Estimated Reading Time: 25-30 minutes (4,875 words)

Introduction

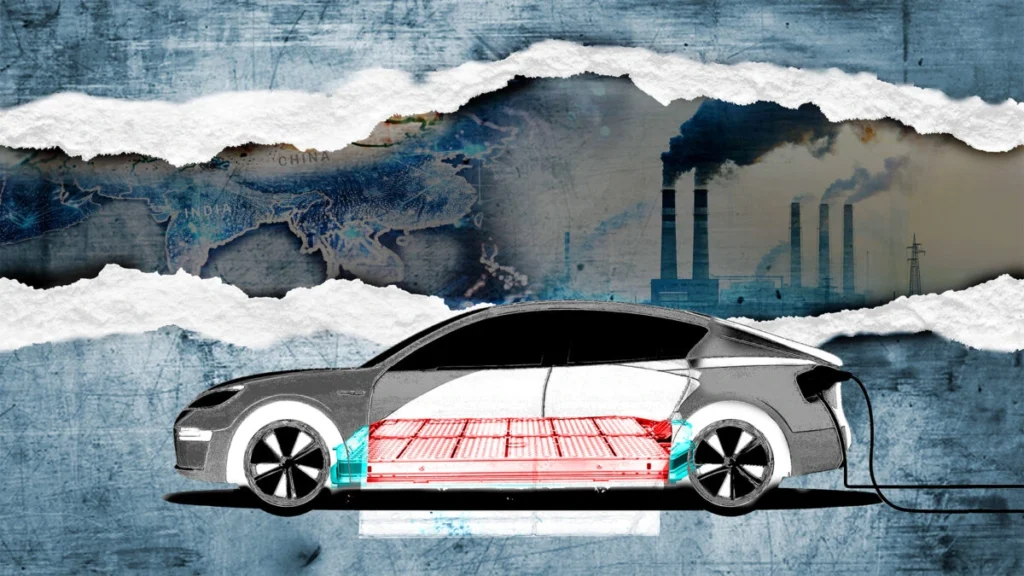

The automotive industry is experiencing a once-in-a-century transformation, driven by the rapid adoption of electric vehicles (EVs). Once considered niche or experimental, EVs are now moving into the mainstream, reshaping global mobility patterns, consumer behavior, and the broader automotive ecosystem. In 2023, electric vehicles accounted for nearly 18% of global new car sales, up from just 2% five years earlier, signaling a dramatic shift in consumer preference toward sustainable, low-emission transportation. This surge is mirrored in India, where government incentives, urban pollution concerns, and declining battery costs are accelerating the adoption of two-wheelers, three-wheelers, and passenger EVs.

While EVs promise reduced greenhouse gas emissions, lower fuel and operational costs, and quieter, cleaner driving experiences, they are also disrupting the traditional automotive aftermarket. Conventional revenue streams, long dominated by frequent oil changes, engine repairs, exhaust maintenance, and transmission services, are shrinking because EVs have fewer moving parts, longer service intervals, and simplified drivetrains. Additionally, the reliance on proprietary software, complex battery management systems, and high-voltage electronics poses challenges for independent garages, spare parts suppliers, and service centers, threatening their historical business models.

This blog delves into the tension EVs are creating in the automotive aftermarket, examining the trends, challenges, and opportunities globally and in India. It highlights how independent garages and aftermarket businesses can adapt, innovate, and pivot toward EV-specific services such as battery replacement, diagnostics, software updates, and training programs. By understanding the evolving landscape and acting proactively, businesses can not only survive the transition but also capitalize on new revenue streams emerging from the EV revolution.

Global EV Market Trends Impacting Aftermarket

🚗 EV Adoption Accelerating

The electric vehicle market is growing at an unprecedented pace worldwide. In 2023, approximately 18% of all new car sales globally were electric, a remarkable jump from just 2% in 2018, reflecting increasing consumer adoption, government incentives, and improvements in battery technology. China, Europe, and the United States remain the leading EV markets, but adoption in India is rapidly catching up, particularly in the two-wheeler and three-wheeler segments.

