Estimated Reading Time: 25-30 minutes (5,119 words)

Introduction

For nearly a decade, electric vehicles (EVs) have dominated headlines and investor attention, driving conversations about sustainability, clean energy, and the future of transportation. Countries like China, the U.S., and European nations have aggressively invested in EV manufacturing, infrastructure, and incentives, while India has emerged as one of the fastest-growing EV markets in Asia, fueled by policy support, urban adoption, and rising environmental awareness. EVs have symbolized the automotive revolution, capturing the imagination of consumers and businesses alike.

However, CES 2026 revealed a pivotal shift in the mobility landscape. While EVs remain an essential component of the future of transportation, they were no longer the primary focus. The spotlight has moved to robotaxis, AI-driven vehicles, and advanced automotive robotics, reflecting a broader transformation: the industry is evolving from being hardware-centric—centered on engines, batteries, and electric drivetrains—to becoming software-defined, autonomous, and intelligence-driven. Vehicles are increasingly seen as platforms for AI, connectivity, and mobility services rather than just modes of transport.

This blog explores why EVs took a back seat at CES 2026, the emerging trends shaping the next decade of mobility, and what these developments mean for both global markets and India’s automotive ecosystem. We’ll delve into robotaxis, autonomous vehicle technologies, AI-powered software platforms, robotics integration, and actionable insights for businesses and consumers preparing for this new era of mobility.

Global EV Market Trends: Steady Growth, Shifting Spotlight

The global electric vehicle (EV) market continues to experience rapid growth, driven by rising environmental concerns, government policies, technological advancements, and shifting consumer preferences. According to Persistence Market Research, the market is expected to expand from $733 billion in 2025 to approximately $1.9 trillion by 2032, representing a CAGR of around 15.5%. This growth reflects not only increasing EV adoption but also significant investment in supporting infrastructure, battery technology, and emerging mobility services.

Segment Breakdown

Within this growing market, battery electric vehicles (BEVs) dominate, accounting for roughly 45% of global EV sales, while passenger EVs make up approximately 66% of total EVs sold worldwide. This indicates that while commercial EVs and electric two-wheelers are growing, passenger cars remain the primary driver of global EV demand. Rising affordability, improved battery efficiency, and expanding charging infrastructure are contributing factors to this trend.

Asia-Pacific Leadership

The Asia-Pacific region, led by China, continues to be the epicenter of EV adoption. China alone accounts for over 50% of global EV sales, making it a key driver for cost reductions in batteries, motors, and other EV components. This leadership has global ripple effects: cheaper components, faster technological innovations, and scalable supply chains allow automakers worldwide to accelerate EV production and adoption. Other Asian markets, such as India, Japan, and South Korea, are quickly following, with supportive policies, subsidies, and infrastructure investments boosting domestic adoption.

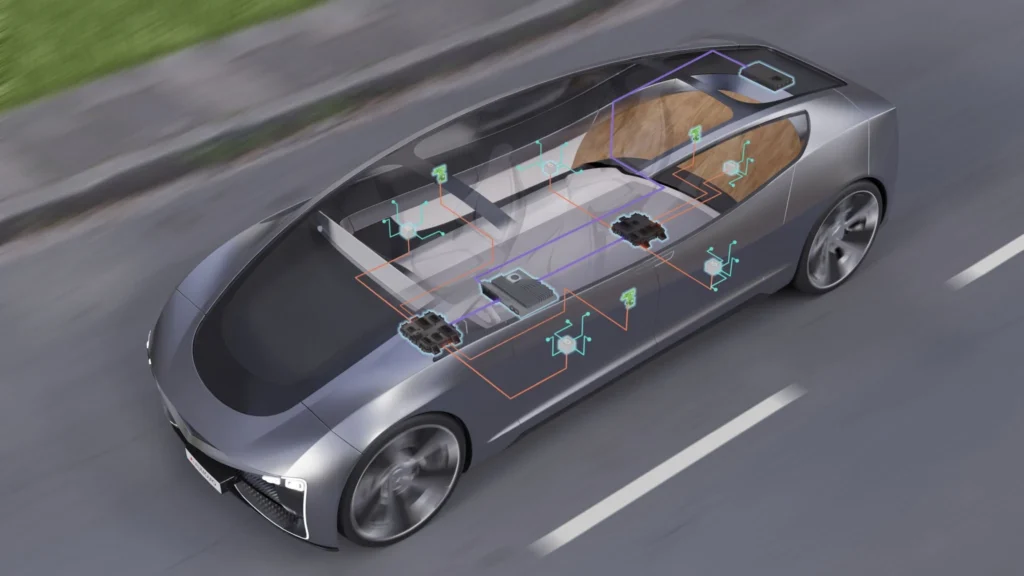

Shifting Spotlight: From Hardware to Intelligent Mobility

While EV adoption continues its upward trajectory, the industry narrative is shifting. Investors and OEMs are increasingly emphasizing software-defined vehicles, AI-powered features, autonomous driving capabilities, and mobility-as-a-service (MaaS) models. Vehicles are no longer just about electric powertrains—they are intelligent platforms capable of real-time data processing, predictive maintenance, personalized user experiences, and integration into autonomous urban transport systems.

