Estimated Reading Time: 18-21 minutes ( 3,747 words)

Introduction

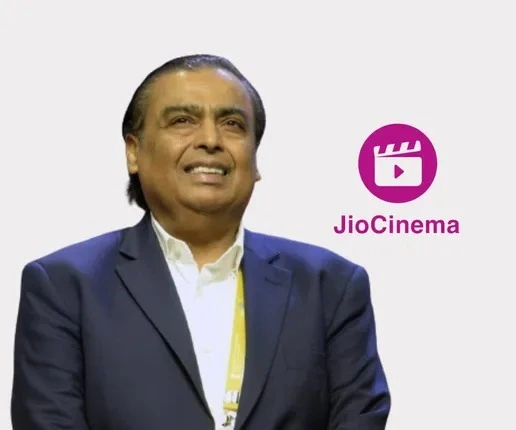

JioCinema’s rise is not just another business story — it represents a fundamental shift in how India consumes entertainment. Over the past few years, the platform has redefined audience behavior by merging affordability, accessibility, and premium content into one seamless experience. Backed by Reliance Industries and its massive Jio telecom ecosystem, JioCinema has turned India’s fragmented OTT market into a battleground for user attention and digital advertising dominance. The platform’s free access to high-value content — especially during major live events like the Indian Premier League (IPL) — disrupted traditional subscription-based models and democratized streaming for millions who were previously priced out of premium OTT services.

What makes this disruption even more significant is its timing. India’s OTT landscape was reaching saturation in 2022–23, with players like Netflix, Disney+ Hotstar, and Amazon Prime Video facing subscriber fatigue and rising churn rates. Amid this slowdown, JioCinema flipped the playbook by offering premium content at zero cost, instantly expanding its user base and pushing the entire industry toward ad-supported (AVOD) models. This move didn’t just capture market share — it reshaped consumer expectations. Suddenly, free access to blockbuster movies, sports, and series became the new normal, forcing every OTT platform to reconsider pricing, partnerships, and user acquisition strategies.

At the same time, JioCinema’s strategy has fueled the rapid adoption of Connected TVs (CTVs) and smart devices across India. As viewers shifted from mobile-only viewing to large-screen experiences, brands and advertisers began to see new opportunities in digital video advertising — particularly among India’s fast-growing tier-2 and tier-3 cities. The Economic Times and other media outlets report that CTV ad spending in India is growing at over 35% year-on-year, largely driven by platforms like JioCinema that combine mass reach with measurable targeting capabilities.

For publishers, advertisers, and content creators, understanding JioCinema’s playbook is critical. This disruption signals a larger trend where data-driven ad monetization, regional storytelling, and integrated ecosystems will define the future of India’s $12+ billion OTT market. Whether you’re building a streaming brand, marketing to India’s digital audience, or creating monetizable content, JioCinema’s journey offers a masterclass in how to blend scale, strategy, and consumer psychology to dominate in a hypercompetitive space.

Quick Timeline: JioCinema’s Key Moves (2022–2025)

- JioCinema’s rapid evolution between 2022 and 2025 tells the story of how a regional OTT player became a national disruptor and global case study in digital strategy. Each milestone represents a calculated move by Reliance to dominate not only entertainment but the broader ecosystem of telecom, commerce, and advertising.

- June 2022 — Viacom18 Secures IPL Digital Rights (₹23,758 crore)

In June 2022, Viacom18, backed by Reliance Industries and Paramount Global, stunned the media world by winning the digital streaming rights for the Indian Premier League (IPL) for the 2023–2027 cycle. The ₹23,758 crore bid was a watershed moment, marking the first time digital rights surpassed TV rights in value, signaling the shift of India’s sports consumption from television to online platforms. This move positioned JioCinema — Viacom18’s digital arm — as the exclusive digital home for IPL, laying the foundation for its dominance in India’s streaming wars. (Source: The Economic Times) - 2023 — The Free IPL Revolution: India’s Largest Digital Event

