Estimated Reading Time: 38-42 minutes (7,325 words)

Introduction

The electric vehicle (EV) market in Australia reached a historic milestone in 2025, surpassing 100,000 total EV sales for the first time in a single calendar year. This landmark achievement reflects a significant shift in consumer behavior, signaling growing confidence in electric mobility, wider vehicle options, and improvements in charging infrastructure across the country. EVs are no longer a niche product; they are increasingly becoming mainstream choices for urban commuters, environmentally conscious consumers, and fleet operators.

December 2025, in particular, marked a pivotal moment in the market. BYD — one of China’s leading electric vehicle manufacturers — emerged as the month’s top-selling EV brand, outselling global heavyweights such as Tesla and Volkswagen. This is especially noteworthy because BYD’s rise illustrates the growing influence of Chinese EV brands in mature foreign markets, where Tesla had previously dominated. The surge in BYD sales was driven by its competitive pricing, a diversified lineup ranging from compact hatchbacks to SUVs, and strategic expansion into Australia’s urban and suburban markets.

Australia’s EV adoption is being fueled by a combination of government incentives, increasing environmental awareness, and declining battery costs, making EVs more accessible than ever before. Consumers are now choosing EVs not only for sustainability but also for their lower total cost of ownership, reduced maintenance needs, and performance advantages over traditional internal combustion engine vehicles.

In this comprehensive blog post, we will:

- Analyze the latest sales data, highlighting which brands and models led the market in December 2025.

- Identify the key factors driving EV adoption in Australia, including infrastructure, government policies, and consumer preferences.

- Examine the implications of these trends for global markets, with a special focus on India, where EV adoption is accelerating but still in a growth phase.

- Provide expert insights and forecasts for the next decade of EV expansion, including technological innovations, market strategies, and policy impacts.

By the end of this article, readers will gain a 360-degree understanding of the current state of the EV market, discover actionable insights for buyers and investors, and learn how emerging trends may shape the global EV landscape — particularly for India, which is poised to become one of the world’s fastest-growing EV markets.

Australia’s EV Sales Snapshot – 2025

The Australian automotive market witnessed a dynamic shift in 2025, driven largely by the accelerated adoption of electric vehicles (EVs). The total new vehicle sales for the year reached approximately 1,209,808 units, reflecting moderate growth over 2024 and signaling a resilient demand for both internal combustion engine (ICE) vehicles and EVs. (Autotalk Australia)

EV Market Share & Segmentation

Electric vehicles, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), have emerged as a significant portion of new vehicle sales in Australia:

- EV share of total vehicle sales: Estimated at 11–12%, up from ~8% in 2024, marking a 50% year-on-year growth in market penetration. (Electric Vehicle Council)

- BEVs accounted for the majority of EV sales, highlighting a clear shift away from hybrids toward fully electric options as battery technology improves and range anxiety diminishes.

- PHEVs maintained a strong niche, appealing to consumers seeking transitional technology between ICE vehicles and full EVs.

Fleet Size & Market Momentum

By late 2025, Australia’s EV fleet exceeded 410,000 vehicles on the road, representing not just new sales but also cumulative adoption over previous years. (Sustainability Matters)

- Record monthly sales: EV sales surpassed 100,000 cumulative units earlier in the year (by September), demonstrating that EV adoption is accelerating faster than in previous years.

- Regional adoption patterns: High adoption rates were observed in urban centers like Sydney, Melbourne, and Brisbane, where charging infrastructure is more developed. Regional uptake remains lower, highlighting the importance of expanding fast-charging networks to support nationwide growth.

EV vs ICE Growth

While overall vehicle sales in 2025 grew modestly (~1–2% YoY), EV sales surged, showing that EV adoption is outpacing traditional ICE vehicles in growth rate, even if overall market share remains a fraction of the total fleet. This trend mirrors global adoption patterns, where markets such as Europe and China are seeing EV growth rates of 30–50% annually in some segments.

Policy & Incentive Impact

Australia’s growth has been partly fueled by government initiatives, such as:

- State-based subsidies and rebates for new EV purchases.

- Reduced registration fees and tax incentives for low-emission vehicles.

- Public investment in charging infrastructure, including fast chargers along highways and urban centers.

However, despite these efforts, Australia still trails mass-market targets necessary to meet long-term emissions goals, such as achieving 50% of new car sales from EVs by 2030. (Xinhua News)

Key Takeaways from 2025

- EV adoption is growing at double-digit rates, with both BEVs and PHEVs contributing to increased market penetration.

- Urban adoption is strong, but rural and regional markets remain underpenetrated due to charging infrastructure gaps.

- Government incentives and growing model availability are critical drivers, yet long-term targets will require broader consumer adoption and infrastructure expansion.

- The growth trajectory observed in Australia offers insights for India, where EV adoption is accelerating, but challenges in affordability, charging infrastructure, and regional availability remain similar.

BYD’s December Sales Leadership

December 2025 proved to be a breakthrough month for BYD in Australia, cementing the brand’s position as a dominant force in the country’s rapidly growing electric vehicle (EV) market. BYD’s success is not just a reflection of strong consumer demand — it also highlights broader shifts in global EV leadership, as Chinese brands increasingly challenge traditional market leaders like Tesla.

December 2025 Sales Data

- Total vehicles sold (all powertrains): ~101,513 units.

- Total EVs sold: ~10,384 units.

- Battery electric vehicles (BEV) share of total December sales: ~8.3%, up from 7.4% in 2024. (Reddit – Australia EV market)

These figures indicate that BYD accounted for a significant portion of the EV market, outpacing other international brands in combined monthly sales, and driving double-digit growth relative to prior months.

Top-Selling BYD Models

BYD’s success was fueled by strategic positioning of its most popular EVs, which offer competitive pricing, advanced battery technology, and appealing features for Australian consumers:

| Model | Key Features | Why It Sold Well |

| Sealion 7 | Mid-size SUV, 500 km range, advanced ADAS | Popular for family use and urban commuting |

| Atto 2 | Compact SUV, 430 km range, fast charging | Ideal for city drivers seeking affordability + performance |

| Seal | Executive sedan, 550 km range, premium tech | Captures higher-end segment, appealing to Tesla switchers |

BYD’s combined monthly EV sales across these models exceeded Tesla’s cumulative December sales, demonstrating the effectiveness of model diversification and pricing strategy.