Trend Insight: The EV revolution is now entering its next phase. While electrification remains critical, the true competitive edge in the next decade will come from AI, autonomy, robotics, and software ecosystems built on top of EV platforms. Companies that master this integration are poised to dominate both global and emerging markets.

Sources: Persistence Market Research – Global EV Market

CES 2026 Highlights: EVs Take a Back Seat

CES 2026 marked a significant turning point in the global automotive narrative, signaling that the future of mobility extends far beyond electric drivetrains. While electric vehicles (EVs) remain a vital component of sustainable transportation, this year’s show demonstrated that intelligent, AI-driven mobility solutions are rapidly becoming the central focus for automakers, tech giants, and mobility startups alike.

EVs Are No Longer the Main Attraction

Compared to previous years, traditional EV displays at CES 2026 were smaller, less numerous, and less central to the show floor. Instead of unveiling new EV models or battery innovations, many companies focused on showcasing next-generation mobility platforms that integrate software, AI, and robotics. This shift reflects an important reality: EVs are increasingly seen as a foundation for intelligent, autonomous, and connected vehicles, rather than the primary headline themselves.

The Main Attractions of CES 2026

- Robotaxis and Autonomous Shuttles

- Companies like Waymo, Hyundai, and Local Motors showcased L4-level autonomous shuttles and urban robotaxis.

- Pilot deployments were demonstrated virtually and through live demos, highlighting the potential for mobility-as-a-service (MaaS) ecosystems in dense urban areas.

- Companies like Waymo, Hyundai, and Local Motors showcased L4-level autonomous shuttles and urban robotaxis.

- AI-Driven In-Car Experiences

- Vehicle cabins are transforming into intelligent, personalized spaces, powered by AI voice assistants, predictive navigation, and real-time traffic and safety analytics.

- Automakers such as Ford and Tesla demonstrated AI-powered dashboards that adapt to driver behavior, automate routine tasks, and enhance passenger convenience.

- Vehicle cabins are transforming into intelligent, personalized spaces, powered by AI voice assistants, predictive navigation, and real-time traffic and safety analytics.

- Robotics and Physical AI for Manufacturing & Logistics

- CES also highlighted the growing role of humanoid and collaborative robots in automotive manufacturing, logistics, and even last-mile delivery.

- Companies like Boston Dynamics and Hyundai demonstrated robots capable of performing complex assembly, inspection, and maintenance tasks, signaling a convergence of mobility and physical AI.

- CES also highlighted the growing role of humanoid and collaborative robots in automotive manufacturing, logistics, and even last-mile delivery.

Expert Insight

“CES 2026 isn’t about EVs alone; it’s about integrated AI systems that will define mobility in the next decade.” — Automotive Analyst, McKinsey

Observation

The overarching trend from CES 2026 is clear: EVs are no longer the sole star of the automotive stage. Instead, they serve as platforms for software, autonomous systems, and AI-driven services. Vehicles are evolving into intelligent mobility hubs, capable of supporting robotaxis, autonomous shuttles, and connected services, all while leveraging electric powertrains as the foundation.

Trend Insight: Automakers that invest in AI, autonomy, and robotics alongside electrification are likely to capture the largest market share in the coming decade, while traditional EV-focused strategies may become increasingly commoditized.

Robotaxis: The New Mobility Frontier

The future of urban mobility is increasingly defined by robotaxis—autonomous, driverless vehicles that promise safe, efficient, and scalable transportation solutions. As cities around the world face rising congestion, pollution, and transportation inefficiencies, robotaxis are emerging as a potential game-changer in both personal mobility and public transit ecosystems.

Global Adoption of Robotaxis

- United States: Companies like Waymo, Cruise, and Tesla are conducting pilot programs in cities such as Phoenix, San Francisco, and Austin, testing Level 4 autonomous vehicles capable of handling most driving scenarios without human intervention.

- Germany: Automotive giants including Volkswagen and BMW are investing heavily in autonomous fleets, integrating AI-based traffic prediction and vehicle-to-infrastructure communication to enhance safety and efficiency.

- Singapore & China: Singapore has deployed autonomous shuttles in controlled zones, while Chinese cities like Shanghai and Beijing are trialing large-scale robotaxi networks through companies like AutoX and Baidu Apollo.