In 2023, JioCinema executed a bold, industry-defining strategy by streaming the IPL completely free to all users, breaking away from the paid subscription model that had long defined premium OTT content. The results were staggering: in the first few weeks alone, JioCinema recorded billions of views and became India’s most downloaded entertainment app. The platform’s unique approach of offering 4K streaming, multiple camera angles, and commentary in 12+ languages elevated user engagement and accessibility. According to deltatre.com, this “freemium-first” IPL model revolutionized how sports were monetized digitally and set new global benchmarks for ad-supported live streaming. - 2024 — Aggressive Pricing, Bundling & Expansion

By 2024, JioCinema transitioned from an experiment to a full-fledged entertainment ecosystem. The platform launched affordable premium tiers priced significantly lower than competitors, while also bundling OTT access with Jio telecom plans, JioFiber broadband, and Reliance Retail offers. These bundles effectively undercut rivals like Disney+ Hotstar, Netflix, and Amazon Prime Video, leading to explosive subscriber growth across urban and semi-urban India. Reuters reported that JioCinema’s bundled offerings not only attracted first-time OTT users but also expanded family-tier adoption, driving up daily watch time and retention rates across demographics. - 2024–2025 — Record Viewership & Market Consolidation

The 2024 and 2025 IPL seasons solidified JioCinema’s position as India’s go-to digital destination for live events and entertainment. In IPL 2024, the platform shattered records with over 500 million unique viewers and billions of streaming minutes, while IPL 2025 crossed an unprecedented 1 billion combined viewers across TV and digital (as per SportsPro Media). These numbers dwarfed historical viewership figures for traditional broadcasters and proved that India’s entertainment future is undeniably digital. Beyond cricket, JioCinema diversified aggressively into Hollywood content (HBO, Warner Bros), original web series, and regional films, creating an integrated platform that caters to every segment of India’s massive online audience. - Through this three-year timeline, JioCinema didn’t just participate in India’s OTT race — it rewrote the rules. By combining strategic rights acquisition, free access, bundling power, and data-driven ad monetization, it became the benchmark for how streaming platforms can achieve scale, profitability, and user loyalty in one of the world’s fastest-growing digital markets.

The disruption playbook — 6 tactics that rewired the market

- Flagship live-rights as a user-acquisition engine — owning IPL digital rights gave JioCinema instant reach and habitual use. Live sports created daily active users and watch-time that most entertainment titles can’t. deltatre.com

- Free and ultra-cheap access — free IPL streaming plus very-low subscription tiers reset consumer price expectations (e.g., family plan reductions). This increased penetration but compressed ARPU and forced competitors to respond. Reuters

- Telco & ecosystem bundling — Reliance’s telecom and retail assets enabled attractive bundling (SIM/data + streaming), lowering customer acquisition costs. (Classic platform bundling play.) LinkedIn

- Hybrid monetization (AVOD + SVOD + event paywalls) — JioCinema used AVOD for mass reach and incremental SVOD / paywalls for premium content and features. This layered approach unlocked multiple revenue streams. PwC

- Investment in CTV & big-screen UX — spikes in Connected TV adoption (Ormax reports ~87% YoY CT V growth) meant JioCinema focused on living-room experiences, amplifying ad inventory and premium placements. The Economic Times

- Data & adtech scale — huge live-event audiences generated first-party data, improving ad targeting and CPMs on AVOD slots — essential for monetization at scale. The Times of India+1

Measured impact — viewership, pricing, and market shifts (with stats)

Market growth & size

- India OTT market grew 20.9% in 2023 to INR 17,496 crore and PwC projects it will roughly double to ~INR 35,062 crore by 2028 (CAGR ≈14.9%). AVOD expected to grow faster (≈26% CAGR for AVOD to 2028). PwC

Record viewership from live sports

- JioCinema reported explosive numbers: billions of views during IPL seasons; industry reporting cites 620 million viewers for IPL 2024 on JioCinema and multi-billion view totals. IPL 2025 reported 1 billion viewers across TV and digital and 840+ billion minutes watched across platforms. These figures illustrate how live rights drive mass attention. sportspro.com+2ottverse.com+2