Tesla vs BYD

While Tesla maintained a strong presence with the Model 3 and Model Y, BYD’s strategy of offering value-oriented, feature-rich alternatives across multiple vehicle segments allowed it to surpass Tesla in monthly cumulative sales:

- Tesla Model Y: ~1,998 units sold in December.

- Tesla Model 3: ~587 units sold.

- BYD combined: ~4,000+ units across top models.

This leadership indicates a shift in consumer preference toward EVs that offer both affordability and versatility, rather than premium branding alone.

Key Factors Behind BYD’s December Success

- Value-for-Money Proposition: BYD’s models are priced competitively compared to Tesla, appealing to a broader audience.

- Model Variety: From compact city cars to mid-size SUVs and premium sedans, BYD covers multiple segments simultaneously.

- Local Availability & Dealership Expansion: BYD increased its dealership footprint in key Australian urban markets, improving accessibility and test-drive opportunities.

- Technology & Range: Long-range batteries and advanced driver-assistance systems (ADAS) make BYD EVs highly attractive to both new EV buyers and Tesla switchers.

- Consumer Awareness & Marketing: Aggressive marketing campaigns highlighting affordability, features, and government incentive compatibility helped boost demand.

Implications for Australia & India

- For Australia: BYD’s rise signals the growing dominance of Chinese EV brands in international markets, particularly where affordability and model range are prioritized.

- For India: This trend offers a preview of the potential competitive landscape, as BYD and other Chinese EV brands expand aggressively in India. Indian consumers may see similar value-oriented EV options competing with Tata, Mahindra, and MG, particularly in the SUV and sedan segments.

✅ Key Takeaways

- December 2025 marked BYD’s clear market leadership in Australia, surpassing Tesla through strategic model variety and pricing.

- Consumers are prioritizing range, features, and affordability, creating opportunities for competitive EV brands.

- The trend underscores the global rise of Chinese EVs, which will influence emerging markets like India over the next 5–10 years.

Brand & Model Breakdown

Australia’s EV market in December 2025 showcased a diverse mix of electric vehicles, reflecting both consumer demand for range, affordability, and advanced technology. BYD dominated the monthly sales charts, not only with a single best-selling model but with multiple entries in the top 10, illustrating broad appeal across SUV, sedan, and compact segments.

Top EVs in December 2025 (Australia)

| Model | Units Sold | Segment / Key Features | Why It Sold Well |

| BYD Sealion 7 | ~2,546 | Mid-size SUV, 500 km range, ADAS, fast charging | Popular among families and urban commuters; strong value-for-money proposition |

| Tesla Model Y | ~1,998 | Compact SUV, 480 km range, premium features | Trusted brand with loyal fanbase; appealing to tech-savvy buyers |

| Tesla Model 3 | ~587 | Sedan, 450 km range, autopilot | Entry-level luxury EV, strong resale value, widely recognized |

| BYD Atto 2 | ~531 | Compact SUV, 430 km range, smart features | Affordable SUV option; attractive to city drivers seeking performance + tech |

| BYD Seal | ~413 | Executive sedan, 550 km range, premium interior | Premium alternative to Tesla Model 3; high-tech features at lower cost |

| Zeekr 7X | ~293 | Luxury SUV, 520 km range, advanced infotainment | Niche luxury segment; appeals to premium-conscious consumers |

| BYD Atto 3 | ~270 | Compact hatchback, 400 km range, fast charging | Affordable city car; suitable for first-time EV buyers |

| BYD Dolphin | ~265 | Small hatchback, 380 km range, urban-friendly | Economical, compact, ideal for short commutes |

| Kia EV5 | ~246 | Compact SUV, 420 km range, smart features | Competitive pricing and growing brand awareness in Australia |

| Toyota bZ4X | ~183 | SUV, 400 km range, hybrid tech | Reliable brand reputation; appeals to conservative buyers seeking durability |

📊 Key Insights:

- BYD dominates the top 10, holding 4 out of 10 spots with a mix of mid-size SUVs, sedans, and hatchbacks, demonstrating cross-segment appeal.

- Tesla’s presence remains strong, particularly in the premium SUV and sedan segments, but BYD’s volume advantage reflects consumer preference for affordable EVs with long-range and tech features.

- Other brands, such as Zeekr, Kia, and Toyota, occupy niche segments — appealing to luxury buyers, city commuters, or brand-loyal consumers.

Implications for Consumers & Investors

- For Australian Buyers: Wide EV choices now exist across price points and vehicle types, meaning buyers no longer need to compromise between affordability and range.

- For Indian Market Trends:

- BYD’s diverse model portfolio indicates how Chinese EV brands may compete with Tata, MG, and Mahindra in India.

- Affordable SUVs and sedans like the Atto 2 and Seal could appeal to Indian urban and semi-urban buyers if localized pricing is competitive.

- BYD’s diverse model portfolio indicates how Chinese EV brands may compete with Tata, MG, and Mahindra in India.

- Investment Opportunities: Companies with a broad EV model range, strong battery tech, and aggressive marketing strategies are likely to gain faster market share, both in Australia and emerging markets such as India.

Market Takeaways

- BYD’s multi-segment approach enables it to capture both value-conscious and premium buyers.

- Tesla continues to dominate the premium segment, but high prices limit its volume growth in markets like Australia.

- The top 10 EV list highlights the importance of range, technology, and affordability — the three key factors driving adoption in mature and emerging EV markets.

What This Means for the Australian EV Market

Australia’s EV market is at a pivotal moment. The record-breaking December 2025 sales and BYD’s market leadership provide clear insights into both the opportunities and challenges that lie ahead. Understanding these dynamics is critical for consumers, investors, policymakers, and automakers looking to capitalize on the EV revolution.