Stat: According to McKinsey, the global robotaxi market could reach $60–70 billion by 2030, with early adoption concentrated in major urban centers and technology-friendly regions.

Technology Behind Robotaxis

- Level 4 Autonomy: Robotaxis use L4 autonomous systems, which allow fully driverless operation within geofenced urban areas while ensuring safety and compliance with traffic rules.

- Sensors and AI: These vehicles rely on LiDAR, radar, cameras, and advanced AI algorithms for real-time decision-making, obstacle detection, and predictive navigation.

- Connectivity: Integration with 5G networks and smart city infrastructure ensures seamless route planning, fleet management, and passenger communication.

Robotaxi Potential in India

While India’s EV market is booming, robotaxi adoption faces unique challenges:

- Regulatory Hurdles: Current laws do not fully permit fully autonomous commercial operations. Policies are evolving, but large-scale deployment will require clear government frameworks, safety certifications, and insurance models.

- Infrastructure Constraints: Many Indian cities lack consistent road markings, smart traffic signals, and robust digital infrastructure required for L4 autonomy.

- Pilot Programs: Metropolitan areas like Bengaluru and Hyderabad are exploring controlled trials by 2030, especially in tech parks, gated communities, and smart city zones.

Business Models and Opportunities

- Subscription-Based Urban Mobility: Users pay monthly fees for unlimited rides within a city, reducing reliance on personal vehicles.

- On-Demand Ride-Hailing Platforms: Companies can integrate robotaxis into existing apps, offering cheaper, automated rides with optimized routes.

- Fleet-as-a-Service (FaaS): Businesses can deploy robotaxi fleets for corporate campuses, airports, and public transit hubs, monetizing mobility as a service.

Key Takeaway

Robotaxis are poised to become mainstream within 5–10 years, particularly in dense urban centers where car ownership is costly and traffic congestion is high. Widespread adoption could significantly reduce personal car dependency, lower emissions, and create a new ecosystem of AI-driven urban mobility. For businesses, this represents opportunities in fleet management, mobility platforms, AI software, and infrastructure services, while consumers gain access to safer, cost-effective, and convenient transportation.

Automotive AI: Software-Defined Vehicles

The automotive industry is undergoing a profound transformation, shifting from a purely hardware-driven model to software-defined, intelligence-driven vehicles. Modern vehicles are no longer just engines, batteries, and metal frames—they are mobile computing platforms, capable of processing vast amounts of data, adapting to driver behavior, and integrating seamlessly into urban mobility ecosystems.

Key Functions of Automotive AI

AI is increasingly embedded across vehicle systems, enhancing safety, efficiency, and personalization:

- Driver Assistance

- Advanced ADAS (Advanced Driver Assistance Systems) leverage AI to support lane-keeping, adaptive cruise control, automated parking, and collision avoidance.

- Predictive algorithms anticipate road hazards, alert drivers, and can even execute emergency maneuvers autonomously.

- Advanced ADAS (Advanced Driver Assistance Systems) leverage AI to support lane-keeping, adaptive cruise control, automated parking, and collision avoidance.

- Predictive Maintenance

- AI monitors vehicle health in real time, predicting potential component failures before they occur.

- This reduces downtime, minimizes repair costs, and extends the lifespan of critical EV components such as batteries and motors.

- AI monitors vehicle health in real time, predicting potential component failures before they occur.

- Voice & Gesture Control

- AI-powered voice assistants allow drivers and passengers to control navigation, climate, infotainment, and vehicle settings without distraction.

- Advanced gesture recognition is emerging, enabling touchless interaction for enhanced convenience and safety.

- AI-powered voice assistants allow drivers and passengers to control navigation, climate, infotainment, and vehicle settings without distraction.

- Traffic Management & Smart Routing

- AI systems integrate real-time traffic data, weather conditions, and road analytics to optimize routes.

- Autonomous and semi-autonomous vehicles can coordinate with city infrastructure to reduce congestion, emissions, and travel times.

- AI systems integrate real-time traffic data, weather conditions, and road analytics to optimize routes.

Software Growth & Industry Impact

- Automotive software is becoming the primary driver of value in modern vehicles.

- Companies like Bosch forecast that revenue from automotive software will more than double by the mid-2030s, outpacing traditional hardware sales.

- OEMs are increasingly investing in cloud-based platforms, AI algorithms, and over-the-air (OTA) updates, enabling continuous vehicle improvement and post-purchase feature expansion.

Consumer Benefits

- Enhanced Safety: AI-driven systems reduce accidents and improve emergency response.

- Personalization: Vehicles learn user preferences, from seat positions to preferred routes and infotainment settings.

- Seamless Mobility Experience: Integrated AI creates a connected ecosystem where the vehicle communicates with other vehicles, smart city infrastructure, and mobility services.

