Estimated Reading Time: 30-35 minutes ( 5,924 words)

Introduction

For decades, borrowing money was a slow, paperwork-heavy, and often intimidating process. Consumers and businesses had to navigate long bank queues, submit stacks of documents, wait weeks for approvals, and face rigid eligibility criteria that excluded millions from formal credit systems. For first-time borrowers, small business owners, and gig workers—especially in emerging markets like India—accessing credit was often more difficult than earning it.

That reality is rapidly changing. Today, a loan can be approved within minutes, credited instantly, and managed entirely through a smartphone app. From instant personal loans and Buy Now, Pay Later (BNPL) options to digital MSME credit and embedded lending inside e-commerce platforms, borrowing has become faster, simpler, and more user-centric. This transformation is driven by the convergence of fintech innovation, artificial intelligence, digital payments, and alternative data-based credit assessment.

This shift marks the rise of effortless borrowing—a new financial era where access to credit is seamless, intelligent, and increasingly inclusive. Globally, lenders are moving away from manual underwriting toward automated, real-time decision-making. In India, the combination of UPI, Aadhaar-based e-KYC, mobile-first users, and fintech-bank partnerships has accelerated this transition at an unprecedented scale, bringing millions of previously underserved individuals and small businesses into the formal financial ecosystem.

In this comprehensive guide, we explore:

- What effortless borrowing truly means and how it differs from traditional lending

- Why digital and instant credit is booming globally and in India, backed by data and market trends

- The key technologies enabling this transformation, including AI, alternative credit scoring, and digital public infrastructure

- The risks, regulatory challenges, and consumer protection measures shaping sustainable growth

- The 10-year outlook for digital credit, and how borrowing will evolve by 2035

Whether you are a consumer, entrepreneur, investor, or fintech enthusiast, understanding this shift is essential to navigating the future of finance in an age where borrowing is becoming nearly frictionless.

What Is Effortless Borrowing?

Effortless borrowing refers to technology-driven, low-friction access to credit that removes the traditional barriers associated with bank loans—such as extensive paperwork, long approval cycles, and rigid eligibility rules. Instead of relying solely on manual verification and legacy credit scoring, effortless borrowing uses digital platforms, automation, and data intelligence to deliver faster, simpler, and more inclusive lending experiences.

In practical terms, effortless borrowing allows individuals and businesses to apply for, receive, and manage loans entirely online, often within minutes. Borrowers no longer need to visit a bank branch, submit physical documents, or wait days for approval. This shift is redefining how credit is accessed globally and is especially transformative in countries like India, where a large population has historically been underbanked.

🔑 Key Characteristics of Effortless Borrowing

📱 Fully Digital, App-Based Experience

Loan applications are completed through mobile apps or websites with intuitive interfaces. Identity verification, KYC, agreement signing, and repayment tracking all happen digitally, creating a seamless end-to-end borrowing journey.

⚡ Instant or Same-Day Approvals

Advanced algorithms and real-time data analysis enable lenders to approve loans in minutes or hours instead of weeks. Many platforms offer instant disbursal, making credit available exactly when it is needed.

🤖 AI-Driven Credit Assessment

Artificial intelligence and machine learning models assess borrower risk by analyzing thousands of data points. These systems reduce human bias, improve accuracy, and allow lenders to serve customers who may not qualify under traditional credit models.

📊 Use of Alternative Data Sources

Rather than relying only on credit bureau scores, lenders use alternative data such as:

- UPI and bank transaction history

- E-commerce purchase behavior

- Utility and mobile bill payments

- GST and invoicing data (for MSMEs)

This approach significantly expands credit access for first-time borrowers and small businesses.

🧾 Minimal or Zero Paperwork

With Aadhaar-based e-KYC, digital document uploads, and automated verification, paperwork is reduced to the bare minimum. Many loans require no physical documents at all, lowering friction and operational costs.

📌 Common Examples of Effortless Borrowing in Action

- Instant Personal Loan Apps:

Short-term and personal loans approved and disbursed within minutes through fintech platforms and NBFC-backed apps. - Buy Now, Pay Later (BNPL):

Small-ticket, interest-free or low-cost credit embedded directly into online and offline purchases, especially in e-commerce and retail. - Embedded Credit in E-Commerce & Super Apps:

Loans and EMIs offered directly at checkout or within apps like marketplaces, travel platforms, and food delivery services. - MSME Digital Working Capital Loans:

Automated credit lines for small businesses based on GST filings, sales data, and cash flow analysis—helping MSMEs manage liquidity efficiently.

💡 Why It Matters

Effortless borrowing shifts lending from being bank-centric to user-centric. It democratizes access to credit, supports financial inclusion, and aligns borrowing with real-world financial behavior rather than rigid documentation. As digital ecosystems mature, effortless borrowing is fast becoming the default way people and businesses access credit, not just an alternative.

Global Digital Lending Market Trends

The global lending ecosystem is undergoing a fundamental transformation as digital-first credit models replace traditional bank-centric lending. Advances in fintech infrastructure, artificial intelligence, and consumer-facing digital platforms have made borrowing faster, more accessible, and deeply integrated into everyday economic activity. What was once a standalone financial product is now becoming an embedded service within digital ecosystems.