Analysts project that by 2030, the global EV fleet will exceed 150 million vehicles, representing a substantial portion of the total automotive market. This growth is being driven not only by stricter emission regulations and climate commitments but also by the declining total cost of ownership (TCO) of EVs compared to internal combustion engine (ICE) vehicles. Battery costs have fallen by ~85% over the past decade, making EVs more affordable, while charging infrastructure expansion is reducing range anxiety for consumers.

⚡ Impact on the Aftermarket

As EV adoption accelerates, the traditional automotive aftermarket is undergoing a major transformation. EVs have fewer moving parts, eliminating the need for frequent oil changes, fuel filter replacements, exhaust system repairs, and complex transmission maintenance. This shift is putting pressure on independent garages, parts suppliers, and service centers that have historically relied on these recurring revenue streams.

At the same time, demand for EV-specific services is rising sharply. Key areas of growth include:

- Battery diagnostics and replacements – EV batteries degrade over time, and monitoring their health is crucial for vehicle performance and safety.

- Software updates and firmware upgrades – Many EVs now rely on connected systems and over-the-air updates, which require specialized skills.

- High-voltage system repairs – Motors, inverters, and power electronics are complex, requiring certified training and advanced diagnostic tools.

- Regenerative braking maintenance – Although brake wear is reduced, specialized components still need inspection and occasional replacement.

This shift from mechanical to electronic and software-based maintenance is reshaping revenue models for the automotive aftermarket globally.

📊 Market Size & Outlook

The EV aftermarket market is experiencing rapid growth, though it is evolving differently from the ICE aftermarket.

| Region | 2024 Market Value | 2033 Forecast | CAGR |

| Global EV Aftermarket | USD 81.8M | USD 475.7M | 20.5% |

| India EV Aftermarket | USD 4.6B | USD 22.1B | 25% |

Key Insight:

While traditional ICE parts demand is declining, new revenue streams are emerging from batteries, power electronics, connected services, and software maintenance. Independent garages that adapt early by offering EV-specific services—such as battery health monitoring, high-voltage diagnostics, and software updates—can capitalize on this growth. Moreover, OEMs are increasingly offering partnerships and certifications, providing an avenue for independent service providers to secure authorized EV work and recurring revenue.

🔑 Takeaways for Global Market Trends

- EV adoption is accelerating rapidly across all major markets, reshaping demand for traditional parts and services.

- Maintenance focus is shifting from mechanical to electronic and software-driven services.

- Global and Indian EV aftermarket sectors are projected to grow at double-digit CAGRs, highlighting opportunities for early adopters in service, parts, and training.

- Independent garages and suppliers must invest in EV infrastructure, tools, and training to remain competitive.

India’s EV Aftermarket Landscape

🇮🇳 Market Trends

India’s electric vehicle market is experiencing rapid growth across multiple segments, including two-wheelers, three-wheelers, and passenger cars. Two-wheelers account for the majority of EV adoption due to affordability, shorter daily travel distances, and urban commuting needs, while three-wheelers are increasingly electrified for shared mobility and last-mile logistics. Passenger EV adoption, though smaller, is growing steadily, supported by government incentives like FAME-II, reduced GST on EVs, and state-level subsidy programs.

EV registrations in India surged by ~150% YoY in 2024, with urban hubs such as Delhi, Mumbai, Bengaluru, Pune, and Hyderabad leading adoption. According to the IMARC Group, this growth is not just limited to vehicles but also reflects the expansion of charging infrastructure, battery swapping stations, and connected EV services, which are critical for supporting a large-scale EV ecosystem. Analysts forecast that by 2030, India’s EV aftermarket could reach USD 22.1 billion, driven by batteries, electronics, diagnostics, and training services.

🔧 Current Challenges

Despite rapid EV adoption, the aftermarket ecosystem in India faces significant hurdles:

- Infrastructure Gap

- Around 80% of garages in India are not equipped for EV servicing, lacking high-voltage safety tools, specialized lifts, insulated toolkits, and diagnostic equipment.