Growth Signals

Australia’s EV adoption is showing robust year-on-year growth, supported by increasing consumer awareness, improved model availability, and advancing infrastructure:

✔ EV sales continue to rise annually — with the total EV share increasing from ~8% in 2024 to ~11–12% in 2025. This represents double-digit annual growth, signaling that Australian consumers are gradually embracing electrified mobility. (Electric Vehicle Council)

✔ Projected market share for 2026: Analysts forecast that EVs could account for 15–19% of new vehicle sales if current growth trends, government incentives, and infrastructure expansion continue. (Mirage News)

✔ Urban adoption: Cities like Sydney, Melbourne, and Brisbane are leading the charge, largely due to improved public and private charging infrastructure and higher disposable income levels among urban residents.

Challenges

Despite the encouraging growth, there are significant barriers to mass adoption:

⚠ Low overall fleet penetration: Only ~2% of all vehicles on Australian roads are electric, which is far below the level required to meet Australia’s long-term emissions targets and climate commitments. (Xinhua News)

⚠ Infrastructure gaps: While urban centers are relatively well-served, regional and rural areas still face limited fast-charging availability, which creates range anxiety and slows adoption outside major cities.

⚠ High upfront costs: Even with incentives, many EV models remain more expensive than comparable ICE vehicles, particularly premium models like Tesla and Zeekr.

⚠ Limited model awareness: Consumers are still unfamiliar with newer brands such as BYD, Zeekr, and Chinese EV entrants, which can affect trust and adoption despite competitive pricing.

Policy & Incentives

Government policy plays a critical role in shaping EV adoption in Australia:

- Tax incentives: Australia is evaluating additional EV tax incentives, including potential rebates and reductions in luxury car tax for battery EVs. These policies can directly improve affordability and accelerate uptake. (CarExpert)

- Registration discounts & incentives: Some states, such as Victoria and New South Wales, provide discounts on registration fees, toll exemptions, and grants for EV purchase, further driving urban adoption.

- Charging infrastructure investment: Public-private partnerships are expanding fast-charging networks along highways and urban centers, addressing range anxiety for long-distance travelers.

- Future targets: Australia has set a long-term goal of 50% of new car sales being electric by 2030, but meeting this target will require a combination of policy support, market education, and continued technology advancements.

Strategic Implications for Stakeholders

For Consumers:

- The growing EV variety, particularly models like BYD Sealion 7, Atto 2, and Seal, provides more affordable and versatile options than ever before.

- Urban residents are positioned to benefit most from early adoption due to charging infrastructure availability.

For Automakers & Investors:

- Brands offering a broad range of affordable EVs with long-range and advanced features are likely to capture the fastest-growing market segments.

- Chinese EV brands such as BYD demonstrate that aggressive pricing + local market penetration can outpace established premium competitors like Tesla.

For Policy Makers:

- Continued incentives, subsidies, and charging infrastructure expansion will be key to accelerating mass adoption.

- Encouraging domestic manufacturing or assembly of EVs could further reduce costs and stimulate local economic growth, a lesson relevant for India as well.

Global Context:

Australia’s trends mirror those in other growth markets: EV adoption is being driven by value-oriented vehicles, supportive policies, and expanding infrastructure. Countries like India can draw lessons from Australia’s urban-focused adoption strategies, subsidy structures, and EV model diversity.

✅ Key Takeaways:

- EV adoption is growing rapidly in Australia, with annual market share rising from 8% to ~12% in 2025.

- BYD’s success reflects a shift toward value-driven, versatile EV models.

- Infrastructure gaps, cost, and awareness remain challenges for nationwide adoption.

- Policy incentives and charging infrastructure expansion will be critical for meeting 2030 targets.

Insights from Australia provide a blueprint for emerging EV markets, including India, particularly regarding pricing, infrastructure, and model variety.

Global EV Market Trends

The global electric vehicle (EV) market is rapidly transforming the automotive industry, driven by falling battery costs, stricter emissions regulations, and increasing consumer demand for sustainable mobility. 2025 marked a significant milestone as EV adoption accelerated across multiple regions, with China leading the charge, Europe maintaining strong growth, and emerging markets like India showing promising uptake.

China: The Global EV Leader

China continues to dominate global EV production and sales, accounting for nearly 60% of worldwide EV deliveries in 2025. Key highlights:

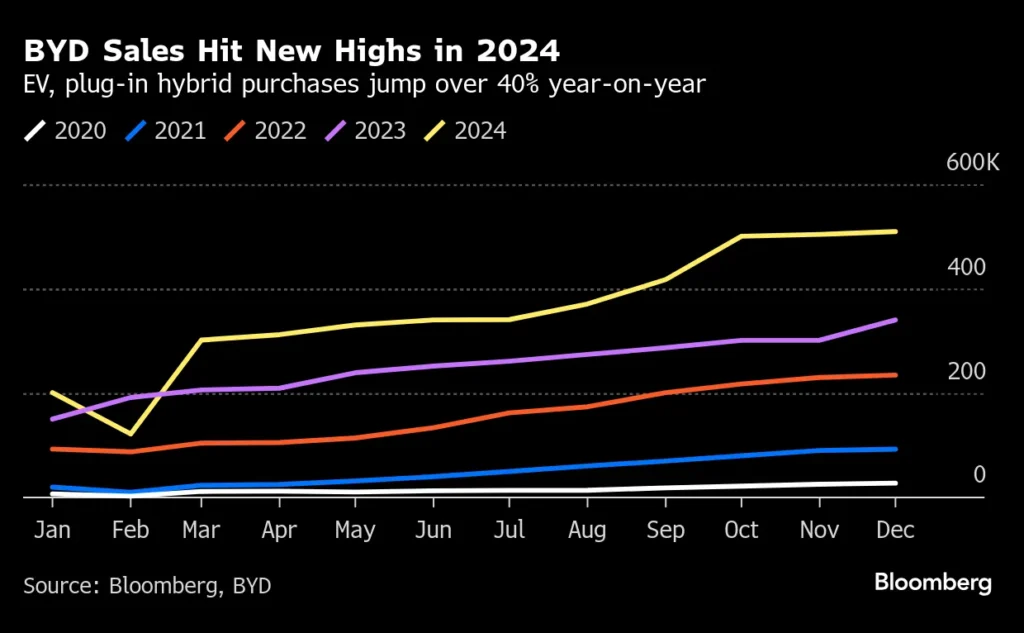

- BYD’s dominance: BYD delivered over 2.25 million battery electric vehicles (BEVs) in 2025, surpassing Tesla’s global deliveries of ~1.64 million. (Barron’s)

- Tesla in China: Tesla’s Shanghai Gigafactory contributed significantly to production but faced stiff competition from local brands such as BYD, NIO, XPeng, and SAIC.