Pricing & ARPU

- Strategic price cuts (e.g., premium plans reduced to ₹29–89 tiers in 2024) forced the market to reconsider ARPU strategies — a trade-off between reach and per-user revenue. Reuters and industry reports documented these pricing changes. Reuters

Platform economics & consolidation signals

- The value of digital-first rights and bundling with telecom/retail has accelerated M&A and partnerships. Analysts expect further consolidation and bundling deals across platforms and telcos. PwC+1

10-Year Outlook for India’s OTT Market (2025–2035)

- The next decade will be transformative for India’s OTT ecosystem, as it moves from a fast-growing digital segment to a core pillar of the country’s media and entertainment industry. Driven by deeper internet penetration, 5G rollout, regional content expansion, and the rise of Connected TV (CTV), India is poised to become the largest OTT audience market in the world by 2030, surpassing both the U.S. and China in total active users.

- User Base Growth: India Becomes the World’s Largest OTT Audience

India’s OTT user base is already experiencing exponential growth, fueled by cheaper data, affordable smartphones, and a new generation of digital-first consumers. According to Ormax Media and The Economic Times, India reached approximately 601 million OTT users by 2025, with projections suggesting this number could cross 900 million by 2030 and 1.1 billion by 2035. The next wave of growth will come from Connected TV (CTV) adoption, as more households upgrade to smart TVs and high-speed broadband. CTV penetration is expected to grow at over 25% CAGR, making India one of the largest CTV markets globally. Rural and semi-urban India will drive much of this expansion, where freemium models and regional-language content play a pivotal role in onboarding first-time OTT users. - Monetization Mix: Hybrid Models Define the Future

The era of pure subscription-based OTT models is ending. Going forward, hybrid monetization — combining AVOD (Ad-supported Video on Demand), SVOD (Subscription Video on Demand), and TVOD (Transactional Video on Demand) — will dominate the landscape. Platforms like JioCinema and MX Player are already proving that free or low-cost ad-supported models can attract massive user bases and generate substantial ad revenue through programmatic and targeted advertising. PwC’s Global Entertainment & Media Outlook (2024–2028) estimates that while SVOD will continue to contribute significantly to revenue, AVOD will be the fastest-growing segment, expected to grow at over 17–20% CAGR through 2030. The rise of first-party data, AI-driven ad personalization, and retail media integrations will make OTT platforms key players in India’s $35+ billion digital advertising ecosystem. - Content Strategy: Regional + Live = Growth Engine

Content localization will be the defining factor for OTT success in India over the next decade. Reports by KPMG and FICCI-EY highlight that regional-language consumption already accounts for over 50% of total OTT watch time, and this share is projected to grow further. Platforms will continue to invest heavily in Tamil, Telugu, Bengali, and Marathi content, alongside live entertainment such as sports, music events, and reality shows. The integration of AI-based dubbing and subtitling tools will allow global and Indian content to reach wider audiences seamlessly. Meanwhile, live sports streaming (cricket, football, kabaddi) will remain a major growth driver — especially as rights packages expand and 5G makes HD streaming more accessible. OTT platforms that master the art of balancing mass-market regional storytelling with global-standard production will emerge as leaders in user engagement and retention. - Risks and Challenges: Sustainability of Growth Models

Despite the promising trajectory, the OTT sector faces several challenges that could shape its evolution. Reuters and PwC caution that rights inflation — especially for cricket and premium sports — could pressure margins and profitability. As platforms compete for exclusive content, bidding wars may inflate costs beyond sustainable levels. Additionally, ad-market cyclicality could impact revenue stability for AVOD players, while regulatory scrutiny around market consolidation and data privacy will likely tighten in the years ahead. Another key risk is the sustainability of “free-first” models — platforms that rely heavily on ad revenue must ensure long-term profitability without compromising user experience. - Overall, the 2025–2035 decade will see India’s OTT industry mature from an experimental, high-growth phase into a data-driven, content-rich, and ad-tech-integrated powerhouse. The platforms that can strike the right balance between scale, personalization, and monetization — much like JioCinema’s current playbook — will define the next generation of digital entertainment in India and beyond.