From developed economies to emerging markets, digital lending is expanding rapidly, driven by consumer demand for instant credit, businesses seeking faster access to capital, and lenders aiming to reduce operational costs while improving risk assessment.

📊 Key Global Market Statistics

According to leading industry reports from Statista, McKinsey, and Business Research Insights:

- The global fintech lending market is valued at approximately USD 589 billion in 2025.

- The market is projected to exceed USD 2.3 trillion by 2035, reflecting the mainstream adoption of digital credit.

- This represents a robust compound annual growth rate (CAGR) of ~16% over the next decade.

This growth is being fueled by:

- Rising smartphone and internet penetration

- Declining reliance on physical bank branches

- Increasing comfort with digital financial services post-pandemic

- Strong venture capital and institutional investment in fintech

📌 Key Insight: Digital lending is no longer limited to startups—it is now a strategic priority for global banks, BigTech companies, and payment platforms.

🔑 Major Global Digital Lending Trends

🔹 Rise of Embedded Finance

One of the most powerful trends is the rise of embedded finance, where lending is seamlessly integrated into non-financial platforms. Consumers can now access loans directly within:

- E-commerce checkouts

- Travel booking apps

- Ride-hailing and delivery platforms

- SaaS tools for businesses

This removes friction and increases loan adoption by offering credit at the exact moment of need.

🔹 Shift from Banks to Platform-Based Lending

While traditional banks remain important, a growing share of lending is moving toward:

- Fintech platforms

- Digital marketplaces

- Super apps and BigTech ecosystems

These platforms leverage vast user data, superior UX, and automation to outperform banks on speed and personalization, especially for small-ticket and short-term credit.

🔹 AI Replacing Manual Underwriting

Artificial intelligence and machine learning are rapidly replacing human-led credit assessment. AI models:

- Analyze thousands of data points in real time

- Reduce approval times from days to minutes

- Improve default prediction and fraud detection

- Enable dynamic interest rates based on risk profiles

This transition significantly lowers operating costs while expanding credit access to thin-file and no-file borrowers.

🔹 Explosive Growth of Buy Now, Pay Later (BNPL)

BNPL has emerged as one of the fastest-growing digital lending segments globally, especially in:

- Retail and e-commerce

- Travel and hospitality

- Consumer electronics and lifestyle purchases

BNPL appeals to younger consumers who prefer short-term, transparent credit without traditional loan complexity, reshaping consumer spending behavior worldwide.

🔹 Cross-Border Digital Lending in Emerging Markets

Digital lending is increasingly crossing borders, particularly in:

- Southeast Asia

- Africa

- Latin America

Global fintechs are using scalable digital infrastructure to serve underbanked populations in emerging markets, often partnering with local institutions to navigate regulation and distribution.

💡 Expert Insight

“Digital lending will move from a product to a background service embedded into daily transactions.”

— McKinsey & Company

This insight highlights a critical shift: borrowing will become invisible. Users may not even consciously “apply” for a loan—credit decisions will happen automatically in the background, integrated into payments, purchases, and business workflows.

📌 Why This Matters for the Future of Finance

The global digital lending boom signals a broader redefinition of financial services—from institution-led to experience-led finance. As lending becomes faster, smarter, and embedded, platforms that combine trust, technology, and responsible credit practices will dominate the next phase of global finance.

India’s Effortless Borrowing Revolution

India is at the forefront of the global digital lending transformation, emerging as one of the fastest-growing and most dynamic digital credit markets in the world. The convergence of large unmet credit demand, rapid smartphone adoption, and strong digital public infrastructure has created a fertile ground for effortless borrowing to scale at unprecedented speed. For millions of individuals and small businesses, digital lending has become the first point of access to formal credit.

Unlike many developed markets where digital lending is largely a convenience upgrade, in India it represents a structural shift toward financial inclusion, enabling credit access for first-time borrowers, gig workers, MSMEs, and consumers outside metro cities.

📈 India Digital Lending Snapshot

According to data from RBI, NPCI, and leading financial publications:

- Over 11 crore digital loans were issued in FY 2024–25, highlighting the mainstream adoption of app-based and platform-led credit.

- Fintech NBFCs disbursed more than ₹1 lakh crore in personal loans, demonstrating the growing role of non-bank digital lenders in consumer credit markets.

- India’s digital lending ecosystem is expanding at an estimated ~40% compound annual growth rate (CAGR)—one of the highest globally.

- UPI penetration, now covering hundreds of millions of users, is enabling small-ticket and micro-credit access, particularly for daily consumption, emergencies, and short-term liquidity needs.

📌 Key Insight: A large share of these loans are going to first-time or thin-file borrowers, indicating a major expansion of the formal credit base.

🌟 Why India’s Digital Lending Story Is Unique

India’s effortless borrowing revolution is powered by a combination of scale, technology, and policy innovation that few countries can replicate.

🔹 Large Underbanked Population

Despite rapid progress, a significant portion of India’s population remains underserved by traditional banks. Digital lending bridges this gap by offering:

- Lower eligibility thresholds

- Faster onboarding

- Credit access without extensive credit history

This has opened doors for rural users, informal workers, and micro-entrepreneurs.

