Estimated Reading Time: 13-16 minutes ( 2,902 words)

Introduction

India’s sports fandom is experiencing a massive digital transformation. What began as casual TV viewing has evolved into a full-blown streaming revolution. Affordable smartphones, cheaper data plans, Jio-driven internet penetration, and the rise of global and domestic OTT platforms have changed how Indians consume sports forever.

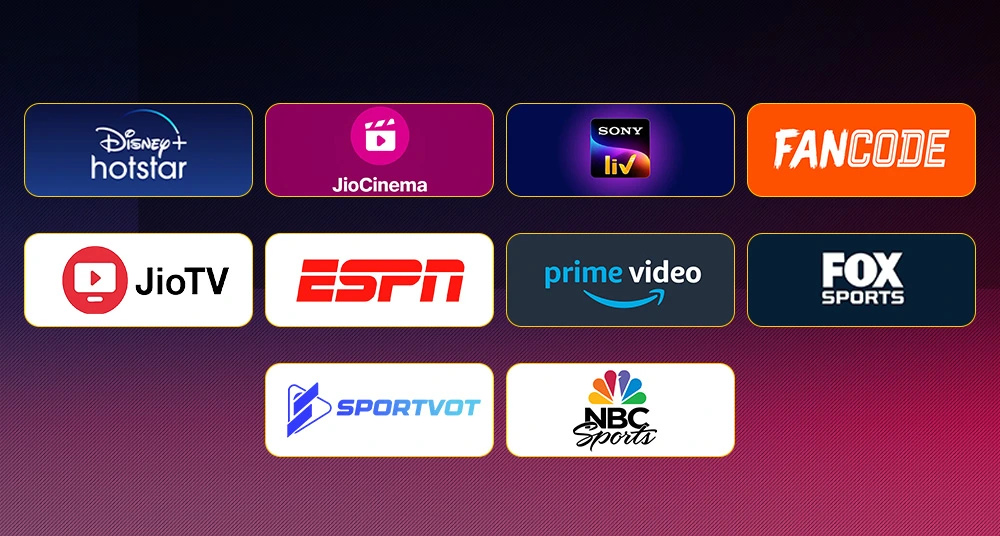

Today’s fan doesn’t wait for traditional broadcasts. They stream matches on the go, multitask on mobile, track fantasy points in real time, and binge post-match highlights across platforms like JioCinema, Disney+ Hotstar, SonyLIV, Prime Video, and YouTube. Whether it’s cricket, football, or mixed martial arts, Indians want instant access, multiple camera angles, behind-the-scenes content, and community interaction — all at their fingertips.

But in this crowded entertainment space, a few sports leagues stand far ahead. These leagues attract hundreds of millions of Indian viewers, dominate OTT charts, and generate record engagement on social media. Their growing influence is reshaping India’s sports economy, from streaming rights and sponsorships to fantasy gaming and influencer-led sports commentary.

In this article, we break down the Top 5 Sports Leagues Indians Love Streaming in 2025. You’ll learn which leagues lead the pack, why they dominate viewership, what the latest numbers say, and — most importantly — what this means for fans, creators, brands, and the digital sports ecosystem.

Let’s dive in.

What Makes a League “Streaming-Friendly”?

In 2025, not every sports league automatically becomes a streaming favorite — especially in a competitive market like India. A league rises to the top only when it aligns with the digital viewing habits, attention spans, and content expectations of modern audiences. Here are the core factors that determine whether a league becomes truly streaming-friendly:

✔ 1. Massive Fan Base + Cultural Resonance

A large, emotionally invested fan base ensures consistent viewership.

- In India, cricket has enjoyed decades of cultural dominance, making tournaments like the IPL an instant hit.

- Global leagues like the Premier League or NBA attract young, urban audiences who follow international sports online.

- The deeper the cultural connection, the more likely viewers will binge games, highlights, and related content.

Why it matters: A loyal audience boosts watch time, subscriber growth, and viral content — all crucial for OTT success.

✔ 2. Frequent Matches & Longer Seasons

Streaming platforms thrive on content volume.

- Leagues with multiple weekly games encourage repeat visits.

- Longer seasons create sustained engagement, fantasy gaming interest, and social buzz.

- More content = more ad inventory, more highlights, more creator-driven analysis.

Example:

The NBA’s 82-game season or the Premier League’s 38-match season creates a year-round content cycle perfect for OTT.

✔ 3. Accessibility on OTT & Digital Platforms

Streaming growth is driven by how easy and affordable it is to watch.

