital wellness markets globally.

Highlights:

- AI-assisted wellness tools guide users on nutrition, sleep, and exercise.

- Therapy apps and mental health platforms like BetterHelp and Talkspace provide accessible, affordable counseling.

- Fitness apps with subscription models, such as Peloton, FitOn, and MyFitnessPal, have millions of active users.

📊 Statistic: Over 1 in 3 Americans now rely on some form of digital tool to monitor health, reflecting rapid adoption (New York Post, 2025).

5. Is the digital wellness segment profitable?

Highly profitable. Digital wellness platforms benefit from:

- Recurring revenue models through subscriptions.

- Low operational overhead compared to physical gyms or clinics.

- Scalability to global users without geographic limitations.

- Integration with wearables and AI tools, adding value for premium users.

💡 Example: Calm reported over USD 150 million in annual revenue, driven primarily by subscriptions, corporate wellness contracts, and premium content.

6. Which consumers spend most on wellness?

- Middle- to high-income individuals (annual household income > USD 75,000) dominate spending on premium wellness services and products.

- Aging adults (65+) prioritize preventive and longevity-focused products, including nutrition supplements and mobility aids.

- Millennials & Gen Z are tech-savvy and subscription-oriented, driving digital wellness, fitness apps, and personalized nutrition.

📊 Insight: Combining high disposable income with tech adoption and wellness awareness defines the most profitable consumer segments.

7. Can Indians invest in the U.S. wellness market?

Yes. Opportunities exist through:

- Public Equities: Investing in companies like Abbott, Nestlé, Peloton, Calm, and Teladoc via U.S. stock exchanges.

- Startups & Venture Capital: Partnering with or funding U.S.-based wellness tech startups with global scalability.

- Cross-border Wellness Services: Launching products targeting Indian-American or global wellness consumers, including digital apps, nutrition products, and telehealth platforms.

💡 Tip: Understanding regulatory requirements and currency risk is critical for Indian investors targeting U.S. wellness ventures.

8. What are the top niches to invest in?

High-growth investment areas include:

- AI & Digital Health Platforms: Telehealth, fitness apps, and AI-driven self-care.

- Preventive Diagnostics: Wearables, biomarker monitoring, and at-home health kits.

- Nutrition Products & Functional Foods: Protein-rich snacks, nutraceuticals, plant-based foods.

- Virtual & Experiential Wellness Services: Meditation programs, online coaching, and wellness retreats.

- Sustainability & Clean-Label Products: Eco-conscious supplements, packaging, and plant-based offerings.

📊 Insight: Combining digital solutions with preventive health or nutrition trends maximizes scalability, retention, and investor returns.

9. Is preventive healthcare different from traditional healthcare?

Yes. The distinction lies in approach and timing:

| Feature | Preventive Healthcare | Traditional Healthcare |

| Goal | Avoid disease, maintain wellness | Treat illness after onset |

| Tools | Wearables, health apps, nutrition, fitness | Hospital visits, medication, surgery |

| Consumer Role | Active participation, self-monitoring | Passive treatment under physician guidance |

| Cost Focus | Reduces long-term healthcare expenses | Often reactive and costly |

💡 Example: Using a continuous glucose monitor and personalized nutrition plan is preventive, whereas taking medication after diabetes diagnosis is reactive.

10. How does culture influence wellness trends?

- Lifestyle Aspirations: Americans increasingly adopt wellness as part of status, self-improvement, and social identity.

- Social Media & Influencers: Platforms like Instagram, TikTok, and YouTube accelerate adoption of fitness trends, diets, and mindfulness practices.

- Workplace Culture: Corporate wellness programs normalize wellness behaviors and create habit loops for employees.

- Generational Preferences: Gen Z prioritizes digital-first, personalized, and sustainable solutions, while older generations emphasize longevity and preventive care.

📊 Insight: Cultural awareness is critical for wellness brands to tailor products, messaging, and channels to specific demographic segments.

11. How important is sustainability in wellness products?

- Extremely important. Consumers increasingly prefer eco-friendly, clean-label, and ethically sourced products.

- Examples: Plant-based protein powders, biodegradable packaging, cruelty-free supplements, and carbon-neutral wellness products.

- Market Impact: Brands with strong sustainability positioning command premium pricing and stronger loyalty (Market.us, 2025).

💡 Tip for Investors: Companies integrating sustainability + tech + personalization are often the most attractive for growth and long-term market share.

Summary

- The U.S. health and wellness market is projected to reach USD 1.56–2.19 trillion by 2033, reflecting robust, sustained growth across multiple segments (IMARC Group, 2025).