🔹 Smartphone-First, App-Native Users

India skipped the desktop era and moved directly to mobile-first finance. Affordable smartphones and low-cost data have made app-based borrowing intuitive, even for non-urban users. For many Indians, a lending app is their first “bank branch.”

🔹 Digital Public Infrastructure (DPI) Advantage

India’s globally admired digital public infrastructure stack is a key enabler of effortless borrowing:

- Aadhaar-based e-KYC enables instant identity verification

- UPI supports real-time payments and repayment automation

- Account Aggregator (AA) framework allows secure, consent-based data sharing

Together, these systems dramatically reduce onboarding costs, fraud risk, and approval times.

🔹 Strong Fintech–Bank & NBFC Partnerships

Rather than competing head-on, Indian fintechs increasingly collaborate with:

- Banks

- NBFCs

- Payment platforms

Fintechs provide technology, data analytics, and customer experience, while regulated institutions provide capital and compliance—creating a scalable and sustainable lending ecosystem.

📌 Sector Impact Highlights

- Consumers: Faster personal loans, credit lines, and BNPL options

- MSMEs: Digital working capital based on GST and cash flow data

- Gig Economy: Credit for drivers, delivery partners, and freelancers

- Tier 2 & Tier 3 Cities: Rapid rise in loan disbursements outside metros

🔮 What This Means for India’s Financial Future

India’s effortless borrowing revolution is not just about convenience—it is reshaping credit access, consumption patterns, and economic participation. As regulation matures and technology deepens, digital lending is expected to become the primary channel for retail and small business credit over the next decade.

Technologies Powering Effortless Borrowing

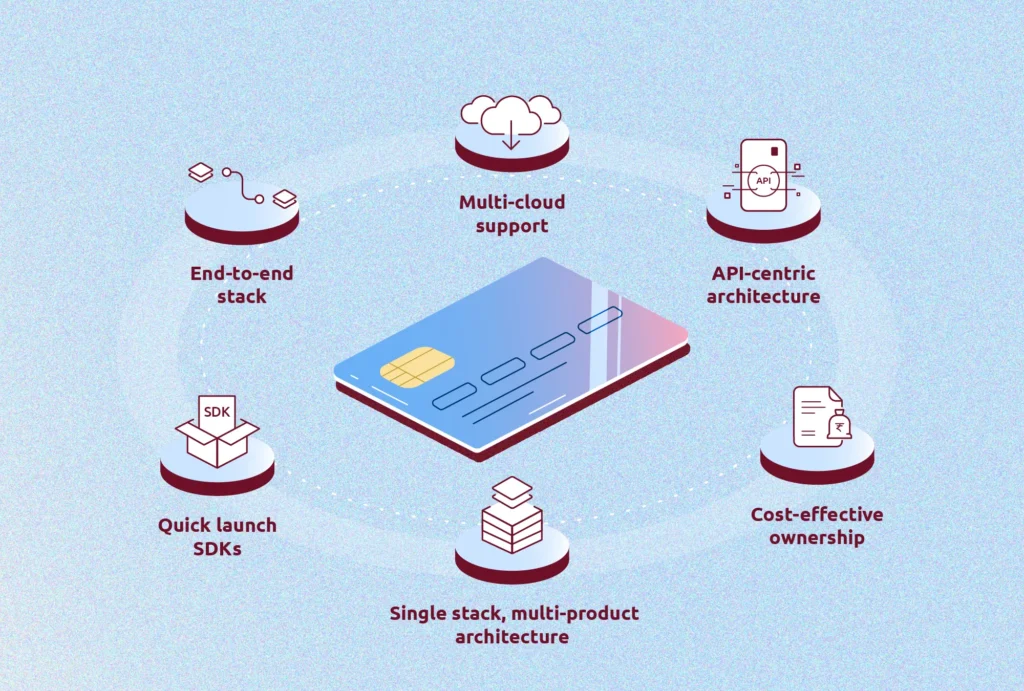

Effortless borrowing is not powered by a single innovation, but by a powerful technology stack that combines artificial intelligence, data intelligence, and digital public infrastructure. Together, these technologies eliminate friction from the lending process, reduce risk for lenders, and expand credit access to underserved populations. In India and globally, this tech-led transformation is redefining how credit decisions are made and executed.

🤖 Artificial Intelligence & Machine Learning

AI and machine learning are the core engines behind modern digital lending platforms. Unlike traditional underwriting—which relies on static credit scores and manual verification—AI models continuously learn from large datasets to make faster and more accurate credit decisions.

Key Applications of AI in Lending:

- Real-Time Credit Scoring:

AI analyzes thousands of data points in seconds, enabling instant approval or rejection decisions based on current financial behavior rather than outdated credit records. - Advanced Fraud Detection:

Machine learning models detect unusual transaction patterns, identity mismatches, and behavioral anomalies, helping lenders prevent fraud and reduce loan defaults. - Personalized Loan Offers:

AI enables dynamic loan structuring, offering personalized interest rates, tenures, and credit limits based on individual risk profiles and repayment capacity.