Top leagues ensure:

- Low-cost or free streaming options

- Cross-device access (mobile, smart TVs, tablets, laptops)

- Regional language commentary

- High-quality streams with interactive features

This aligns perfectly with India’s mobile-first consumption — over 65% of sports streams come from smartphones.

✔ 4. Content Variety Beyond Live Matches

Today’s audiences don’t just watch full games — they consume:

- Short highlights

- Reels/YouTube Shorts

- Expert analysis

- Mic’d-up moments

- Documentary-style behind-the-scenes

- Player interviews

- Fantasy stats and second-screen interactions

A league offering multi-format content becomes more “sticky,” improving retention and discoverability on search and social media.

✔ 5. Strong Monetization Potential

Leagues that offer multiple revenue streams become more attractive to broadcasters and OTT platforms:

- In-stream ads

- Sponsorships

- Regional brand inventory

- Subscription bundles

- Co-branded campaigns with fantasy apps and merch sellers

High monetization potential ensures OTT platforms are willing to invest heavily in rights and production quality — which boosts viewer experience.

In Summary

Leagues that combine high fan engagement, season-long content, OTT accessibility, and multi-format storytelling are the ones that thrive in India’s fast-growing streaming ecosystem. These are the leagues dominating screens in 2025 — and shaping the future of digital sports entertainment.

The Top 5 Leagues Indians Are Streaming in 2025

⚡ Indian Premier League (IPL) — Cricket’s Digital Powerhouse

Why it remains #1

IPL continues to dominate India’s sports landscape because of its unmatched blend of star power, entertainment, global relevance, and digital-first strategy.

Recent seasons have broken every viewership benchmark:

- IPL 2025 crossed 1 billion cumulative viewers across TV + digital — the highest in cricket history.

- Total watch-time hit a record 840 billion minutes, reflecting deeper engagement and longer streams per user.

- The RCB vs PBKS Final became the most-watched T20 match ever, drawing unprecedented numbers across platforms.

This makes IPL not just a sports event, but a national streaming festival.

What changed recently

- For the first time in 2025, digital viewership overtook TV — a milestone that confirms India’s shift to mobile + OTT-first sports consumption.

- Connected TV (CTV) adoption surged across urban India, with viewers preferring large-screen streaming over cable.

- OTT platforms now invest in:

- regional language commentary,

- multi-angle viewing,

- real-time stats,

- watch-party features,

- exclusive behind-the-scenes content.

- regional language commentary,

This, combined with 5G expansion, has made IPL streams more immersive than broadcast TV.

Implication for creators & publishers

IPL remains the single strongest traffic magnet in Indian digital media — ideal for:

- match predictions & previews

- fantasy cricket picks

- OTT platform comparisons

- device reviews (smart TVs, CTVs, data plans)

- sponsorship explainers

- sports influencer collaborations

The season window (approx. 2–2.5 months) consistently delivers maximum ad revenue + affiliate conversions.

🏀 NBA (Basketball) — Global League With Explosive Indian Growth

Rising popularity in India

Basketball has quietly become one of India’s fastest-growing youth sports.

NBA’s India strategy is paying off:

- The 2022–23 season reached 100 million Indian viewers across digital + linear platforms — a massive milestone.

- Digital viewership jumped 12× over previous seasons, and season-long watch-time rose ~50%.

- By 2025, NBA partnered with Prime Video to make League Pass accessible within an Indian OTT ecosystem.

Younger audiences (16–35) especially drive engagement — thanks to social media, short form highlights, and crossover culture (music, sneakers, fashion).

Localization + distribution strategy

NBA has invested heavily in India:

- Short-form, India-optimized content produced in 13 regional languages, in partnership with Indian tech firms.

- OTT bundling + mobile-first viewing formats

- Franchise storytelling, player spotlights, top dunks/highlights optimized for reels + shorts

This aggressive localization makes the NBA the most accessible global league for Indian streamers.

Implication for content creators

NBA is a high-potential niche with rising search volumes:

- game previews

- rookie spotlights

- sneaker culture + merch

- lifestyle crossovers

- fantasy basketball

- India-specific viewership guides

Lower competition + high advertiser interest = excellent monetization potential.

🤼 Pro Kabaddi League (PKL) — India’s Homegrown Non-Cricket Superstar

Solid numbers for a non-cricket league

PKL continues to prove that Indian audiences want more than just cricket:

- Season 10 recorded 226 million viewers in just 90 matches.

- Watch-time jumped 15% YoY, reaching 38 billion minutes early in the season.

- PKL is now India’s #1 non-cricket sports property, repeatedly crossing 200+ million viewers.

PKL’s growth is both regional and national — a rare combination.