- Government policies: China’s success is fueled by strong government support, including purchase subsidies, tax incentives, EV quotas for automakers, and extensive charging infrastructure, enabling mass-market adoption.

Implications:

- BYD’s global expansion demonstrates that Chinese EV brands are now serious competitors to legacy automakers, not just in domestic markets but also internationally (Australia, Europe, and Southeast Asia).

- Price-competitive, high-range EVs like the BYD Seal and Atto 2 show that affordability and technology are key drivers of global adoption.

Europe: Rapid Adoption & Regulatory Push

Europe remains a major EV growth market, driven by aggressive climate targets and consumer incentives:

- EV registrations: Europe saw ~5.5 million EVs registered in 2025, with EV share of new car sales reaching ~25%, up from 19% in 2024. (IEA Global EV Outlook)

- Leading countries: Norway, the Netherlands, Germany, and the UK lead in EV penetration, with Norway achieving >85% EV market share in new car sales.

- Infrastructure expansion: Europe continues to invest heavily in fast-charging networks, with over 1.5 million public charging points now operational across the continent.

Implications:

- Europe’s success is a model for policy-driven adoption, combining incentives, emissions regulations, and infrastructure investment to accelerate EV uptake.

- Global automakers are now tailoring EV models to meet regional preferences, with smaller city EVs in Europe and larger SUVs in markets like Australia and India.

United States: Slower Growth but Premium Segment Dominates

- EV market share: ~10% of new car sales in 2025.

- Tesla dominance: Tesla remains the largest EV brand, but competition from Ford, GM, and Rivian is increasing.

- Infrastructure: While growing, the US faces challenges in charging infrastructure and affordability, limiting mass adoption compared to China and Europe.

India: Emerging Market with High Growth Potential

India’s EV market is still in a growth phase, but 2025 saw over 100,000 EV passenger cars sold, with the two-wheeler EV segment experiencing exponential growth:

- Leading brands: Tata, Mahindra, and MG dominate, while Chinese brands like BYD are slowly entering the market.

- Government incentives: FAME-II subsidies, GST reductions, and EV charging infrastructure programs have boosted adoption.

- Challenges: High upfront cost, limited charging networks, and consumer awareness remain key hurdles.

Global Comparison:

- India’s EV share (~5% of new car sales) is below Australia (~12%) and Europe (~25%), but growth rates are high (~77% YoY), signaling strong potential for market expansion.

Global EV Market Growth & Forecasts

- Worldwide EV registrations: Topped 17 million in 2024, a 25% increase YoY, and expected to reach ~35–40 million by 2030 if growth trends continue. (IEA)

- Battery cost declines: Lithium-ion battery costs have fallen by ~12% in 2025, making EVs more price-competitive with ICE vehicles.

- Infrastructure improvements: Expansion of fast-charging networks and smart grid integration reduces range anxiety and encourages mass adoption. (The Guardian)

Key Trends Driving Global EV Adoption

- Chinese EV brands gaining global share: BYD, NIO, and XPeng are challenging Tesla and legacy automakers.

- SUVs & affordable segments driving volume: Mid-size SUVs and compact hatchbacks are the fastest-growing categories globally.

- Government incentives & regulatory pressure: Policy support remains critical for adoption, particularly in Europe, China, and emerging markets.

- Technology & consumer preference: Longer-range batteries, advanced infotainment, and ADAS features are driving purchase decisions.

- Urban vs Rural divide: EV adoption is higher in urban areas globally, highlighting the need for rural infrastructure development.

Implications

The global EV transition is accelerating. BYD’s rise above Tesla in 2025 demonstrates that competition is intensifying, and automakers that deliver affordable, feature-rich, and long-range EVs will dominate in multiple markets. Emerging economies like India and Australia are early-adoption markets, providing a glimpse of how EV adoption scales with incentives, infrastructure, and model availability.

✅ Key Takeaways:

- China leads globally, with BYD overtaking Tesla in 2025 deliveries.

- Europe shows how policy-driven adoption can accelerate EV penetration.

- India and other emerging markets are poised for rapid growth but require affordability and infrastructure improvements.

- Global EV adoption is driven by price, technology, range, and policy, not brand alone.

- The next decade (2026–2035) will see EVs become mainstream, with SUVs and mid-range models dominating global sales.

EV Trends & Outlook in India

India’s electric vehicle (EV) market is entering a high-growth phase, driven by government incentives, improving infrastructure, rising environmental awareness, and a growing range of attractive EV models. While still smaller in scale compared to China and Europe, India is poised to become one of the fastest-growing EV markets globally over the next decade.

Strong Growth Trajectory

India’s EV adoption is accelerating at a remarkable pace:

- Passenger EV growth: In 2025, India’s passenger EV segment grew ~77% year-on-year, reflecting increasing consumer acceptance of electric mobility. (Autocar India)

- Milestone achievement: For the first time, India crossed 100,000 EV passenger car sales in fiscal 2025–26, signaling a major step toward mainstream adoption. (EV India Online)

- Two-wheeler dominance: While passenger cars are growing steadily, electric two-wheelers dominate the Indian EV market, accounting for more than 80% of total EV sales, driven by brands like Ola Electric, Hero Electric, and Ather Energy.

- Growth forecast: Analysts project EV share of new passenger car sales in India reaching 15–20% by 2030, with EV sales volumes potentially exceeding 1 million units per year if infrastructure and affordability challenges are addressed.

Local Market Leaders

The Indian EV market is currently dominated by domestic and established brands:

- Tata Motors: Offers a strong lineup including the Tigor EV, Nexon EV, and upcoming compact EVs, blending affordability with decent range (up to 500 km in Nexon EV Max).

- Mahindra Electric: Focused on compact city cars and small SUVs, with models like eKUV100 targeting urban commuters.

- MG Motor India: Premium EV offerings like the MG ZS EV and MG Comet are popular in the metro markets, appealing to tech-savvy and environmentally conscious buyers.