📌 Impact: AI-driven lending reduces operational costs, improves credit quality, and enables lenders to serve first-time and thin-file borrowers more efficiently.

📊 Alternative Credit Data & Behavioral Insights

Traditional credit scoring systems often exclude individuals and small businesses with limited formal credit history. Effortless borrowing platforms overcome this challenge by leveraging alternative data sources that reflect real-world financial behavior.

Common Alternative Data Sources:

- UPI Transaction History:

Provides insights into spending patterns, income stability, and repayment behavior in real time. - E-Commerce Purchase Data:

Indicates consumption habits, transaction frequency, and financial discipline, especially useful for BNPL and short-term credit. - Utility & Mobile Bill Payments:

Regular payment behavior for electricity, water, gas, and telecom bills acts as a strong proxy for creditworthiness. - GST & Invoicing Data for MSMEs:

Enables automated assessment of business cash flows, revenue consistency, and working capital needs.

📌 Why It Matters: Alternative data dramatically expands financial inclusion by enabling lenders to assess credit risk beyond traditional CIBIL or bureau scores.

🔐 Digital Public Infrastructure (India’s Strategic Advantage)

India’s globally recognized Digital Public Infrastructure (DPI) is a critical enabler of effortless borrowing at scale. This government-backed technology ecosystem reduces friction, enhances trust, and lowers the cost of credit delivery.

Core DPI Components:

- Aadhaar-Based e-KYC:

Enables instant, paperless identity verification, reducing onboarding time from days to minutes while maintaining regulatory compliance. - UPI AutoPay:

Facilitates automated, recurring loan repayments, lowering default risk and improving borrower convenience. - Account Aggregator (AA) Framework:

Allows secure, consent-based sharing of financial data (bank statements, GST data, investments) between users and lenders, enabling transparent and accurate credit assessment.

📌 Global Significance: India’s DPI stack is increasingly viewed as a model for other emerging economies seeking to scale digital finance responsibly.

🌐 How These Technologies Work Together

The real power of effortless borrowing lies in integration. AI processes alternative data sourced via digital infrastructure, enabling lenders to:

- Approve loans instantly

- Price risk dynamically

- Monitor borrower behavior continuously

- Offer proactive credit support

This creates a closed-loop, intelligent lending system that evolves with the borrower.

🔮 Looking Ahead

As these technologies mature, the future of borrowing will feature:

- Fully automated loan lifecycle management

- Predictive credit offers before users apply

- Embedded lending across apps and platforms

- Stronger data privacy and consent controls

Together, these innovations will make borrowing smarter, safer, and nearly invisible, cementing effortless borrowing as a foundational pillar of future finance.

Case Studies & Real-World Examples

Real-world case studies demonstrate how effortless borrowing is not just a concept but a working financial model already delivering scale, speed, and profitability. From large Indian NBFCs to global BNPL leaders, these examples show how technology-led lending is reshaping both consumer behavior and lender operations.

📌 Case Study 1: Bajaj Finance — AI-Driven Lending at Scale (India)

Bajaj Finance, one of India’s largest non-banking financial companies (NBFCs), offers a powerful example of how traditional lenders are reinventing themselves through technology. By integrating AI-driven automation and voice-based digital assistants, the company has significantly reduced friction across the loan lifecycle.

Key Innovations:

- AI Voice Bots for Loan Disbursal:

Bajaj Finance uses AI-powered voice bots to guide customers through loan eligibility checks, documentation, and approval processes—eliminating the need for manual agent interaction in many cases. - End-to-End Digital Processing:

From application to disbursal, most loans are now processed digitally, allowing approvals within minutes for repeat and pre-qualified customers.

Measurable Impact:

- Expected to disburse ₹5,000+ crore worth of loans through automated channels in the near term.

- Loan processing time reduced by over 70%, significantly improving customer satisfaction and operational efficiency.

- Lower cost per loan due to reduced human intervention and faster turnaround.

📌 Why It Matters: Bajaj Finance’s transformation highlights how AI and automation can help large, regulated institutions scale effortless borrowing without compromising risk management.

📌 Case Study 2: Buy Now, Pay Later (BNPL) Platforms — Redefining Consumer Credit (Global)

Globally, Buy Now, Pay Later (BNPL) platforms have emerged as one of the most visible and widely adopted forms of effortless borrowing. Companies such as Klarna (Europe), Affirm (USA), and LazyPay (India) have reimagined short-term consumer credit by embedding it directly into the purchase journey.

How BNPL Works:

- Credit is offered at the point of checkout, both online and offline.

- Approvals happen in seconds using lightweight credit checks and alternative data.

- Consumers repay in short installments, often interest-free if paid on time.

Business & Consumer Impact:

- Higher checkout conversion rates for merchants, as BNPL reduces upfront payment friction.

- Increased average order values, particularly in fashion, electronics, and travel.

- Enables small-ticket, high-frequency borrowing, appealing to younger and credit-averse users.

📌 Why It Matters: BNPL platforms demonstrate how credit, when embedded seamlessly into everyday transactions, becomes a natural extension of commerce rather than a standalone financial decision.