- Most traditional service centers continue to operate on ICE maintenance models, making it difficult to handle EV-specific repairs safely.

- Around 80% of garages in India are not equipped for EV servicing, lacking high-voltage safety tools, specialized lifts, insulated toolkits, and diagnostic equipment.

- Skill Shortage

- EVs require mechanics trained in high-voltage systems, battery management, regenerative braking, and software diagnostics.

- Currently, only a small fraction of Indian technicians have formal training in these areas, creating a critical bottleneck for scaling independent EV services.

- EVs require mechanics trained in high-voltage systems, battery management, regenerative braking, and software diagnostics.

- OEM Dominance in Parts and Software

- Many EV components, including batteries, inverters, and onboard software, are controlled by original equipment manufacturers (OEMs).

- Proprietary software and limited availability of spare parts restrict independent repair options, forcing most EV owners to rely on authorized service centers.

- Many EV components, including batteries, inverters, and onboard software, are controlled by original equipment manufacturers (OEMs).

- High Capex for Garages

- Upgrading a traditional garage to handle EVs requires investment in diagnostic tools, safety training, battery handling equipment, and software subscriptions, which can be prohibitive for small or medium-sized service centers.

- Upgrading a traditional garage to handle EVs requires investment in diagnostic tools, safety training, battery handling equipment, and software subscriptions, which can be prohibitive for small or medium-sized service centers.

💡 Opportunities

While challenges exist, the rapidly evolving EV ecosystem also presents lucrative opportunities for businesses and entrepreneurs in India’s aftermarket sector:

- Battery Replacement and Recycling Services

- EV batteries have limited lifespans (typically 6–10 years) and create demand for replacement, refurbishment, and second-life applications such as energy storage.

- Battery recycling is expected to be a high-margin service segment, as governments enforce regulations for sustainable disposal.

- EV batteries have limited lifespans (typically 6–10 years) and create demand for replacement, refurbishment, and second-life applications such as energy storage.

- Specialized EV Training and Certification

- Establishing EV training centers for mechanics can address the skill gap while creating a new revenue stream.

- Training can cover high-voltage safety, diagnostics, firmware updates, and regenerative braking maintenance.

- Establishing EV training centers for mechanics can address the skill gap while creating a new revenue stream.

- Software-Driven Predictive Maintenance

- Connected EVs generate large volumes of operational data. Businesses can leverage this data to offer predictive maintenance subscriptions, reducing unexpected breakdowns and building recurring revenue models.

- Connected EVs generate large volumes of operational data. Businesses can leverage this data to offer predictive maintenance subscriptions, reducing unexpected breakdowns and building recurring revenue models.

- Tier-2 and Tier-3 Urban Markets

- While metro cities dominate current adoption, smaller cities and towns are poised for EV growth, particularly for two- and three-wheelers. Early aftermarket players can establish service networks in these emerging markets.

- While metro cities dominate current adoption, smaller cities and towns are poised for EV growth, particularly for two- and three-wheelers. Early aftermarket players can establish service networks in these emerging markets.

- Partnerships with OEMs and Fleet Operators

- Collaborating with EV manufacturers, fleet operators, and ride-sharing companies allows independent garages to secure authorized maintenance contracts, ensuring steady demand for EV services.

- Collaborating with EV manufacturers, fleet operators, and ride-sharing companies allows independent garages to secure authorized maintenance contracts, ensuring steady demand for EV services.

🔑 Key Takeaways

- India’s EV aftermarket is poised for rapid growth, particularly in batteries, diagnostics, and software services.

- Significant gaps exist in infrastructure, skills, and OEM-independent repair capacity, which can hinder growth if not addressed.

- Businesses that invest in EV-ready garages, training, and predictive service models can capture early-mover advantage and thrive as the Indian EV market expands.