- Preventive healthcare is a major driver, with consumers increasingly focusing on avoiding illness through fitness, nutrition, and regular monitoring.

- Digital innovation, including AI tools, telehealth, wellness apps, and wearables, is transforming accessibility, personalization, and engagement.

- Consumer wellness awareness — mental health, mindfulness, and holistic well-being — is shaping demand for new products and services.

- Key high-growth niches include AI-driven wellness platforms, nutrition & functional foods, preventive diagnostics, and personalized wellness services.

- Opportunities exist for both businesses and investors, particularly those combining technology, subscription models, personalization, and sustainability, to capture long-term market share.

Conclusion

The United States health and wellness market is set for sustained, multi-trillion-dollar growth through 2033, driven by a convergence of consumer priorities, technological innovation, and lifestyle trends. As Americans increasingly embrace preventive healthcare, there is rising demand for fitness, nutrition, mental well-being, and holistic health solutions that empower individuals to take control of their own health.

Key growth drivers include:

- Preventive care adoption, reducing reliance on reactive medical treatments and emphasizing longevity, mobility, and chronic disease prevention.

- Digital transformation, including AI-driven apps, wearables, telehealth, and virtual coaching, which make wellness personalized, scalable, and accessible.

- Integrated wellness experiences, where physical health, mental wellness, nutrition, and lifestyle solutions are combined into cohesive offerings.

Investment opportunities in this sector are extensive:

- AI and digital health platforms that scale globally with subscription models.

- Preventive diagnostics enabling personalized monitoring and early intervention.

- Nutrition and functional foods capitalizing on growing consumer demand for convenience, immunity, and plant-based solutions.

- Experiential wellness offerings like retreats, corporate programs, and hybrid digital-physical fitness services.

Despite challenges such as regulatory hurdles, accessibility gaps, and market saturation, companies that prioritize innovation, personalization, sustainability, and data-driven insights are likely to capture significant market share.

💡 Final Insight: With evolving consumer behaviors, a tech-enabled ecosystem, and growing investor interest, the U.S. health and wellness sector stands out as one of the most dynamic and promising global markets, offering long-term opportunities for brands, startups, and investors alike.

Sources

Here are the reliable sources cited (and some additional high‑authority references) you can use to back up your blog content on the United States Health & Wellness Market 2033:

Market Size & Forecast

- U.S. Health & Wellness Market Size & Forecast — IMARC Group:

U.S. Health and Wellness Market Size & Forecast (2025–2033) — IMARC Group Report Summary- Covers core U.S. wellness market valuation (USD 939 billion in 2024) and projected growth to USD ~1.56 trillion by 2033. IMARC Group

- Global Health & Wellness Market Trends — Market.us:

Global Health & Wellness Market Size and Trends Overview (Market.us)- Provides forecast for the global health & wellness market and key drivers like wearable devices, wellness tourism, and consumer spending patterns. Market.us

- Expanded Market Forecast — Precedence Research:

Health & Wellness Market Overall Global Forecast (Precedence Research)- Offers long‑range outlook to 2034 with U.S. figures and segment drivers. Precedence Research

- Corporate Wellness Segment Forecast — IMARC Group:

U.S. Corporate Wellness Market Growth Forecast (2025–2033)- Focused insight on corporate wellness programs as part of broader wellness industry growth. Industry Today

Industry Trends & Consumer Behavior

- AI Usage for Health & Wellness (Survey) — New York Post:

Over 1 in 3 Americans Use AI to Manage Their Health (Survey)- Data showing consumer adoption of AI for wellness planning, meal ideas, and exercise routines. New York Post

- FDA Regulatory Shift on Wellness Tools — Reuters:

U.S. FDA Eases Regulation on Wearables & Fitness Tools- Latest guidance changing how devices and apps are regulated in the wellness market. Reuters

Global Market Context

- Global Health & Wellness Outlook to 2033 — IMARC Group:

Global Health & Wellness Market Forecast (IMARC Group)- Shows global market size and North America’s dominant share. IMARC Group

- Global Digital Health Market Growth — IMARC Group:

Global Digital Health Market to USD 1.91 Trillion by 2033- A broader digital health perspective relevant to the U.S. wellness tech ecosystem. IMARC Group

Additional Relevant Data (Optional Enhancers)

- Wellness Tourism & Spa Growth Insight — Wikipedia/Day Spa industry data:

U.S. Spa & Wellness Services Growth Insight (Wikipedia)- Useful for wellness experiences and tourism segments. Wikipedia

- Future of Wellness Consumer Behavior — McKinsey Wellness Survey:

McKinsey Future of Wellness Trends Survey (2025)- Indicates how consumer priorities and segments are changing globally and in the U.S. McKinsey & Company