🌍 Broader Implications of These Case Studies

Together, these examples illustrate two key truths about the future of lending:

- Scale and trust matter: Large institutions can successfully adopt fintech innovation.

- Experience drives adoption: Borrowers prefer fast, invisible, and contextual credit over traditional loan applications.

Effortless borrowing succeeds when technology reduces friction while maintaining transparency, security, and regulatory compliance.

Benefits of Effortless Borrowing

Effortless borrowing delivers significant advantages across the financial ecosystem—empowering consumers, accelerating business growth, and improving credit inclusion. By removing traditional barriers to credit access, digital lending models create a win-win scenario for borrowers, lenders, and platforms alike.

👤 Benefits for Consumers

⚡ Faster Access to Funds

One of the most impactful benefits of effortless borrowing is speed. Digital lending platforms can approve and disburse loans within minutes or hours, compared to days or weeks under traditional banking systems. This rapid access is especially critical for:

- Medical emergencies

- Short-term cash flow gaps

- Unexpected personal expenses

For many users, instant credit can be the difference between disruption and stability.

🧾 Lower Documentation & Process Stress

Effortless borrowing eliminates the need for extensive paperwork, physical branch visits, and repeated verification. With digital KYC, automated checks, and app-based workflows, borrowers can apply for loans with minimal effort, reducing both stress and time commitment.

This simplified process is particularly valuable for:

- Salaried professionals with limited time

- Self-employed individuals without formal income proofs

- Rural and semi-urban users unfamiliar with complex banking procedures

🌱 Credit Access for First-Time & Underserved Borrowers

Traditional lending models often exclude individuals with little or no credit history. Effortless borrowing platforms use alternative data and behavioral insights to evaluate creditworthiness, enabling:

- First-time borrowers to enter the formal credit system

- Gig workers and freelancers to access loans

- Young professionals to build credit profiles early

📌 Long-term Impact: Greater financial inclusion and healthier credit behavior over time.

🏢 Benefits for Businesses & Platforms

📈 Higher Sales Conversion & Customer Retention

For businesses, offering embedded credit options—such as BNPL or instant EMIs—at the point of purchase significantly reduces payment friction. Customers are more likely to complete transactions when flexible credit is available, leading to:

- Higher checkout conversion rates

- Increased average order values

- Improved customer loyalty

This is particularly effective in e-commerce, travel, electronics, and education sectors.

💰 Embedded Credit Monetization Opportunities

Effortless borrowing enables businesses and platforms to monetize credit without becoming lenders themselves. Through partnerships with fintechs and NBFCs, companies can earn:

- Referral commissions

- Revenue share on interest or fees

- Increased lifetime customer value

📌 Example: Marketplaces and apps offering instant credit turn financing into an additional revenue stream.

🔄 Better Cash Flow & Working Capital Management

For MSMEs and service providers, digital lending provides faster access to working capital based on real-time business data. Automated credit lines help businesses:

- Smooth cash flow fluctuations

- Manage inventory and payroll

- Scale operations without long approval cycles

This agility supports growth while reducing dependency on informal or high-cost credit sources.

🌐 Why These Benefits Matter

By aligning credit access with real-world financial behavior and digital usage, effortless borrowing shifts finance from being institution-centric to user-centric. The result is a more inclusive, responsive, and efficient lending ecosystem that supports economic growth at both individual and enterprise levels.

Risks, Challenges & Regulation

While effortless borrowing has dramatically improved access to credit, it also introduces new risks and systemic challenges. The speed and convenience of digital lending, if not managed responsibly, can lead to financial stress for borrowers and reputational and regulatory risks for lenders. As digital credit scales, strong regulation, transparency, and consumer awareness become critical to ensuring sustainable growth.

🚨 Key Risks Associated with Effortless Borrowing

🔻 Over-Borrowing & Debt Traps

Instant access to credit can encourage impulsive or repeated borrowing, especially when loans are approved with minimal friction. Short-term loans with high interest rates or fees can quickly snowball into debt traps if repayments are missed or rolled over.

This risk is particularly high for:

- First-time borrowers

- Young users and gig workers

- Consumers using multiple loan apps simultaneously

📌 Impact: Rising defaults, damaged credit scores, and long-term financial stress.

📱 Unregulated & Illegal Loan Apps

India has witnessed a surge in illegal digital loan apps that operate outside RBI regulations. These apps often:

- Charge exorbitant interest rates

- Hide fees in fine print

- Use unethical recovery practices

- Misuse personal data for harassment

Such platforms exploit vulnerable borrowers and undermine trust in the digital lending ecosystem.

🔐 Data Privacy & Consent Concerns

Effortless borrowing relies heavily on user data—bank transactions, mobile usage, and behavioral insights. Without proper safeguards, this raises serious concerns around:

- Unauthorized data access

- Excessive data collection

- Misuse of personal contacts and media

📌 Key Challenge: Balancing data-driven credit assessment with user privacy and informed consent.

🏛 Regulatory Actions & Consumer Protection (India)

To address these risks, the Reserve Bank of India (RBI) has introduced a series of regulatory measures aimed at protecting borrowers while encouraging innovation.