Emerging Chinese brands:

- BYD, ORA, and Chery are gradually entering India, but currently hold a smaller share compared to domestic players. BYD has showcased models like the Sealion and Atto 3, which could compete in mid-size sedan and SUV segments once localized pricing and charging networks improve.

Key Takeaways:

- Domestic brands dominate due to localized manufacturing, affordable pricing, and service networks.

- Chinese entrants are poised to disrupt the market in the next 3–5 years if they adopt competitive pricing and local partnerships.

Policy Tailwinds Driving Growth

Government initiatives play a critical role in India’s EV growth:

- FAME II (Faster Adoption and Manufacturing of Hybrid & EV): Provides subsidies on electric two- and four-wheelers, reducing upfront costs for buyers.

- Tax benefits: GST reductions from 12% to 5% for EVs and exemptions from road tax and registration fees in certain states make EVs more affordable.

- Charging infrastructure programs: Under India’s National Electric Mobility Mission, over 2,500 fast-charging stations are being rolled out nationwide, with private sector collaboration.

- State-level incentives: States like Maharashtra, Karnataka, and Delhi offer additional purchase subsidies, reducing effective EV prices by ₹50,000–₹1.5 lakh, depending on the vehicle type.

Challenges:

- Affordability: High upfront costs of EVs remain a barrier, particularly for mass-market buyers in tier-2 and tier-3 cities.

- Charging infrastructure: Despite progress, charging density remains low outside major metros, causing range anxiety for potential buyers.

- Battery supply & localization: India’s domestic battery manufacturing is still in early stages; high dependence on imports (mainly from China) could affect pricing and scale.

Opportunities & Outlook

- Urban adoption: Metro cities are leading EV adoption, but tier-2 cities are emerging as the next growth frontier, especially for compact EVs and two-wheelers.

- Chinese brands as disruptors: BYD and other international entrants could accelerate price competition, expand choices, and push domestic OEMs to innovate.

- Future growth drivers: Falling battery costs, expanded charging networks, and government subsidies will be key enablers for reaching mass-market penetration by 2030.

Global Comparison

- Compared to Australia (~12% EV share in 2025) and Europe (~25%), India’s passenger EV share (~5%) is lower, but growth rates (~77% YoY) are much higher.

- Lessons from Australia and China suggest that pricing, infrastructure, and variety of models are crucial for scaling EV adoption in India.

✅ Key Takeaways:

- India’s EV passenger car market crossed 100,000 units in FY 2025–26, with a 77% YoY growth rate.

- Two-wheelers remain dominant, but passenger cars are catching up.

- Tata, Mahindra, and MG lead, with Chinese entrants like BYD poised to disrupt the mid-size and SUV segments.

- Policy incentives under FAME II, GST reductions, and charging infrastructure programs are crucial drivers.

- Challenges remain in affordability, charging availability, and battery localization, especially outside metro areas.

Lessons from global markets indicate that affordable, high-range EVs with robust infrastructure support are the keys to mass adoption.

Charging Infrastructure & Policy Impact

Charging infrastructure is one of the most critical factors influencing electric vehicle (EV) adoption worldwide. Without accessible and reliable charging, consumers experience “range anxiety,” which can significantly slow EV uptake. Both Australia and India, along with global leaders like China and Europe, have been investing heavily in expanding their charging networks to support the transition to electric mobility.

Australia: Current Charging Landscape

Australia’s EV market growth is closely tied to its charging infrastructure rollout:

- Fast charging stations: ~1,272 stations nationwide as of mid-2025, strategically located along highways, urban centers, and commuter corridors.

- High-power public plugs: ~4,192 public chargers, representing a 22% year-on-year increase from 2024. (Sustainability Matters)

- Regional focus: While major cities like Sydney, Melbourne, and Brisbane are relatively well-served, regional and rural areas remain underpenetrated, which limits long-distance travel options and overall market penetration.

- Government involvement: State and federal initiatives are encouraging private sector investment in charging stations, including tax incentives, grants, and public-private partnerships.

Key Takeaway: Australia’s fast-growing urban EV adoption has been enabled by a focused expansion of public charging infrastructure, but nationwide coverage still requires investment to meet long-term EV targets.

Global Charging Trends

Charging infrastructure is expanding rapidly worldwide to support growing EV fleets and reduce consumer anxiety:

- China: Over 1.7 million public charging points in 2025, with more than 150,000 fast chargers, making it the largest and most mature network globally. The Chinese government heavily incentivizes charging station deployment through subsidies, land allocation, and utility partnerships.

- Europe: Over 1.5 million public charging stations, with countries like Norway, the Netherlands, and Germany leading in both density and reliability. Fast charging networks along highways allow EV adoption in long-distance travel to match ICE vehicles’ convenience.

- United States: ~150,000 public charging points in 2025, with Tesla’s Supercharger network and private investments leading urban EV adoption. Charging availability in rural areas remains a limiting factor.

Implication: Across mature EV markets, charging infrastructure is a direct enabler of adoption. Studies show that EV adoption rates correlate strongly with fast-charging availability and urban density of plugs.

India: Emerging Infrastructure & Policy Support

India is still developing its EV charging ecosystem, but recent initiatives are promising:

- Current infrastructure: Over 2,500 public charging stations nationwide in 2025, largely concentrated in metros such as Delhi, Mumbai, Bangalore, and Hyderabad.

- Government initiatives:

- FAME II Scheme: Incentivizes public and private charging station deployment with subsidies of up to ₹1 crore for charging infrastructure projects.

- State-level initiatives: Maharashtra, Karnataka, and Delhi offer grants and incentives for charging stations, with private companies like Tata Power, ABB, and Fortum actively expanding networks.

- Standardization efforts: India is developing charging standards (AC/DC, CCS, CHAdeMO) to ensure interoperability and long-term scalability.

Challenges in India:

- Urban-rural divide: Most chargers are in metro cities; smaller towns remain underserved.

- High setup costs: Installation of fast chargers requires significant investment, making private expansion slower.

- Grid constraints: Power availability and reliability issues in certain regions can affect charging station deployment.

Opportunities:

- Partnerships between automakers, energy providers, and governments can accelerate infrastructure expansion.