How EVs Are Reducing Traditional Aftermarket Demand

The rise of electric vehicles (EVs) is significantly disrupting the traditional automotive aftermarket by changing the nature and frequency of vehicle maintenance. Unlike internal combustion engine (ICE) vehicles, EVs have fewer mechanical components, simpler drivetrains, and advanced electronics, which reduces the demand for many conventional services that independent garages have historically relied upon.

| Traditional Service | EV Impact | Details & Context |

| Oil changes | Eliminated | EVs do not have an engine that requires lubricating oil, completely removing this recurring revenue stream for garages. |

| Fuel filters | Eliminated | Without combustion engines, fuel filtration is no longer required, further reducing maintenance jobs. |

| Exhaust systems | Eliminated | EVs produce zero tailpipe emissions; no mufflers, catalytic converters, or exhaust pipes are needed, removing both repair and replacement demand. |

| Brake pads | Reduced wear | Regenerative braking systems in EVs convert kinetic energy into electricity, significantly reducing brake wear and the frequency of brake pad replacement. |

| Transmission repairs | Simplified drivetrain reduces failures | EVs often use a single-speed transmission with far fewer moving parts compared to multi-gear ICE systems, reducing mechanical failures and repair requirements. |

📉 Key Impacts on Independent Garages

- Revenue Pressure:

Traditional services like oil changes, fuel system maintenance, exhaust repairs, and transmission overhauls account for a substantial portion of recurring revenue for garages. The elimination or reduction of these services directly impacts income for independent workshops. - Shift in Customer Expectations:

EV owners expect specialized battery maintenance, software updates, and diagnostic services, which differ from conventional repair offerings. Garages that fail to offer EV-specific services may lose customers to OEM-authorized service centers or specialized EV workshops. - Longer Service Intervals:

Many EV components, including motors and high-voltage electronics, require less frequent servicing than ICE engines, further decreasing the volume of routine service jobs. - Pressure to Adapt:

Independent garages must pivot toward EV-focused services such as battery health checks, inverter repairs, software diagnostics, regenerative braking system maintenance, and high-voltage electrical system repairs. Those that adapt early can capture the growing EV aftermarket revenue, while those that do not risk obsolescence.

💡 Key Insight

The shift to EVs is not just a technological change but a business transformation. Independent garages that rely solely on traditional maintenance services face declining revenue streams, whereas those that invest in EV infrastructure, training, and specialized services can thrive in the rapidly expanding EV ecosystem.

Challenges for Independent Garages & Service Providers

The rapid adoption of electric vehicles (EVs) is redefining the operational landscape for independent garages and service providers. While EVs create new opportunities, they also bring unique challenges that can disrupt traditional business models. Understanding these challenges is critical for aftermarket players who want to stay competitive.

1. Access to Parts & Software

One of the most significant hurdles for independent garages is limited access to EV parts and software:

- OEM-controlled components: Most EV parts—including batteries, inverters, power electronics, and proprietary sensors—are controlled by original equipment manufacturers (OEMs). Unlike ICE vehicles, aftermarket alternatives are scarce or unavailable, reducing options for independent repair shops.

- Proprietary software and diagnostics: EVs rely heavily on software for battery management, motor control, and regenerative braking. Independent garages require expensive diagnostic tools, specialized software licenses, and connectivity with OEM servers to perform accurate repairs.

- Impact on costs and service: The combination of limited parts and expensive software access increases service costs, making it challenging for independent garages to compete with OEM-authorized centers.

Example: Tesla’s EV service model uses proprietary diagnostics and over-the-air software updates, which restricts independent garages from performing even minor repairs without OEM approval.

2. High Training Costs

Mechanics need specialized skills to safely and effectively service EVs:

- High-voltage safety: EV batteries operate at hundreds of volts, requiring mechanics to follow strict safety protocols to prevent electrical hazards.

- Battery management & diagnostics: Understanding battery degradation, thermal management, and regenerative braking systems requires technical expertise and certification.

- Training gaps in India: Most tier-2 and tier-3 cities lack formal EV training programs, limiting the availability of qualified technicians.

Impact: Garages face both upfront costs for training and ongoing investment in skill updates, creating a barrier for smaller or mid-sized service providers.