📜 RBI Digital Lending Guidelines

The RBI mandates that:

- Loans must be disbursed and repaid only between regulated entities and borrower bank accounts

- Fintech apps must act as service providers, not lenders

- Complete transparency in interest rates, fees, and repayment schedules

🧾 Mandatory Lender Disclosure

Borrowers must be clearly informed about:

- The name of the regulated lending institution

- Annual Percentage Rate (APR)

- All charges, penalties, and cooling-off periods

This improves informed decision-making and reduces mis-selling.

🚫 Ban on Illegal Recovery Practices

The RBI has strictly prohibited:

- Harassment and intimidation

- Public shaming or threats

- Unauthorized access to contacts and photos

Violations can result in penalties, app bans, and legal action.

🛑 Warning Box: Borrower Safety First

Always borrow from RBI-regulated banks or NBFCs only.

Before taking a digital loan, verify the lender’s registration, read the loan agreement carefully, and avoid apps that promise “guaranteed approval” or pressure you to borrow immediately.

🌐 Why Regulation Matters for the Future

Strong regulation is not a barrier to innovation—it is a foundation for trust. As effortless borrowing becomes mainstream, regulatory clarity ensures:

- Long-term ecosystem stability

- Protection for vulnerable borrowers

- Sustainable fintech growth

Platforms that prioritize ethical lending, transparency, and data protection will emerge as long-term winners in the future of digital finance.

Comparison: Traditional Loans vs Effortless Borrowing

| Feature | Traditional Loans | Effortless Borrowing |

| Approval Time | Takes several days to weeks, involving branch visits, manual verification, and credit committee approvals | Minutes to a few hours using automated underwriting, real-time data analysis, and instant decision engines |

| Paperwork | Heavy documentation including physical forms, income proofs, bank statements, and in-person signatures | Minimal to zero paperwork with digital KYC, e-signatures, and paperless onboarding |

| Credit Access | Limited primarily to salaried individuals with strong credit history | Inclusive access for gig workers, MSMEs, first-time borrowers, and thin-file customers |

| Credit Assessment | Based mainly on traditional credit scores, income slips, and collateral | Uses AI-driven models and alternative data such as UPI history, utility bills, GST data, and spending behavior |

| Disbursement Speed | Funds released after multiple internal checks and manual approvals | Instant or same-day disbursal directly to the borrower’s bank account |

| Customer Experience | Complex, time-consuming, and branch-dependent | Seamless, app-based, and mobile-first with real-time tracking and notifications |

| Flexibility | Rigid loan amounts, fixed tenures, and limited customization | Personalized loan offers, dynamic credit limits, and flexible repayment options |

| Transparency | Fees and terms often explained verbally or buried in paperwork | Digital dashboards showing interest rates, EMIs, fees, and repayment schedules upfront |

| Accessibility | Mostly urban and metro-focused | Pan-India reach, including Tier 2, Tier 3 cities, and rural areas |

10-Year Outlook (2025–2035): The Future of Effortless Borrowing

The next decade will fundamentally redefine how credit is created, priced, delivered, and regulated. Effortless borrowing will evolve from a fintech innovation into a core financial utility, operating quietly in the background of daily life.

What to Expect Over the Next 10 Years

🤖 AI-First & Autonomous Underwriting

By 2035, most lending decisions will be made by AI-only underwriting engines, with minimal human intervention. These systems will continuously analyze real-time financial behavior—income flows, spending patterns, repayment discipline, and risk signals—to approve or adjust credit instantly. Traditional static credit scores will give way to living credit profiles that update in real time.

Impact: Faster approvals, lower default rates, and more accurate risk pricing—especially for gig workers and MSMEs.

📲 Credit Embedded in Every Digital Experience

Borrowing will no longer feel like a separate financial action. Instead, credit will be embedded seamlessly into apps and platforms—from e-commerce checkouts and travel bookings to healthcare payments, education platforms, and B2B marketplaces. Consumers may not even “apply” for a loan; credit will activate automatically when a transaction requires it.

Example: A business ordering inventory receives instant working capital at checkout without leaving the app.

📉 Real-Time, Dynamic Interest Rates

Interest rates will become dynamic and personalized, adjusting based on real-time risk signals rather than fixed loan terms. Borrowers with improving cash flows or strong repayment behavior may see interest rates reduce automatically, incentivizing responsible borrowing.

Result: Fairer pricing, higher transparency, and stronger borrower-lender trust.

🌍 Stronger, More Harmonized Global Regulations

As digital lending scales globally, governments and regulators will introduce stricter, tech-aware frameworks to protect consumers. Expect:

- Standardized disclosure norms

- AI model audits and explainability rules

- Stronger data privacy and consent laws

In India, RBI’s digital lending guidelines will evolve further, supported by the Digital Public Infrastructure (DPI) stack.

🌱 Massive Leap in Financial Inclusion

By 2035, effortless borrowing could bring billions of unbanked and underbanked individuals into formal credit systems—especially across Asia, Africa, and Latin America. Micro-credit, pay-as-you-go financing, and nano-loans will support livelihoods, entrepreneurship, and economic mobility at scale.