Real-World Example

- Ford recently announced the rollout of Level 3 autonomy coupled with AI voice assistants, slated for select markets by 2028.

- These vehicles can handle driving in specific conditions autonomously, while the AI assistant manages tasks such as navigation, traffic updates, and in-car entertainment—effectively transforming the vehicle into a software-first mobility platform.

Trend Insight

The rise of automotive AI is a paradigm shift. While EVs provide the foundation, AI defines the intelligence and usability of the vehicle. Future vehicles will no longer be measured solely by horsepower or battery range, but by the sophistication of their software, AI capabilities, and integration with urban mobility networks.

Robotics in Automotive & Mobility

The automotive industry is rapidly evolving beyond electrification and AI integration. At CES 2026, a major highlight was the growing role of robotics—both humanoid and collaborative—in shaping the future of mobility. These robots are no longer confined to factory floors; they are extending into logistics, vehicle servicing, and even in-vehicle assistance, representing a convergence of physical AI and intelligent mobility systems.

Key Applications of Robotics in Automotive & Mobility

- Manufacturing & Assembly

- Collaborative robots (cobots) work alongside human operators to perform complex assembly tasks, from installing EV batteries to precision welding.

- Cobots improve production efficiency, reduce errors, and enhance worker safety, particularly when handling heavy or hazardous components.

- Humanoid robots are also being tested for repetitive inspection tasks, quality control, and maintenance within factories, further streamlining production lines.

- Collaborative robots (cobots) work alongside human operators to perform complex assembly tasks, from installing EV batteries to precision welding.

- Logistics & Delivery

- Robotics are increasingly used in warehousing, vehicle part transport, and last-mile delivery.

- Autonomous mobile robots (AMRs) can navigate complex factory layouts, moving materials between assembly stations, while reducing reliance on human labor for repetitive tasks.

- In urban mobility, delivery robots integrated with AI can transport packages or supplies in cities, complementing EV fleets and autonomous vehicles.

- Robotics are increasingly used in warehousing, vehicle part transport, and last-mile delivery.

- In-Vehicle Assistant Functions

- CES 2026 showcased prototypes of humanoid and assistant robots inside vehicles, capable of interacting with passengers, controlling infotainment systems, monitoring safety, and assisting with navigation or emergency tasks.

- These robots are designed to enhance passenger experience, particularly in autonomous or semi-autonomous vehicles where human drivers may not be engaged in controlling the vehicle.

- CES 2026 showcased prototypes of humanoid and assistant robots inside vehicles, capable of interacting with passengers, controlling infotainment systems, monitoring safety, and assisting with navigation or emergency tasks.

Trend Insight: Robotics as a Mobility Multiplier

Robotics in automotive ecosystems is not a replacement for human workers—it is an augmentation of human efficiency and safety. Across manufacturing, logistics, and passenger mobility, robots enable:

- Faster production cycles and reduced operational downtime

- Safer work environments in factories and warehouses

- Smarter urban mobility solutions by supporting autonomous fleets and delivery networks

Global & India Perspective

- Global Leaders: Companies like Hyundai, Boston Dynamics, and Tesla are integrating robotics with AI to develop hybrid human-robot workflows and autonomous delivery systems.

- India Potential: While adoption in India is currently limited, tech-driven startups and EV manufacturers are exploring cobots for EV assembly, automated logistics hubs, and urban delivery robots. Regulatory support and growing EV production could accelerate robotics integration over the next decade.

Key Takeaway

CES 2026 underscored that robotics is a critical pillar of the future mobility ecosystem. By combining humanoid and collaborative robots with AI-driven software and autonomous vehicles, the industry is moving toward seamless, intelligent, and highly efficient mobility solutions that benefit manufacturers, businesses, and consumers alike.

India Market Outlook: EVs, AI & Autonomy

India is rapidly emerging as a key player in the global EV revolution, driven by rising consumer awareness, government incentives, and the need to reduce urban air pollution. However, while EV adoption is accelerating, the deployment of robotaxis and AI-driven mobility solutions is still in the early stages, constrained by regulatory, infrastructure, and technological challenges.

EV Growth in India

The Indian EV market has seen robust growth across all vehicle segments in recent years:

- Two-Wheelers: Sales increased by 11% year-on-year in 2025, driven by urban commuters seeking cost-effective, emission-free transportation. Affordable e-scooters and motorcycles are dominating this segment.

- Passenger Vehicles: EV sales nearly doubled in 2025, fueled by mid-range and premium electric cars from both domestic manufacturers like Tata Motors, Mahindra Electric, and international entrants such as Hyundai and MG Motor.

- Commercial Vehicles & Buses: Adoption is gaining traction, particularly in logistics, e-commerce, and public transport fleets, where EVs offer long-term operational savings.