Risks & Regulatory Considerations

- As India’s OTT industry matures, platforms like JioCinema face increasing financial, operational, and regulatory challenges that could shape the long-term sustainability of their business models. While aggressive expansion has fueled rapid user growth, the economics of content rights, monetization transitions, and market concentration introduce significant risks that both investors and policymakers are closely watching.

- Rights Cost vs. Revenue Imbalance

One of the biggest challenges for OTT platforms is managing the soaring cost of content rights, especially in sports. The ₹23,758 crore bid by Viacom18 for IPL digital rights (2023–2027) — as reported by The Economic Times — represents one of the highest media rights deals in global streaming history. While this investment delivered record-breaking viewership and ad revenues, such high upfront spending can strain cash flows and profitability if advertising demand or subscription uptake falls short of projections. OTT platforms must now balance between premium content acquisition and sustainable monetization models. Failure to achieve this equilibrium could lead to cash burn cycles, forcing platforms to either increase prices or reduce exclusive content offerings, both of which risk alienating users. - Transitioning from Free to Paid: The Retention Dilemma

Another major risk lies in shifting users from free access to paid or hybrid models. JioCinema’s free IPL streaming strategy brought in millions of new users, but as Reuters reported, the platform plans to introduce tiered pricing and hybrid monetization in 2025. This transition will be delicate — users who joined for free may resist paywalls or migrate to competing platforms if perceived value drops. To mitigate churn and backlash, OTT services are experimenting with segmented paywalls, where premium sports, ad-free viewing, or early-access content are charged while the basic tier remains free. The key to success will be clear communication of added value (better quality, exclusivity, rewards) to retain engagement while improving ARPU (Average Revenue Per User). - Regulatory Oversight and Market Consolidation Risks

As Reliance, Disney, and other media giants consolidate their OTT and broadcasting assets, regulatory scrutiny is intensifying. According to PwC India, large-scale mergers, joint ventures, or cross-sector partnerships between telecom and OTT firms are drawing attention from India’s Competition Commission (CCI) and sectoral regulators. The primary concern is market concentration — where integrated platforms could bundle internet, content, and commerce in ways that stifle smaller competitors. Future regulations may impose limits on bundling, exclusive partnerships, or data-sharing practices to preserve fair competition. In parallel, data privacy, content censorship, and consumer protection laws are evolving rapidly, and OTT platforms must maintain strict compliance with India’s IT Rules 2021 and forthcoming Digital India regulations. - In essence, while JioCinema and similar players have revolutionized the OTT space, the road ahead requires careful financial and strategic navigation. Balancing growth with compliance, and scale with sustainability, will determine which platforms thrive in the next decade of India’s digital entertainment revolution.

What creators, publishers and blogs should do (opportunity map)

- Exploit event SEO: Live match previews, minute-by-minute liveblogs, player fantasy guides, highlights, and streaming how-to guides capture traffic spikes during IPL and similar events. Use match schedules and long-tail queries. deltatre.com

- Local-language long-form: Produce regional language explainers, show recaps, and recommendation lists — huge untapped traffic. KPMG/industry reports flag regional adoption as critical. LinkedIn

- Monetize with affiliates: Promote streaming subscriptions, CTV devices (Fire TV, Mi TV sticks), data plans (telco bundles) and fantasy gaming signups with affiliate links and coupon codes.

- Lead magnets & email capture: Offer “IPL weekend streaming checklist”, “Best CTV setup for streaming” or “Daily fantasy starter pack” PDFs to convert event-driven visitors into repeat readers.

FAQs Section

1. How many viewers did JioCinema get for IPL 2024 and 2025?

JioCinema achieved record-breaking viewership during IPL 2024 and 2025. Industry reports and SportsPro Media cite that IPL 2024 attracted around 620 million digital viewers, while IPL 2025 crossed 1 billion total viewers across both TV and digital platforms. These staggering numbers highlight the unmatched power of live sports to drive digital engagement, advertising demand, and app installs at scale. The platform’s multilingual commentary, 4K quality, and interactive features significantly boosted average watch times compared to traditional TV.