3. Investment in Tools & Infrastructure

EV servicing demands specialized infrastructure, which many traditional garages do not possess:

- Insulated tools and safety equipment: Mechanics must use gloves, mats, and insulated hand tools rated for high-voltage systems.

- EV-compatible lifts and hoists: EVs are heavier due to battery packs, requiring robust lifts designed for higher weight distribution.

- Diagnostic stations and software licenses: Advanced EV software platforms are required for accurate troubleshooting and updates.

Impact: Setting up an EV-ready workshop can involve capital expenditures several times higher than traditional ICE garages, particularly for small independent shops.

4. Revenue Model Shift

EVs have fewer moving parts and require less frequent maintenance, which fundamentally changes the revenue model for independent garages:

- Reduced service frequency: With no oil changes, fuel systems, or exhaust maintenance, recurring service revenue drops significantly.

- New focus on value-added services: Independent garages must pivot toward battery health checks, inverter repairs, firmware updates, regenerative braking maintenance, and connected vehicle services.

- Alternative revenue streams: Subscription-based maintenance plans, fleet contracts for EV taxis or delivery vehicles, and predictive maintenance services are emerging models to offset revenue loss from traditional repairs.

Insight: Garages that fail to adapt to these new revenue streams risk losing profitability, while those that embrace the shift can capture high-margin EV-specific service opportunities.

🔑 Key Takeaways

- Access to OEM-controlled parts and software is a major barrier for independent garages.

- Specialized training and certification are essential for high-voltage EV repair, yet scarce in many Indian regions.

- High upfront investment in tools, lifts, and diagnostic equipment is required to safely handle EVs.

- The traditional service-based revenue model is declining, necessitating new approaches such as subscriptions, fleet maintenance, and predictive services.

Early adaptation and strategic investment in EV capabilities can help independent garages survive and thrive in the evolving aftermarket ecosystem.

Emerging Opportunities in the EV Aftermarket

While electric vehicles (EVs) pose challenges for traditional automotive aftermarket businesses, they are also creating exciting new opportunities for service providers, entrepreneurs, and investors. By pivoting to EV-specific services, garages and suppliers can unlock high-margin revenue streams and future-proof their operations.

1. Battery Recycling & Second-Life Market

EV batteries are central to the vehicle’s performance, but they degrade over time. As adoption increases, the demand for battery replacement, refurbishment, and recycling will grow exponentially:

- Second-life applications: Used EV batteries, once degraded for automotive use, can be repurposed for stationary energy storage, such as solar energy storage systems, microgrids, and backup power solutions.

- Battery recycling: End-of-life EV batteries contain valuable materials like lithium, cobalt, nickel, and manganese, which can be recovered and reused. Recycling not only addresses environmental concerns but also reduces dependence on raw material imports.

- Market potential: The global second-life and recycling market is projected to reach USD 10–15 billion by 2030, offering substantial revenue opportunities for innovative service providers.

- India-specific outlook: With the government promoting battery recycling policies and incentives, Indian entrepreneurs can capitalize on the growing domestic EV fleet and contribute to sustainable practices.

2. Connected Car Services

EVs are increasingly connected through telematics and onboard software systems, which creates opportunities for data-driven services:

- Remote diagnostics: EVs constantly generate data on battery health, motor performance, and charging behavior. Garages can offer remote diagnostics to detect issues before they escalate.

- Predictive maintenance subscriptions: Using AI and telematics, service providers can predict component failures, offering subscription-based maintenance plans to fleet operators, taxi services, and individual EV owners.

- Fleet management opportunities: Companies operating EV fleets, including delivery vehicles and ride-sharing services, are actively seeking connected services for real-time monitoring, route optimization, and preventive maintenance, creating recurring revenue potential for aftermarket businesses.

3. EV Software & Firmware Updates

Software has become a critical component of EV performance, safety, and user experience:

- Monetizable updates: OEMs and authorized service providers can generate revenue by providing software patches, security updates, performance enhancements, or feature unlocks.

- Third-party services: Independent service centers with proper certifications can offer diagnostic software tools, update installations, and firmware troubleshooting, expanding their service portfolio.