Source: Times of India – EV Wholesales 2025

Government Targets and Policy Support

The Indian government has set ambitious electrification targets for 2030, under programs like FAME-II (Faster Adoption and Manufacturing of Hybrid & Electric Vehicles) and state-level incentives:

- Passenger Cars: 30% of all new cars to be electrified

- Commercial Vehicles: 70% adoption target, including delivery vans and cargo vehicles

- Buses: 40% of urban and intercity buses to be electric

- Two/Three-Wheelers: 80% electrification target for urban mobility

Additionally, initiatives like tax exemptions, subsidies, and EV charging infrastructure expansion are accelerating adoption, especially in metro cities such as Bengaluru, Delhi-NCR, Mumbai, and Hyderabad.

AI & Autonomous Mobility in India

- Current Status: Robotaxis and autonomous vehicles are still in the conceptual and pilot stage due to regulatory ambiguity, inconsistent urban infrastructure, and complex traffic conditions.

- Pilot Projects: Some metropolitan areas, notably Bengaluru and Hyderabad, are exploring controlled autonomous vehicle trials by 2030, primarily in tech parks, industrial zones, and smart city corridors.

- Opportunities: The early-stage adoption presents opportunities for AI software platforms, mobility-as-a-service (MaaS), fleet management solutions, and robotics integration in India’s urban transport systems.

Key Opportunity

India presents a unique market for integrated EV + AI + autonomy solutions. While EV adoption is strong and accelerating, robotaxis, autonomous delivery fleets, and AI-powered mobility services are still nascent, leaving significant opportunities for startups, OEMs, and tech providers to shape India’s future urban mobility ecosystem.

Trend Insight: The coming decade in India will be defined not only by electric adoption, but by the integration of AI, autonomy, and intelligent mobility services, which could revolutionize urban transport, reduce congestion, and improve sustainability.

10-Year Outlook: 2026–2035

The next decade promises transformational shifts in mobility, where electrification, AI, autonomy, and robotics converge to create intelligent, sustainable, and highly efficient transportation ecosystems. Here’s a detailed 10-year outlook across key trends:

| Trend | Short Term (2026–2028) | Mid Term (2029–2031) | Long Term (2032–2035) |

| EV Adoption | – Steady growth globally and in emerging markets- Battery costs continue to decline, making EVs more affordable- Charging infrastructure expands in urban areas and highways | – EVs expected to account for ~50% of global passenger vehicle sales– OEMs invest heavily in EV-only platforms- Energy storage innovations improve range and efficiency | – Battery Electric Vehicles (BEVs) dominate new vehicle sales in most developed markets- EV adoption widespread in commercial fleets and public transport- Integration with renewable energy grids becomes standard |

| Autonomy | – Level 2–3 Advanced Driver Assistance Systems (ADAS) widespread, including lane keeping, adaptive cruise control, and automated parking- Early L4 robotaxi pilots in select cities globally | – Level 4 autonomous vehicles in pilot deployments and controlled urban zones- Shared autonomous mobility services gain traction in smart cities- Regulatory frameworks evolve to support commercial autonomy | – Level 4 and Level 5 autonomous vehicles widely operational across cities and highways- Robotaxis and autonomous freight fleets become mainstream- Urban mobility increasingly managed by intelligent, self-driving systems |

| AI Software | – Vehicles equipped with AI assistants, predictive maintenance, traffic and route optimization– AI enhances driver convenience and safety | – Rise of software-defined vehicles with over-the-air (OTA) updates- AI-driven fleet management, vehicle-to-everything (V2X) communication- Advanced personalization and predictive AI for passengers | – Full AI orchestration, where vehicles autonomously plan routes, energy usage, and maintenance schedules- Integration with smart city systems and urban traffic management- AI becomes a key differentiator in vehicle value and user experience |

| Robotics | – Industrial and logistics robots deployed in EV manufacturing and supply chains- Cobots (collaborative robots) enhance efficiency and safety | – Robotics-as-a-Service (RaaS) models emerge, supporting autonomous warehouses, delivery robots, and fleet servicing- Increased adoption in urban logistics | – Daily urban integration of robotics in mobility, including in-vehicle assistants, autonomous last-mile delivery, and fleet maintenance- Seamless interaction between robots, AI, and autonomous vehicles in smart cities |

Key Insights

- Convergence of Trends: The next decade will not be defined by a single innovation. Success will come to companies and cities that integrate EVs, autonomy, AI, and robotics into unified mobility systems.

- Urban Mobility Transformation: Robotaxis, autonomous buses, and delivery robots will reshape urban transport, potentially reducing personal car ownership and traffic congestion.

- Software Becomes the Differentiator: Vehicle hardware will increasingly become a platform, while AI and software capabilities will determine market leadership and user experience.