Outcome: Credit becomes a tool for empowerment, not exclusion.

🔚 The Big Picture

By 2035, borrowing will become almost invisible—activated automatically, priced fairly, and repaid seamlessly in the background. The winners in this new era will be platforms that balance speed with responsibility, innovation with regulation, and access with financial discipline.

FAQs Section

1. What is effortless borrowing?

Effortless borrowing is a digital-first lending model that allows individuals and businesses to access credit instantly, with minimal paperwork and friction. Instead of visiting a bank branch, borrowers can apply through apps or web portals. AI-powered credit scoring, alternative data, and automated disbursals enable approvals within minutes rather than days. Globally, this trend is seen in BNPL platforms like Klarna and Affirm, while in India, Bajaj Finserv, LazyPay, and Paytm exemplify this approach.

Key Features:

- Fully digital loan application

- AI/ML-driven approval

- Integration with e-commerce, wallets, or banking apps

Minimal documentation

2. Is digital lending safe in India?

Yes, if you use RBI-regulated banks or NBFCs. The RBI Digital Lending Guidelines (2022) enforce:

- Transparency in interest rates, fees, and repayment schedules

- Prohibition of illegal loan apps and harassment practices

- Data protection and consent-based data sharing

Red flags to avoid:

- Apps promising guaranteed approval

- Lenders not listed on RBI’s website

- Aggressive recovery tactics

Pro Tip: Always verify the lender’s registration and check online reviews before borrowing.

3. What is alternative credit scoring?

Alternative credit scoring uses non-traditional financial and behavioral data to determine creditworthiness, enabling inclusion of first-time borrowers and thin-file customers. Data points include:

- UPI and bank transaction history

- E-commerce purchase patterns

- Utility bill and mobile bill payments

- GST and invoicing data for MSMEs

Example: A delivery partner with no prior loans may qualify for a micro-loan because their regular UPI transactions and bill payments indicate financial stability.

4. Are instant loans more expensive than traditional bank loans?

Often, yes, because lenders price speed, convenience, and higher risk. Short-term loans via apps may have interest rates 15–30% per annum or higher for nano and micro-credit.

Cost-saving tips:

- Compare APR, processing fees, and repayment options across platforms

- Pay off loans early when possible

- Use BNPL for small-ticket, short-term credit

5. Who benefits the most from digital lending?

- First-time borrowers without formal credit history

- Gig and freelance workers with irregular income

- MSMEs and startups needing working capital

- Young professionals and urban millennials seeking instant personal credit

- Rural and semi-urban users with limited access to bank branches

Stat Insight: Over 11 crore digital loans were disbursed in India FY24–25, many going to previously underbanked populations (RBI, NPCI).

6. How does AI improve digital lending?

AI transforms lending by:

- Real-time credit scoring: Analyzing thousands of data points instantly

- Fraud detection: Identifying unusual patterns and mitigating risk

- Personalized offers: Custom interest rates, tenures, and credit limits

- Dynamic monitoring: Tracking repayment behavior to adjust credit limits proactively

Impact: Faster approvals, lower default rates, and better financial inclusion.

7. What role does UPI play in India’s digital borrowing?

UPI provides:

- Instant fund transfers for loans

- Behavioral data for credit scoring

- Automated repayments via AutoPay

- Enables micro-credit access for small-ticket loans

Example: A shopkeeper can receive a ₹10,000 working capital loan in minutes, and repayments are automatically deducted via UPI AutoPay without manual intervention.

8. What are the main risks for consumers?

Key risks include:

- Over-borrowing leading to debt traps

- Hidden fees or opaque terms

- Borrowing from unregulated apps

- Data misuse or privacy breaches

Mitigation: Borrow responsibly, maintain timely repayments, and use RBI-regulated lenders only.

9. How are regulators controlling risks?

- RBI mandates transparency and consent for digital lending

- Illegal apps and abusive recovery practices are banned

- Periodic audits of fintech and NBFC platforms

- Account Aggregator framework ensures secure, permissioned data sharing

Impact: Protects borrowers while fostering innovation.

10. Will effortless borrowing replace traditional banks?

Not entirely. Banks remain key for capital, compliance, and large-scale lending. However, they are increasingly partnering with fintechs for:

- Faster approvals

- App-based lending

- Embedded financial services

Trend: Banks focus on regulated capital, while fintechs enhance user experience and speed.

11. How will borrowing evolve over the next decade?

- AI-only underwriting models

- Credit embedded in apps—BNPL, travel, retail, and healthcare

- Dynamic interest rates based on repayment behavior

- Stronger regulations and data privacy laws

- Massive financial inclusion for billions worldwide

By 2035, borrowing could become invisible, activating automatically when a transaction or need arises.

12. How to use digital credit responsibly?

- Compare interest rates and fees

- Borrow only what you need

- Avoid multiple concurrent loans

- Track EMIs via apps or budgeting tools

- Read terms & conditions carefully

Outcome: Builds a healthy digital credit profile and avoids debt traps.