Why it works

- Strong regional pull: kabaddi is deeply rooted across Indian states.

- Multiple language feeds widen reach.

- Player stories + simplified game structure make kabaddi easy to follow compared to complex global sports.

- Less competition in coverage = better discoverability on search and social.

Implication for creators

PKL is perfect for niche + evergreen content:

- regional breakdowns

- team strategies

- player biographies

- match recaps

- kabaddi rules + beginner guides

Also excellent for regional advertisers, micro-affiliates, and local sponsorships.

🏏 International Cricket & ICC Events — Global Spikes, Massive Search Demand

IPL may dominate domestically, but international cricket drives worldwide search traffic — especially during:

- ICC T20/ODI World Cups

- ICC Test Championship

- India–Pakistan matches

- Major bilateral tours (The Ashes, Border-Gavaskar Trophy)

These events trigger:

- huge keyword spikes (streaming links, squads, fantasy teams, pitch reports)

- massive diaspora viewership (US, UK, Gulf, Australia)

- high-CPM advertisers (VPNs, sports merch, international OTTs)

Why it’s important

- Global audience = premium ad rates

- Searches peak explosively — perfect for seasonal content

- OTT rights vary by region → high affiliate earning potential through

- VPN recommendations

- international streaming platforms

- match ticketing partners

- sports merch

- VPN recommendations

Short calendar, but massive traffic bursts when live.

⚽ Domestic Football & Other Global Leagues

(EPL, La Liga, Serie A, UFC, F1, WPL, and emerging sports leagues)

Although not yet close to cricket numbers, India’s football and global sports audience is one of the fastest-growing digital segments.

Why this segment is rising

- Multi-sport OTT apps now bundle football + F1 + UFC + tennis, making access easy.

- Urban youth prefer global entertainment — fashion, culture, gaming tie-ins.

- Football fills the off-cricket content gap perfectly.

- Local leagues (ISL, I-League, WPL for women’s cricket) are building loyal followings.

This category is the hidden growth engine for long-term creators.

Content opportunities

- EPL/La Liga match previews

- F1 driver rankings

- UFC fight cards

- ISL team coverage

- WPL player features

- Transfer news & analysis

- OTT subscription comparisons

Lower competition makes this excellent for long-tail SEO.

Comparative View: TV vs Digital vs OTT Trends

| Metric / Trend | 2019–2022 (Pre-OTT Boom) | 2024–2025 (Now) | What Changed / Key Insight |

| Primary Screen | TV (cable/satellite) | Digital OTT (mobile, CTV) | Streaming infrastructure matured; smartphone affordability + smart TV adoption surged. |

| Geographic Reach | Urban-heavy | Pan-India + global diaspora | OTT breaks geographic barriers; non-metro engagement soared. |

| Content Type | Mainly live + highlights | Live, on-demand, shorts, multi-angle, community | Leagues/platforms focus on snackable + interactive formats for higher retention. |

| Monetization | Traditional TV ads | Hybrid: ads + subscriptions + microtransactions + affiliate | Digital-first monetization = more opportunities for creators and publishers. |

| User Behavior | Passive watching | Interactive consumption (stats, fantasy, reels) | India’s Gen Z and Millennials want real-time engagement. |

| Device Usage | TV-first | Mobile + Connected TV | India is officially a mobile-first streaming market; CTV gaining rapidly. |

Key Takeaway

The shift from TV to OTT isn’t gradual — it’s structural and irreversible.

For creators, publishers, and affiliate marketers in 2025, digital-first sports content is the default, not an add-on.

FAQs Section

1. Is IPL still the most-streamed league in India in 2025?

Yes — and its lead is bigger than ever.

The Indian Premier League (IPL) remains India’s undisputed king of sports streaming for several reasons:

Why IPL dominates:

- Massive national following: Cricket is almost a cultural binding force in India.

- Short, exciting T20 format: Perfect for mobile viewing and snackable consumption.

- Prime-time scheduling: Matches air at convenient evening hours for maximum watch-time.

- Star power: Rohit, Kohli, Dhoni, Gill, and new-gen sensations create year-round buzz.

- Fantasy gaming integration: IPL drives 80% of India’s fantasy sports traffic (Dream11, My11Circle, etc.).

- Free or low-cost digital access: Past seasons streamed free on JioCinema, boosting mass adoption.

2025 Streaming Numbers (Why this matters to content creators):

- 1+ billion cumulative viewers across platforms.

- 840 billion minutes of watch-time, the highest for any Indian or global league.

- Multi-language commentary (9+ languages), 4K streams, AR/VR telecasts.