- India’s Opportunity: While global markets may reach L4/L5 autonomy sooner, India can leapfrog in EV adoption and AI integration, particularly in urban centers and smart city projects, by combining policy support with private sector innovation.

Key Stats & Infographics

The mobility landscape is rapidly evolving, driven by EV adoption, AI integration, autonomous systems, and robotics. Highlighting key statistics and trends helps readers understand both global and Indian market dynamics, as well as the technology focus showcased at CES 2026.

Global EV Market Statistics

- CAGR 2025–2032: The global EV market is projected to grow at 15.5% annually, expanding from $733 billion in 2025 to ~$1.9 trillion by 2032 (Persistence Market Research).

- Battery Electric Vehicles (BEVs): BEVs dominate roughly 45% of global EV sales, with passenger EVs accounting for ~66% of total EV sales.

- Key Drivers: Falling battery costs, improved charging infrastructure, stricter emissions regulations, and consumer preference for sustainable transportation.

India EV Market Growth

- Two-Wheelers: Sales grew by 11% YoY in 2025, driven by urban commuters and affordability of e-scooters and motorcycles.

- Passenger Vehicles: Nearly 100% YoY growth in 2025, signaling rapid consumer adoption in metro and Tier-1 cities.

- Commercial Vehicles & Buses: Adoption is accelerating in logistics, e-commerce fleets, and public transport, supported by government incentives like FAME-II.

- Policy Impact: Government targets for 2030 aim for 30% passenger cars, 70% commercial vehicles, 40% buses, and 80% two/three-wheelers electrified, highlighting strong future growth potential.

CES 2026 Technology Focus

- AI & Autonomy: ~60% of exhibits emphasized autonomous vehicles, AI-driven dashboards, predictive systems, and robotaxi platforms.

- Robotics: ~30% focused on humanoid robots, collaborative cobots, and robotics applications in manufacturing, logistics, and mobility.

- Traditional EVs: Only ~10% of the show floor highlighted conventional EV models or battery innovations, reflecting the shift from hardware to intelligent mobility ecosystems.

Key Takeaways from Stats

- EV adoption continues strong globally and in India, but the focus is shifting to software, AI, and robotics integration.

- CES 2026 indicates that the next wave of automotive innovation will prioritize intelligent, autonomous, and connected vehicles over traditional EV hardware.

- India, while still early in autonomous mobility, presents massive opportunities for pilot programs, MaaS integration, and AI-enabled urban transport.

FAQs Section

1: Why were EVs not the main highlight at CES 2026?

While EVs remain critical to sustainable mobility, CES 2026 emphasized the next frontier of intelligent transportation. The show focused on AI-driven vehicles, robotaxis, and robotics, signaling a shift from hardware-centric innovations like batteries and drivetrains toward software-defined, autonomous, and connected mobility ecosystems. This trend indicates that the automotive industry sees vehicles as platforms for AI and services, rather than just electric hardware.

2: What is a robotaxi?

A robotaxi is a taxi that operates with partial or full autonomy. At Level 4 autonomy, it can drive without a human operator in geofenced urban areas, navigating traffic, signals, and obstacles autonomously. Some advanced robotaxis integrate AI for route optimization, passenger personalization, and real-time traffic prediction. Globally, cities like San Francisco, Singapore, and Shanghai are piloting robotaxi fleets as part of urban mobility solutions.

3: When will autonomous vehicles become mainstream?

The timeline depends on technology, regulation, and infrastructure:

- Short Term (2026–2028): L2–L3 driver assistance systems become widespread, assisting humans in lane-keeping, adaptive cruise control, and emergency braking.

- Mid Term (2029–2031): L4 robotaxis may be commercially deployed in pilot cities globally, including limited urban corridors in Europe, North America, and Asia.

- Long Term (2032–2035): L5 full autonomy, capable of handling all driving conditions without human input, could reach global deployment, potentially transforming urban transport, logistics, and ride-hailing ecosystems.

4: How is India adopting EVs?

India is experiencing rapid EV growth, particularly in urban two-wheeler and passenger car segments:

- Two-Wheelers: 11% YoY growth in 2025, with rising adoption of e-scooters and motorcycles.

- Passenger EVs: Nearly doubled in sales in 2025, fueled by both domestic players (Tata Motors, Mahindra Electric) and international entrants (Hyundai, MG Motors).

- Government Targets for 2030:

- 30% of passenger cars electrified

- 70% of commercial vehicles electrified

- 40% of buses electrified

- 80% of two/three-wheelers electrified Government policies, charging infrastructure expansion, and urban adoption are expected to drive India toward becoming a major EV market by 2030.

- 30% of passenger cars electrified

5: What role does AI play in vehicles?