2. Did Viacom18 really pay ₹23,758 crore for IPL digital rights?

Yes. In the 2023–2027 media rights auction, Viacom18 secured exclusive IPL digital rights for ₹23,758 crore — one of the most expensive digital sports deals in the world. As reported by The Economic Times, this deal symbolized the moment digital overtook television in perceived value, signaling India’s transition into a digital-first entertainment economy. It also demonstrated Reliance’s strategic intent to make JioCinema the go-to destination for live sports and mass entertainment.

3. Is JioCinema free for IPL?

JioCinema offered completely free streaming of IPL 2023 and 2024, disrupting the subscription-based OTT model. However, as of 2025, the newly formed Reliance–Disney joint venture has begun testing hybrid access models, where some matches, premium features (like 4K or multiple camera angles), or ad-free streams may require a paid subscription. Reuters reports that this approach aims to balance mass reach with monetization through ads and subscriptions. Always check the latest announcements before match day to know which matches are free or premium.

4. How did JioCinema’s pricing affect competitors?

JioCinema’s low-cost and bundled pricing (₹29–₹89 monthly plans in 2024) disrupted the market by resetting consumer expectations around affordability. Competitors like Disney+ Hotstar, Amazon Prime Video, and Netflix were forced to revise pricing tiers, introduce cheaper mobile plans, and strengthen their ad-supported models (AVOD). This led to a broader industry shift toward hybrid monetization, as ARPU (Average Revenue Per User) pressure mounted and user retention became the new priority. (Source: Reuters)

5. Will rising content and rights costs make the OTT model unsustainable?

High rights costs — particularly for live sports like IPL — present a significant financial challenge. The sustainability of these deals depends on whether platforms can effectively monetize through diversified revenue streams, such as ad sales, sponsorships, microtransactions, and paid subscriptions. According to PwC, platforms that fail to convert their large free user bases into paying customers or premium advertisers risk long-term cash flow stress. The key lies in balancing content investment with scalable adtech and retention strategies.

6. What does this mean for new or smaller OTT startups?

For smaller OTT players, JioCinema’s dominance underscores the need to differentiate rather than compete directly. Startups should focus on regional content, niche storytelling, owned communities, and creator-led ecosystems. Platforms that specialize in vernacular entertainment, local sports, or influencer-driven content will continue to find loyal audiences. As LinkedIn industry insights note, startups that build sustainable unit economics and community engagement can thrive even without massive rights investments.

7. Are advertisers benefiting from JioCinema’s massive reach?

Yes, advertisers have seen significant advantages. JioCinema’s IPL streams generated billions of ad impressions, giving brands unparalleled exposure to India’s digital audience. The platform’s ability to leverage first-party data and programmatic targeting enhanced ad relevance and conversion rates. However, The Times of India notes that CPM (Cost Per Mille) rates can fluctuate due to ad inventory oversupply and evolving measurement standards. As India’s adtech ecosystem matures, expect more transparent metrics and improved ROI tracking.

8. How can publishers and media outlets capture IPL traffic?

Publishers can ride the IPL wave by creating timely, SEO-rich, and interactive content. Strategies include:

- Publishing match previews, live blogs, and player profiles.

- Offering streaming guides, affiliate deals (fantasy leagues, smart TVs, mobile data plans).

- Using lead magnets (e.g., free IPL score widgets, newsletters).

Running real-time polls and fan quizzes to boost engagement.

According to Deltatre, consistent updates, cross-channel promotion, and quick-loading AMP pages can significantly improve traffic and ad revenue during IPL season.

9. Is Connected TV (CTV) really that important in India?

Absolutely. India is witnessing a CTV boom as streaming shifts from smartphones to large-screen experiences. Ormax Media reported an 87% year-on-year surge in CTV users in 2025, driven by affordable smart TVs, JioFiber broadband, and 5G rollout. For advertisers, this means higher engagement and premium ad placements, while for OTT platforms, it opens up new monetization formats such as interactive ads and shoppable content. The Economic Times predicts that CTV will account for over 30% of OTT ad revenues by 2030.