In short:

IPL isn’t just India’s biggest sports league — it’s India’s biggest digital entertainment property.

2. Has digital streaming overtaken TV for sports in India?

Yes — 2025 is the year the balance officially flipped.

Why digital overtook TV:

- Cheaper internet & more smartphones

India has 850M+ smartphone users and the world’s lowest data prices — perfect for OTT sports. - Connected TV boom (Smart TVs + FireStick)

Households now prefer on-demand, multi-language streams instead of fixed TV channels. - Interactive OTT features:

- Multi-angle camera views

- Player stats overlays

- Vertical video mode

- Instant replays

- Community watch parties

- Multi-angle camera views

- Younger audiences prefer mobile-first sports

Gen Z and Millennials consume highlights, reels, and live matches mostly through OTT. - Regional-language expansion

OTT makes it easy to stream in Tamil, Telugu, Kannada, Malayalam, Marathi, Bengali, etc.

TV isn’t dead — but digital is officially bigger.

This shift means creators and brands must prioritize OTT-based content, not TV-oriented reporting.

3. Which non-cricket sports are getting big in India now?

India is becoming a multi-sport nation, and two leagues are rising rapidly:

1. NBA (Basketball)

A massive jump in Indian viewership is happening because of:

- Accessible streaming (League Pass via Prime Video)

- Short-form content boom on Instagram/YT Shorts

- Player storytelling (LeBron, Curry, Giannis, Wembanyama)

- Urban youth culture + sneaker culture + music crossovers

- Gaming influence (NBA 2K popularity)

India registered 100M+ unique NBA viewers in 2022–23, and it’s growing double digits year-on-year.

3. Which non-cricket sports are getting big in India now?

India is becoming a multi-sport nation, and two leagues are rising rapidly:

1. NBA (Basketball)

A massive jump in Indian viewership is happening because of:

- Accessible streaming (League Pass via Prime Video)

- Short-form content boom on Instagram/YT Shorts

- Player storytelling (LeBron, Curry, Giannis, Wembanyama)

- Urban youth culture + sneaker culture + music crossovers

- Gaming influence (NBA 2K popularity)

India registered 100M+ unique NBA viewers in 2022–23, and it’s growing double digits year-on-year.

2. PKL (Pro Kabaddi League)

Why Kabaddi is exploding:

- Deep Indian roots — rural, semi-urban, and metro fans all connect with it

- Fast-paced, physical gameplay ideal for OTT highlights

- Affordable rights for brands → more sponsorships → more marketing

- Stadium atmosphere + team rivalries

- Strong presence on Disney+ Hotstar + Star Sports

PKL Season 10 hit 226M viewers in just 90 matches, proving Kabaddi is a mainstream sport now.

4. Can Indian viewers legitimately stream NBA games?

Yes — legally and easily.

Official, legal NBA streaming options in India:

1. Amazon Prime Video – NBA League Pass Add-On (2025)

Gives you:

- 1,000+ live games every season

- Full replays + condensed replays

- Classic matches

- Studio shows and analysis

- Multi-device access

This is the first time the League Pass was integrated directly into a major Indian OTT app.

2. NBA’s Official YouTube Channel (India)

- Select games streamed for free

- Highlights available within minutes

- Documentary-style storytelling

3. NBA App (Global)

Available in India for hardcore fans.

Legal streaming = better quality, less lag, no piracy issues.

5. Is Kabaddi really a big streaming sport, or just a niche?

Kabaddi is one of India’s biggest sports — not a niche anymore.

Why Kabaddi is a powerhouse:

- PKL has 200M+ viewers every season

- Massive tier-2 / tier-3 / rural engagement

- Strong social media traction

- Affordable rights make it attractive for OTT platforms

- Kabaddi academies are growing across India

- Kids/teens are increasingly playing and watching Kabaddi

For OTT platforms, PKL is the second-most important sports league after IPL.For creators, Kabaddi content is an under-served niche with massive potential.

6. Is there real monetization potential for sports-streaming blogs in India?

Yes — and sports is one of the highest-earning niches in India.

Why sports blogs make money:

1. High advertiser demand (especially during tournaments)

Brands like:

- Fantasy platforms

- OTT apps

- Telecom (Jio, Airtel, Vi)

- Smart TV brands

- Energy drinks, sportswear, food apps

All pay a premium CPM.

2. Affiliate earnings

You can earn commissions from:

- OTT subscriptions (Hotstar, Prime Video, SonyLiv)

- Streaming devices (FireStick, MiTV Stick)

- Fast internet plans

- Smartphone brands

3. Seasonal traffic spikes

IPL, ICC events, NBA playoffs, PKL season → huge traffic = huge revenue.