AI is transforming vehicles into intelligent platforms:

- Driver Assistance: Lane-keeping, adaptive cruise control, collision avoidance.

- Predictive Maintenance: Monitors vehicle health to preempt failures and reduce downtime.

- In-Vehicle Personalization: Learns user preferences for seating, climate, infotainment, and navigation.

- Traffic Prediction & Routing: Integrates real-time data for optimal route planning.

- Fleet Optimization: AI manages shared mobility and robotaxi operations, improving efficiency and reducing congestion.

6: Are robotaxis safe?

Safety is a primary focus for autonomous mobility:

- Sensors & AI: Lidar, radar, cameras, and advanced AI algorithms detect obstacles, vehicles, and pedestrians.

- Geofenced Operations: Robotaxis initially operate in controlled urban zones to minimize risk.

- Real-World Trials: Companies like Waymo, Cruise, and AutoX are conducting thousands of miles of test drives to validate reliability. Studies show that autonomous systems have potential to reduce human error, which causes over 90% of road accidents globally.

7: Will EVs disappear in the future?

No. EVs remain the foundation of sustainable mobility, providing the platform for electrification and integration with AI, autonomy, and robotics. However, future mobility will be defined more by software and intelligent services than by electric drivetrains alone. The value in the next decade lies in AI-powered, autonomous, and connected vehicles built on EV platforms.

8: How will robotics integrate with mobility?

Robotics is set to enhance manufacturing, logistics, and passenger experiences:

- Industrial & Manufacturing Robots: Cobots improve EV assembly efficiency, quality control, and safety.

- Logistics Robots: Autonomous mobile robots (AMRs) support warehouse management, supply chains, and last-mile deliveries.

- In-Vehicle Assistants: Humanoid or AI-powered robots may guide passengers, assist in vehicle operation, or provide safety monitoring in autonomous fleets.

- Robotics-as-a-Service (RaaS) is emerging as a scalable business model to integrate robots across mobility ecosystems.

9: Which companies are leading automotive AI?

Key global players include:

- Bosch: AI-driven software and sensors for ADAS and predictive maintenance.

- Ford: L3 autonomy and AI voice assistants for personalized driving.

- Hyundai: Robotics integration and autonomous mobility solutions.

- Tesla: Full self-driving (FSD) software and AI autopilot systems.

- Waymo: L4/L5 robotaxi deployment and autonomous fleet management.

- Nvidia: AI chipsets and platforms for autonomous and connected vehicles.

10: What is the business opportunity in robotaxis?

Robotaxis present multiple revenue streams and business models:

- Ride-Hailing Platforms: AI-enabled autonomous taxis reduce operational costs compared to human drivers.

- Subscription-Based Urban Mobility: Users pay monthly fees for unlimited rides in geofenced zones.

- Fleet Management & Software Licensing: AI platforms optimize routes, monitor vehicle health, and integrate with city traffic management.

- Robotics-as-a-Service (RaaS): Robotics integration for delivery, maintenance, and in-vehicle assistance can generate recurring revenue streams.

- Long-Term Outlook: As adoption increases, robotaxis could reduce personal car ownership, cut urban congestion, and enable sustainable mobility, creating a multi-billion-dollar market globally.

Summary

- EVs remain important but not the spotlight: CES 2026 showcased a shift from electric vehicles to robotaxis, automotive AI, and robotics as the next frontier of mobility.

- Global EV growth continues: The worldwide EV market is projected to grow from $733B in 2025 to ~$1.9T by 2032, but software, AI, and autonomous systems are becoming equally critical.

- Robotaxis are gaining momentum: Autonomous taxis and shuttles are emerging as urban mobility solutions, with pilot projects in global cities and potential future adoption in India.

- Automotive AI defines future vehicles: AI-driven features such as driver assistance, predictive maintenance, and personalized in-car experiences are creating software-defined vehicles.

- Robotics expands beyond cars: Humanoid and collaborative robots are transforming manufacturing, logistics, and mobility services, signaling a broader integration of physical AI.

- India’s EV market is growing, autonomy is nascent: Strong EV adoption is supported by government policies, while robotaxis and high-level autonomous systems are still in early-stage planning, offering future opportunities.

Conclusion

CES 2026 sent a clear signal: while electric vehicles remain a cornerstone of the automotive revolution, they are no longer the centerpiece of innovation. The future of mobility is increasingly defined by robotaxis, automotive AI, and advanced robotics, reflecting a shift from traditional hardware-centric solutions to software-driven, intelligent ecosystems.