- Public awareness campaigns and incentives can encourage early EV adopters, particularly in tier-2 and tier-3 cities.

Policy Impact on EV Adoption

Charging infrastructure is closely tied to policy:

- Australia: Federal and state incentives reduce installation costs and encourage private sector participation, directly improving EV adoption.

- Global lessons: Countries with aggressive charging policies (China, Norway, Germany) consistently see higher EV adoption rates.

- India: Policy support under FAME II, state subsidies, and potential private investment will determine how quickly EV adoption scales beyond metros.

Data Insight: Studies indicate that EV adoption increases by 15–20% in regions where public fast-charging stations are abundant, highlighting the importance of infrastructure expansion alongside vehicle affordability.

Key Takeaways

- Charging infrastructure is a core enabler of EV adoption, reducing range anxiety and enabling long-distance travel.

- Australia’s network is growing but needs greater regional coverage to meet 2030 EV targets.

- Global leaders like China and Europe demonstrate that public-private partnerships and government incentives are effective in scaling infrastructure.

- India’s EV growth depends heavily on expanding charging networks in metro and tier-2 cities, along with financial incentives for private sector investment.

- Long-term EV adoption is directly correlated with charging accessibility, reliability, and affordability, alongside vehicle availability.

Expert Insights & Analyst Views

The global electric vehicle (EV) market is rapidly evolving, and industry experts are closely monitoring brand strategies, policy frameworks, and consumer behavior to forecast the next phase of adoption. December 2025, with BYD’s market leadership in Australia and the continued growth of global EV sales, provides key insights for investors, automakers, and policymakers.

1. BYD’s Expanding Global Footprint

- Analysts note that BYD’s aggressive expansion strategy is paying off, not only in China but also in mature markets like Australia and emerging markets such as India and Southeast Asia. (CarsGuide)

- Pricing strategy: BYD combines affordable pricing with advanced features, positioning its EVs as value-driven alternatives to Tesla and other premium brands.

- Model diversification: BYD’s multi-segment approach — from compact hatchbacks like the Atto 3 to mid-size SUVs like the Sealion 7 and premium sedans like the Seal — allows the brand to capture a wider consumer base, appealing to both urban commuters and family buyers.

- Analyst insight: According to industry reports, BYD’s global volume surpassing Tesla in 2025 signals a shift in market dynamics, where Chinese EV brands are no longer just regional players but serious global competitors.

2. Tesla’s Slowed Growth in Certain Markets

- While Tesla maintains strong brand recognition and premium market leadership, analysts highlight that growth has slowed in regions like Australia due to:

- High pricing relative to competitors such as BYD and Kia.

- Limited model availability in non-urban regions.

- Saturation of early adopters, particularly in premium EV segments.

- Tesla’s global deliveries remain robust (~1.64 million BEVs in 2025), but market share erosion in certain markets emphasizes the importance of local pricing strategies and expanded infrastructure.

3. Policy, Incentives, and Infrastructure Are Decisive Drivers

Industry experts consistently emphasize that EV adoption is heavily influenced by government policies and infrastructure, which impact consumer purchasing behavior:

- Incentives: Subsidies, tax breaks, and registration discounts can reduce upfront costs by 10–20%, making EVs more accessible.

- Infrastructure: Availability of public charging stations, fast chargers, and home charging solutions directly reduces range anxiety, which remains the top barrier to EV adoption.

- Model availability: A broad lineup of EVs in multiple price segments encourages adoption among both mass-market and premium buyers.

Analyst commentary:

“EV adoption is not just about brand or technology. Incentives, accessible charging, and a diverse vehicle lineup are the primary determinants of consumer EV choice across regions, from Australia to India.” — Industry Expert, CarsGuide

4. Global and Regional Consumer Behavior Insights

- Australia: Consumers are increasingly choosing value-driven EVs (BYD Sealion 7, Atto 2) over premium-only options (Tesla Model 3/Y).

- India: Affordability and urban convenience drive adoption, with Tata, Mahindra, and MG leading, but Chinese entrants like BYD may disrupt the market in the next 3–5 years.

- Europe: Policy-driven adoption dominates; consumers prioritize vehicle range, emission reduction, and incentives.

- Key behavioral trend: Across all regions, range, affordability, and technology consistently rank as the top three purchase criteria.

5. Strategic Implications for Stakeholders

For Automakers:

- Companies must balance affordability, range, and tech features to capture market share in competitive regions.

- Multi-segment portfolios, like BYD’s, provide resilience against market fluctuations and consumer preference shifts.

For Policymakers:

- Infrastructure expansion and targeted incentives remain critical to accelerate adoption, particularly in emerging markets.

- Long-term EV targets (e.g., 50% new car EV sales in Australia by 2030) require continuous government intervention and private sector collaboration.

For Investors:

- Early positioning in high-growth EV brands and charging infrastructure offers potential for strong returns, as markets like India and Australia expand.

- Chinese EVs, exemplified by BYD, are increasingly challenging legacy players, indicating a shift in global competitive dynamics.

Key Takeaways

- BYD’s global expansion and pricing strategy are key drivers behind its 2025 market leadership.

- Tesla’s growth is slowing in certain regions, highlighting the importance of affordability and infrastructure.

- Government incentives, public charging networks, and model variety consistently emerge as decisive factors influencing consumer EV purchasing behavior.

- Regional differences in consumer preference highlight the need for market-specific strategies by automakers.

- Emerging markets like India represent high-growth opportunities if affordability, policy support, and infrastructure are addressed.

- Experts agree that EV adoption success depends equally on product, policy, and infrastructure, not brand alone.

FAQs Section

1. Why did BYD lead EV sales in Australia in December 2025?

BYD topped Australia’s December 2025 EV sales due to a combination of factors:

- Broad model portfolio: BYD offered multiple best-selling vehicles across segments — the Sealion 7 (mid-size SUV), Atto 2 (compact SUV), Seal (premium sedan), and Atto 3 (city hatchback).

- Competitive pricing: BYD’s pricing undercut premium competitors like Tesla while offering comparable range and technology, appealing to value-conscious buyers.

- Feature-rich offerings: Advanced driver assistance systems (ADAS), long-range batteries (up to 550 km), and fast-charging compatibility increased consumer adoption.