10. Will OTT consolidation continue in India?

Yes. The OTT sector is moving toward consolidation and strategic partnerships. The Reliance–Disney merger, Sony–Zee deal, and potential global tie-ups show that scale, content libraries, and distribution reach are key survival factors. However, PwC notes that regulators like the Competition Commission of India (CCI) are monitoring these consolidations closely to prevent monopolistic dominance. Future mergers may face stricter oversight, especially where telecom and OTT ecosystems overlap.

11. How can content creators and influencers monetize during this OTT boom?

Creators can tap into the OTT wave through multiple income streams:

- Sponsored video ads and brand collaborations during live events.

- Affiliate funnels promoting fantasy sports, streaming subscriptions, or gadgets.

- Paid newsletters and behind-the-scenes micro-content tied to popular shows or matches.

Partnering with OTT platforms for exclusive creator-led originals or live commentary formats.

With OTT becoming the mainstream digital playground, creators who align with trending content (like IPL, K-dramas, AI shows, etc.) can build both reach and recurring income.

Summary / Key Takeaways

JioCinema has completely reshaped India’s OTT ecosystem by combining affordable access, strategic partnerships, and aggressive content acquisition. Backed by Reliance Jio’s massive telecom user base, it broke the traditional subscription model by offering premium content for free, including the Indian Premier League (IPL) and blockbuster films from Viacom18’s network. This move forced competitors like Disney+ Hotstar, Netflix, and Amazon Prime Video to rethink pricing, ad strategies, and regional content investments to retain users.

The platform’s disruption goes beyond pricing — JioCinema’s focus on mass reach, multilingual expansion, and ad-supported streaming (AVOD) aligns with India’s fast-growing digital ad economy. With Reliance integrating content, telecom, and commerce under one digital umbrella, JioCinema is not just a streaming app but a gateway to India’s digital entertainment future. Over the next decade, the OTT market is projected to grow over $12 billion by 2030, and JioCinema’s data-driven approach positions it to dominate this landscape, setting new benchmarks

Conclusion

JioCinema’s rise is more than just a corporate success story — it represents a fundamental shift in how India consumes digital entertainment. By combining massive sports-rights acquisitions with a free or ultra-low-cost access model, JioCinema turned the IPL into a digital-first phenomenon, redefining what scale means in the OTT world. Its integration with Reliance Jio’s telecom ecosystem gave it a distribution moat few competitors could match, while its hybrid monetization model (ads + subscriptions) demonstrated how strategic flexibility can drive both reach and revenue.

More importantly, JioCinema’s disruption forced the entire OTT ecosystem — from global giants like Netflix and Disney+ Hotstar to local players like SonyLIV and Zee5 — to rethink pricing, user experience, and regional engagement. By making premium sports and entertainment accessible to the masses, it blurred the lines between traditional television and online streaming, accelerating India’s shift toward Connected TV (CTV) adoption and family-based digital viewing habits.

For content publishers, advertisers, and creators, this is a defining moment. Those who can align with the new consumption patterns — through event-based content, real-time coverage, affiliate tie-ins, and vernacular storytelling — stand to gain the most. Monetization opportunities will multiply around high-engagement events, regional markets, and personalized adtech.In short, JioCinema didn’t just compete in India’s OTT market — it reprogrammed it. The platform’s blend of affordability, accessibility, and technological scale has created a blueprint that will influence not just India’s digital economy but global streaming strategies for years to come.

References & sources

(Select load-bearing sources used in article — linkable in your CMS)

- PwC — India Entertainment & Media Outlook 2024–28. PwC

- Economic Times / BCCI IPL media rights coverage (2022) — Viacom18 digital rights ₹23,758 crore. The Economic Times

- DeltaTre / industry analysis — early JioCinema streaming view stats. deltatre.com

- SportsPro / OTTVerse — JioCinema IPL 2024 viewership reports. sportspro.com+1

- Reuters — JioCinema subscription pricing moves (2024). Reuters

- Ormax OTT Audience Report 2025 (reported in Economic Times) — India OTT base & CTV growth. The Economic Times

- Reuters — Reliance-Disney hybrid model shift (2025). Reuters

- Industry analyses and OSS/academic reports on OTT consolidation and adtech. PwC+1