Globally, EV adoption continues to rise steadily, with projections showing the market growing from $733 billion in 2025 to nearly $1.9 trillion by 2032. However, the real value is no longer just in electric drivetrains—it lies in AI-enhanced vehicles, autonomous fleets, and robotic systems that promise safer, more efficient, and highly personalized mobility experiences. Companies like Ford, Bosch, Hyundai, and Waymo are leading this transformation, integrating autonomous systems, AI assistants, and software-defined vehicle architectures that will redefine urban transportation in the next decade.

For India, the picture is equally promising but more nuanced. EV adoption is accelerating, particularly in two-wheelers and passenger vehicles, thanks to supportive government policies such as FAME-II and ambitious electrification targets. However, robotaxis and high-level autonomous systems are still in the nascent stage, limited by infrastructure, regulation, and technology readiness. Urban centers like Bengaluru and Hyderabad could become testing grounds for autonomous mobility, setting the stage for a gradual rollout of AI-driven transport solutions.

Looking ahead, the automotive ecosystem will be multi-layered: EV hardware will provide the platform, AI will manage operations and personalization, and robotics will enhance manufacturing, logistics, and human-vehicle interaction. Businesses must pivot from selling vehicles to delivering intelligent mobility solutions, while consumers will need to adapt to new modes of transport and embrace AI-assisted driving experiences.

In essence, CES 2026 marks the beginning of a new era, where mobility is no longer defined solely by electric powertrains but by integrated intelligence, autonomy, and robotics. For global and Indian markets alike, this shift presents massive opportunities—for innovators, investors, startups, and policymakers—to shape the future of smart, safe, and sustainable transportation.

Takeaway: The EV revolution isn’t over—it’s evolving. The winners of the next decade will be those who combine electrification with AI, autonomy, and robotics to create the mobility experiences of the future.

References

Here’s a consolidated list of verified sources and useful reference links you can include in your blog’s References section — curated for credibility, SEO value, and relevance to the topic “EVs take back seat at CES as robotaxis, robots, and automotive AI set future trends.”

CES 2026 & Automotive Innovation

- InsideEVs — CES 2026 Automotive Coverage

A detailed preview of automotive stories from CES 2026, emphasizing AI, robots, and robotaxis in place of traditional EV exhibits.

👉 Inside EVs CES 2026 Coverage — CES 2026 — AI, robots & autonomous mobility takeover (InsideEVs) - Reuters — Bosch Software & Automotive AI Growth

Coverage of Bosch’s CES 2026 announcements, including software and AI cockpit systems and projected software business growth into the 2030s.

👉 Reuters: Bosch expects tech‑driven car market to boost software sales — Bosch automotive software growth & AI focus at CES 2026 (Reuters) - The Verge — Ford AI Assistant & Level 3 Autonomy Plans

Details on Ford’s upcoming AI voice assistant and its strategy for Level 3 autonomy rollout starting in 2028.

👉 The Verge: Ford’s AI voice assistant & Level 3 autonomy (CES 2026) — Ford AI assistant and Level 3 autonomy plans (The Verge) - SBD Automotive — CES 2026 Automotive Tech Roundup

Insights on automotive AI, robotics, and human‑centered mobility highlights from CES 2026 exhibitors.

👉 SBD Automotive: CES 2026 automotive trends — All things automotive from CES 2026 (SBD Automotive)

Electric Vehicle Market & Policy (Global + India)

- Persistence Market Research — Global EV Market Size & Forecast

Industry forecast showing the global electric vehicle market expanding from ~$733 B in 2025 to ~$1.9 T by 2032 with a strong CAGR.

👉 Persistence Market Research EV market report — Global Electric Vehicle Market Size & Trend (Persistence Market Research) - Times of India — India EV Wholesales 2025 Data

Data showing Indian electric vehicle adoption rising, with two‑wheelers growing 11% YoY and passenger EV sales nearly doubling in 2025.

👉 Times of India: EV wholesales 2025 — India EV Wholesales Surge 2025 (Times of India) - India EV Adoption News — EV Sales Growth 2025

Latest coverage showing EV adoption progress in India (2.3 million units in 2025).

👉 Times of India / ANI — India’s EV adoption climbs to ~2.3 million units in 2025 - IBEF — India Electric Vehicle Industry Overview

Policy and market overview including infrastructure expansion, battery market projections, and EV targets for 2030.

👉 IBEF: Electric vehicle industry in India — India EV Industry & Policy Overview (IBEF) - IBEF – Two‑Wheeler EV Market Growth in India

Analysis on India’s two‑wheeler electrification trends, potential for mass adoption by 2030.

👉 IBEF: Two‑Wheeler EV Sales in India — Electric Two‑Wheeler Market in India (IBEF) - NITI Aayog EV Adoption Roadmap (reported by Economic Times)

India’s government blueprint to accelerate EV adoption aligning policy with electrification goals.

👉 Economic Times / NITI Aayog — EV adoption blueprint for India (source)