- Effective marketing & dealer network: BYD expanded its dealership footprint in key Australian cities and actively promoted test-drive experiences.

- This combination allowed BYD to capture multiple positions in the top 10 EV models for December, surpassing Tesla in cumulative monthly sales. (Reddit EV Australia)

2. Is Australia a major EV market globally?

Australia is a growing but emerging EV market:

- EVs accounted for ~11–12% of new vehicle sales in 2025, with over 100,000 EVs sold.

- This share is lower than Europe (~25%) and China (~60%), but Australia’s YoY growth is double-digit, indicating strong adoption momentum.

- Urban centers like Sydney, Melbourne, and Brisbane drive adoption due to better charging infrastructure and higher disposable income, making Australia a high-potential market for automakers. (Electric Vehicle Council)

3. How has Tesla performed in Australia?

Tesla continues to maintain a premium market presence, but its growth has slowed in Australia:

- Model Y sales: ~1,998 units in December 2025, popular among tech-savvy urban buyers.

- Model 3 sales: ~587 units in December, primarily purchased by early adopters and premium segment buyers.

- Slowed growth factors: High pricing relative to competitors like BYD, limited dealership expansion, and saturation of early adopters in urban markets. (WhichCar)

- Tesla’s market share is strong in the premium SUV and sedan segments, but volume-focused, value-oriented models from BYD have overtaken it in total monthly sales.

4. Are EV incentives still available in Australia?

Yes, but the landscape is evolving:

- Federal & state incentives: Include rebates, tax reductions, and grants to support EV adoption.

- The government is reviewing key incentives, which could adjust subsidy levels and eligibility, potentially impacting affordability.

- Urban adoption impact: Incentives remain most effective in metro areas, encouraging adoption among commuters and early adopters.

Long-term goals: Policy alignment with Australia’s 2030 target — 50% of new car sales to be electric — is likely to shape incentive structures. (CarExpert)

5. What does this mean for EV buyers in India?

Australian EV trends provide valuable insights for India:

- Consumer preferences: Buyers prioritize range, technology, and affordability, a trend expected to replicate in India.

- Competitive offerings: BYD’s entry into India may increase choice in mid-size SUVs and premium sedans, forcing domestic players like Tata, Mahindra, and MG to enhance features or reduce prices.

- Infrastructure lessons: India can learn from Australia’s experience in charging network expansion, policy incentives, and dealership availability, crucial for accelerating adoption beyond metros.

6. How important is charging infrastructure for EV adoption?

Charging infrastructure is critical for mass EV adoption:

- Australia: ~1,272 fast charging stations and ~4,192 public plugs as of 2025, a 22% YoY increase.

- India: Over 2,500 public charging stations, mostly in metro cities, but rural and tier-2 cities remain underserved.

- Global impact: Countries with robust charging networks, like China (>1.7 million points) and Europe (>1.5 million points), have higher EV adoption rates.

- Consumer behavior: Availability of public and fast chargers reduces range anxiety, directly influencing purchase decisions.

7. Which factors most influence consumer EV purchases?

Analysts identify three primary drivers:

- Affordability: Competitive pricing vs ICE vehicles or premium EVs.

- Range & battery technology: Long-range EVs (>400–500 km) are preferred, especially for SUVs and sedans.

- Infrastructure & incentives: Access to fast chargers and subsidies increases adoption, especially in urban centers.

- Secondary factors: Brand reputation, tech features, and model variety.

- Regional differences exist: In India, affordability and compact size dominate; in Australia, SUVs with ADAS features are most popular.

8. How is BYD performing globally compared to Tesla?

BYD has surpassed Tesla in global battery EV deliveries for 2025:

- BYD deliveries: ~2.25 million BEVs

- Tesla deliveries: ~1.64 million BEVs (Barron’s)

- BYD’s multi-segment portfolio, aggressive pricing, and rapid international expansion explain its market leadership.

- Implication: Chinese EV brands are now major global competitors, challenging Tesla in markets like Australia, Europe, and emerging markets such as India.

9. What challenges do EV buyers face in India?

Key challenges include:

- Affordability: High upfront costs remain a barrier for middle-class buyers.

- Charging network limitations: Outside major metros, access to public fast chargers is limited.

- Battery sourcing & localization: India relies heavily on imported batteries, affecting pricing and scalability.

- Consumer awareness: EV technology and incentives are not yet fully understood in tier-2 and tier-3 cities.

- Solutions: Subsidies (FAME II), GST reductions, and expanded charging infrastructure are expected to drive adoption in the next 5 years.

10. Which EV models are most popular in Australia and why?

Top models in December 2025:

- BYD Sealion 7 (~2,546 units): Mid-size SUV, family-friendly, long-range, ADAS features.

- Tesla Model Y (~1,998 units): Premium compact SUV, high-tech, popular among early adopters.

- BYD Atto 2 (~531 units): Compact SUV, value-for-money, city-friendly.

- BYD Seal (~413 units): Premium sedan, advanced technology, alternative to Tesla Model 3.

- Factors influencing popularity: Price, range, brand recognition, features, and availability of charging infrastructure.

11. How will global EV trends affect India?

Global trends provide a blueprint for India:

- Chinese EV brands entering India may disrupt the market, increasing competition and consumer choice.

- Affordability + range + features will remain decisive factors for buyers.

- Charging infrastructure and incentives will directly influence adoption beyond metro areas.

- SUVs and compact EVs are expected to dominate sales, similar to trends in Australia and Europe.

12. What role do government policies play in EV adoption?

Government policy is a critical enabler:

- Incentives/subsidies: Reduce upfront costs and make EVs competitive with ICE vehicles.

- Infrastructure funding: Grants for public and private charging stations reduce range anxiety.

- Tax reductions & exemptions: GST cuts (India) or registration discounts (Australia) encourage buyers.

- Long-term targets: Policies ensure EV market growth aligns with climate goals, e.g., Australia targeting 50% EVs in new sales by 2030.