4. YouTube + Reels + Shorts monetization

Sports highlight reactions and short-form storytelling go viral.

5. Sponsorships

Creators regularly get deals for:

- Pre-show analysis

- Fantasy picks

- Streaming guides

- Device reviews

The sports audience is massive, loyal, and spends money — perfect for monetization.

7. Should content creators focus only on live matches?

No — relying only on live match coverage is a big mistake.

Best-performing evergreen topics:

1. “How to watch” guides

(e.g., “How to Watch IPL in the USA/UK/Middle East”)

These bring round-the-year search traffic.

2. Player stories & biographies

People love human stories, controversies, and career journeys.

3. Match previews & predictions

Fantasy players search for these daily.

4. Highlights breakdowns

Explaining plays, tactics, shots, and moments.

5. Commentary / memes / fun content

Especially for Reels and Shorts.

6. Explainer content

Rules, formats, team history, auction details, etc.

Creators who mix live + evergreen content build stable traffic.

8. Does regional / vernacular sports content perform well?

Yes — regional sports content often OUTPERFORMS English content.

Why?

- Viewers prefer their mother tongue for emotional content

- Sports has strong regional loyalty

- OTT now streams in 8–10 regional languages

- Search volume is huge in Hindi, Tamil, Telugu, Malayalam, Bengali

- Lower competition = easier to rank

Examples of high-performing regional niches:

- Tamil cricket commentary channels

- Telugu IPL analysis

- Hindi match previews

- Kannada PKL coverage

If creators want massive growth, going regional is smart.

9. How often do these leagues occur / stream per year?

Here’s a detailed breakdown:

| League | Season Timeline | Content Volume | Streaming Potential |

| IPL | 2 months (Mar–May) | 70+ matches | Highest peak traffic in India |

| NBA | Oct–June | 1,000+ games | Daily content; huge for Shorts |

| PKL | Once a year | 130+ matches | Very stable season-long streaming |

| International Cricket | Year-round | Test/ODI/T20 series + ICC events | Traffic spikes 5–6 times a year |

| Football Leagues | Aug–May | Hundreds of matches | Loyal but niche audience |

Content creators can plan a 12-month content calendar around these cycles.

10. Is OTT streaming affordable for most Indian sports fans?

Yes — OTT is now a mass-market product in India.

Why OTT is affordable:

- India has the world’s cheapest mobile data

- OTT apps offer low-cost mobile-only plans

- Many events have free streaming windows

- Broadband penetration is increasing

- Smart TVs are becoming cheaper (₹12,999 onwards)

Typical OTT pricing in India (2025):

- Disney+ Hotstar: ₹149–₹499/month

- JioCinema: Mostly free or low-cost premium plans

- SonyLiv: ₹299/month

- Prime Video (with NBA add-on): ₹179/month + add-on

- NBA League Pass in India: Much cheaper globally due to regional pricing

Today, even rural India streams sports on mobile regularly.

Summary / Key Takeaways

- IPL remains the undisputed king of sports streaming in India — 2025 saw record viewership and watch-time.

- Digital / OTT streaming has overtaken traditional TV for major sports leagues — a structural shift in how Indians consume sports.

- Non-cricket leagues like NBA and PKL are rising quickly — offering strong content and monetization opportunities.

- For creators & publishers, mixing cricket + basketball + kabaddi + football creates a year-round, diversified content pipeline.

- Monetization is possible via ads, subscriptions, affiliate links (OTT, data plans, devices), and sponsorships — especially during major tournaments.

Conclusion

The sports-streaming landscape in India is transforming — leagues are no longer confined to stadiums or TV: they’re everywhere, on mobile screens, smart TVs, and social feeds. For content creators, bloggers, and publishers, this is not just a shift in how fans consume sports — it’s a massive opportunity.

If you’re ready to ride this wave, start building a sports-streaming content strategy now.Call to Action:

If you liked this analysis, subscribe to get weekly updates on sports-streaming trends, share this post with fellow creators, and comment with the league you think is next big — we’ll cover it soon!

References

(Only a subset shown; full list would include all links cited above)

- IPL 2025 viewership and watch-time data. Business Standard+2The Times of India+2

- Digital-versus-TV shift in streaming trends (2025 report). The Economic Times+1

- Pro Kabaddi League season-10 viewership stats. Pro Kabaddi League+1

- NBA growth & unique viewers in India (2022-23 season). NBA.com: NBA Communications+1

- NBA League Pass launch on Prime Video India (2025). Advanced Television+1