13. Can MSMEs benefit from effortless borrowing?

Yes. Digital platforms provide:

- Instant working capital loans

- Cash flow-based credit via GST and invoicing data

- Seamless integration with accounting tools

Example: An e-commerce seller receives instant capital for inventory based on monthly sales data, avoiding delays in business expansion.

14. How do BNPL platforms fit into effortless borrowing?

BNPL (Buy Now Pay Later) is a consumer-focused subset of digital lending. Key benefits:

- Interest-free or low-cost short-term credit

- Instant approval at checkout

- Drives higher conversion and average order value for merchants

Global Leaders: Klarna, Affirm, Afterpay

India Leaders: LazyPay, Simpl, ZestMoney

15. How can borrowers avoid scams?

- Verify lender registration on RBI’s website

- Avoid apps with “instant guaranteed approval” promises

- Never share OTPs or passwords

- Check interest rates and fees before accepting

Tip: Stick to regulated NBFCs, banks, or fintech-bank partnerships for safety.

Summary

- Borrowing is becoming faster and frictionless

Effortless borrowing replaces traditional, paperwork-heavy loans with instant, digital credit powered by fintech platforms, mobile apps, and automated approvals, making access to funds quicker and simpler than ever before. - Digital lending is reshaping global finance at scale

Worldwide, digital and fintech lending markets are growing rapidly, driven by AI-powered underwriting, embedded finance, and rising consumer demand for instant credit across e-commerce, travel, and daily spending. - India is leading the digital credit revolution

With UPI, Aadhaar-based KYC, and fintech–NBFC partnerships, India has emerged as one of the fastest-growing digital lending markets, expanding credit access to first-time borrowers, MSMEs, and younger populations. - Technology is the backbone of effortless borrowing

Artificial intelligence, alternative data sources, and digital public infrastructure enable real-time credit decisions, personalized loan offers, fraud detection, and financial inclusion beyond traditional credit score models. - Opportunities come with risks and responsibilities

While effortless borrowing improves convenience, it also raises concerns around over-borrowing, data privacy, and unregulated loan apps, making strong regulation, transparency, and borrower awareness essential. - The future points toward invisible, embedded credit

Over the next decade, borrowing will become seamlessly embedded into everyday transactions, with AI-driven, real-time lending becoming a core financial service rather than a separate banking process.

Conclusion

Effortless borrowing is no longer a niche fintech innovation—it is rapidly becoming the core infrastructure of modern finance. By eliminating paperwork, reducing approval times, and leveraging AI-driven credit assessment, digital lending platforms are transforming how individuals and businesses access capital. What once took weeks can now happen in minutes, reshaping consumer expectations and forcing traditional financial institutions to rethink their lending models.

However, with greater speed and accessibility comes greater responsibility. The widespread adoption of instant credit raises critical concerns around responsible borrowing, data privacy, and regulatory oversight. Ensuring transparency in pricing, preventing over-indebtedness, and protecting users from unregulated or predatory loan apps will be essential to sustaining long-term trust in digital finance ecosystems. Regulators, lenders, and consumers must evolve together to create a balanced and secure borrowing environment.

Looking ahead, India and the global financial system are entering a decade where borrowing becomes embedded, intelligent, and nearly invisible—integrated seamlessly into payments, e-commerce, and everyday financial decisions. For borrowers, this promises greater inclusion and convenience; for lenders, it unlocks new growth and innovation. The institutions that successfully balance technology with ethics and trust will define the future of finance in this new age of effortless borrowing.

References

Here are the reliable sources used or recommended for this blog, complete with links so you can cite them directly in your publication:

India Digital Lending & Fintech Growth

- Digital lending in India saw ₹37,686 crore in loans disbursed, up 27% year-on-year — illustrating rapid growth of effortless borrowing. Digital lending in India surges: Loans disbursed hit Rs 37,686 crore, up 27% YoY – IndiaTracker

- FinTech NBFCs in India sanctioned about 10.9 crore personal loans totaling ₹1,06,548 crore in FY 2024-25, highlighting rising credit penetration via digital platforms. The Economic Times

- A Beams FinTech & JM Financial report shows India has hundreds of active digital lenders and strong funding flows, reflecting ecosystem maturity. ETBFSI.com

Global & Market Trends in Digital Lending

- AI-driven credit scoring and instant credit demand are key global trends reshaping lending markets, boosting efficiency and inclusion. Business Wire

- Digitization in the lending market shows major adoption of automation and AI in underwriting and approvals worldwide. Industry Research

- The digital lending platform market is projected to grow significantly by 2035, driven by tech adoption and embedded finance. Future Market Insights

Technology & Adoption Trends

- Digital lending platforms globally increasingly deploy AI and blockchain tools to improve transparency and speed. Industry Research

- AI credit models are enabling broader access to credit beyond traditional CIBIL-only scores, expanding inclusion. Lendfoundry

Risks & Consumer Protection

- Loan app fraud issues highlight dangers from unregulated digital lending offers and underscore the need for awareness and regulation. The Times of India

India Digital Payments & Financial Inclusion

- UPI adoption has dramatically increased digital financial participation, supporting scalable lending systems. The Times of India