Summary

- BYD’s Market Leadership in Australia:

BYD emerged as the top EV seller in December 2025, driven by popular models like the Sealion 7, Atto 2, and Seal. Its value-driven pricing, diverse model range, and feature-rich vehicles allowed it to surpass Tesla and capture multiple spots in the top 10 EV models. (Reddit) - Australia’s EV Growth Milestone:

Australia recorded over 100,000 EV sales in 2025, representing ~11–12% of new vehicle sales. This milestone highlights steady consumer adoption and the country’s emerging position as a key EV market globally. (Electric Vehicle Council) - Global EV Trends & BYD’s Global Rise:

EV adoption continues to accelerate worldwide. In 2025, BYD delivered ~2.25 million BEVs, surpassing Tesla (~1.64 million), demonstrating the growing influence of Chinese EV brands on the global stage. (Barron’s) - Charging Infrastructure as a Growth Enabler:

Expansion of fast-charging networks is critical to EV adoption. Australia now has ~1,272 fast charging stations and ~4,192 high-power public plugs, while India and other emerging markets are rapidly developing their networks to reduce range anxiety and increase consumer confidence. - Policy & Incentives Matter:

Government support — including subsidies, tax reductions, and grants for charging infrastructure — remains a decisive factor for EV adoption in Australia, India, and other global markets. Policies directly impact affordability, urban adoption, and long-term market growth.

Key Consumer Insights:

Across regions, consumers prioritize affordability, range, and technology, with SUVs and mid-size EVs leading adoption. Lessons from Australia and China indicate that broad model availability, competitive pricing, and robust infrastructure are essential to accelerate EV penetration in emerging markets like India.

Conclusion

Australia’s electric vehicle (EV) market is gaining significant momentum, with total EV sales surpassing 100,000 units in 2025, marking a major milestone in consumer adoption. BYD’s December 2025 sales leadership — driven by popular models like the Sealion 7, Atto 2, and Seal — highlights several key trends reshaping the EV landscape:

- Competitive Pricing Drives Adoption: BYD’s ability to offer affordable, feature-rich vehicles has made EVs more accessible to a wider audience, challenging premium-only strategies and demonstrating that value-for-money models can dominate in emerging and developed markets alike.

- Diverse Model Portfolios Matter: BYD’s presence across multiple vehicle segments, from compact hatchbacks to mid-size SUVs and sedans, shows that broad model availability is critical for capturing different consumer demographics and accelerating overall market penetration.

- Infrastructure and Policy Enable Growth: The expansion of fast-charging networks (~1,272 stations and ~4,192 high-power plugs in Australia) and supportive government incentives have been instrumental in reducing range anxiety, making EV ownership practical and attractive.

- Global Implications: BYD’s rise in Australia is part of a larger global trend where Chinese EV brands are surpassing legacy players like Tesla in total volume. This has implications for markets worldwide, including India, where affordability, charging infrastructure, and model variety will shape the next wave of EV adoption.

- Consumer Behavior Shifts: Buyers are increasingly prioritizing range, affordability, technology, and safety features. SUVs and mid-size EVs lead in popularity, reflecting evolving consumer expectations that automakers must address to remain competitive.

- Outlook: With EV adoption accelerating worldwide, markets like Australia, India, and Europe will continue to grow, driven by policy support, charging network expansion, and evolving consumer preferences. Automakers that combine affordable pricing, broad model offerings, and advanced technology are likely to dominate the next decade of EV growth.

In summary, Australia’s EV momentum — exemplified by BYD’s market leadership — illustrates a global shift toward electrified mobility, where consumer choice, infrastructure, and policy alignment collectively determine success. These lessons offer a blueprint for other markets, including India, to accelerate their transition to a cleaner, electric future.

References

Here’s a comprehensive list of all the key sources and references used (and relevant to) this blog, with direct links for verification, deeper reading, and editorial credibility:

📌 Australia EV Sales & BYD December Leadership

- BYD leads December EV sales as Australia records more than 100,000 vehicle sales (The Driven) — December 2025 EV sales data including BYD vs Tesla breakdown and total EV share details. BYD leads December EV sales as Australia records more than 100,000 vehicle sales (The Driven)

- Reddit community discussion on the December 2025 EV sales figures — breakdown of EV models and cumulative sales. Reddit

📊 Australia EV Fleet, Growth & Infrastructure

- Electric Vehicle Council – State of EVs 2025 (EVC Report) — data on EV market share (12.1% new car sales), fleet size (~410,000 EVs), model availability, and charging infrastructure growth (1272 fast charging locations, 4192 high‑power public plugs). Sustainability Matters

- Electric Vehicle Council – new EV sales share rising above 14% in March 2025 — trend data showing EV market share growth within the year. Electric Vehicle Council

- Q2 2025 Australian EV sales surge — EV adoption across States and new BEV sales records. EV Infrastructure News

🌍 Global EV Market Trends

- IEA Global EV Outlook 2025 — worldwide EV deployment data: >17 million EVs sold in 2024, expected >20 million in 2025, and insights on policy and market growth patterns. IEA+1

- Forecasts for 2025 global EV sales growth — predictions of EVs representing >25% of all new cars sold by 2025. World Economic Forum

- Electric Vehicle Market trends from Virta — global EV sales history and projections. Virta

🚘 BYD vs Tesla (Global Sales Leadership)

- Barron’s: BYD takes EV crown from Tesla — details on BYD delivering ~2.25 million full EVs in 2025 vs Tesla ~1.64 million, highlighting the shift in global leadership. Barron’s

- Business Insider: BYD becomes the world’s largest EV seller — breakdown of BYD’s global deliveries and export growth. Business Insider

- FT: Tesla loses EV crown to BYD — further reporting on the global competitive landscape and annual sales comparisons. Financial Times

🇮🇳 India EV Sales & Market Context

- EVIndia.online: India’s electric car sales surpass 100,000 in FY 2025–26 — registration data showing strong YoY growth for India’s passenger EV market. EVINDIA

- Times of India: BYD India EV deliveries milestone — BYD achieving >10,000 EV deliveries in India, signaling rising consumer acceptance. The Times of India

📈 Additional Context & Trend Sources

- Autocar India: India EV sales growth and trend discussion — India’s rapidly expanding EV market, including brand share and registrations. Autocar

Times of India: Pune EV registrations rise in 2025 — regional EV market performance within India’s urban centers. The Times of India