- Customer retention: Regular software and firmware updates help build long-term customer trust and loyalty, as EV owners prefer service providers who keep their vehicles optimized and safe.

4. Training & Certification

The EV ecosystem is creating a new demand for skilled technicians, making training and certification a lucrative opportunity:

- Specialized courses: Mechanics can be trained in high-voltage safety, battery diagnostics, regenerative braking systems, inverter maintenance, and software troubleshooting.

- Revenue streams for training centers: Offering certification programs for individuals and corporate garages can become a sustainable business model, with recurring fees and partnerships with OEMs or educational institutions.

- Geographic opportunity: Tier-2 and Tier-3 cities in India, which are rapidly adopting EVs, currently lack adequate training infrastructure, presenting first-mover advantage for training providers.

🔑 Key Takeaways

- The EV battery lifecycle creates opportunities in recycling, second-life applications, and energy storage solutions.

- Connected car services and predictive maintenance can generate recurring revenue and strengthen fleet partnerships.

- Software and firmware updates provide high-margin service opportunities for both OEMs and certified independent providers.

- Training and certification programs for mechanics represent a rapidly growing niche that addresses the skill gap while creating a scalable business model.

By strategically investing in these emerging opportunities, independent garages, aftermarket suppliers, and entrepreneurs can transition from declining ICE-dependent revenues to sustainable EV-specific business models, positioning themselves for long-term success in the evolving automotive landscape.

Step-by-Step Guide: Preparing Your Garage for EVs

Transitioning your garage to handle electric vehicles (EVs) is not just about upgrading tools—it requires a strategic combination of training, infrastructure, partnerships, and innovative service models. The following step-by-step guide outlines practical actions to help independent garages thrive in the evolving EV aftermarket.

Step 1: Invest in Training

EV servicing requires specialized knowledge that differs significantly from traditional ICE vehicle repair.

- High-voltage safety: Mechanics must be trained to safely handle batteries, inverters, and power electronics to avoid serious accidents.

- Battery diagnostics and management: Learn to monitor state-of-charge (SoC), state-of-health (SoH), thermal management, and degradation patterns to provide reliable maintenance services.

- Firmware and software troubleshooting: Technicians must understand onboard software, connected car systems, and over-the-air updates.

- Training options: Consider certifications from EV OEMs, technical institutes, or online programs. Partnerships with training providers can also create an additional revenue stream by offering workshops to other garages.

Example: A workshop in Bengaluru partnered with an EV training institute to certify its mechanics, resulting in a 30% increase in high-value EV service contracts within one year.

Step 2: Upgrade Tools & Infrastructure

Modern EVs require specialized tools and infrastructure to ensure safe and efficient servicing.

- Insulated hand tools and gloves for high-voltage systems.

- Diagnostic software and scan tools compatible with multiple EV brands.

- EV-compatible lifts and hoists capable of handling the additional weight of battery packs.

- Safety equipment: High-voltage mats, fire suppression systems, and emergency cut-off tools.

Pro Tip: Prioritize investments that cover multiple EV brands to maximize service potential and ROI.

Step 3: Focus on Battery & Electronics

The core of EV servicing revolves around batteries and electronic systems, which offer high-margin opportunities:

- Battery replacement and refurbishment: Offer second-life battery solutions and replacements.

- Regenerative braking service: Inspect and maintain brake systems optimized for EVs, which last longer but still require periodic checks.

- Firmware and software updates: Provide software patches, safety updates, and feature unlocks for various EV models.

- Diagnostics services: Use connected car tools to predict potential failures and prevent breakdowns, enhancing customer satisfaction.

Step 4: Build OEM Partnerships

Collaborating with OEMs ensures authorized access to parts, training, and software licenses, allowing independent garages to offer a wider range of EV services:

- Negotiate authorized parts supply for batteries, inverters, and other critical components.

- Become a certified service center to attract EV owners who prefer trusted providers.

- Access OEM diagnostic tools, software updates, and technical support, which enhances credibility and service quality.

Example: An EV workshop in Pune secured an OEM partnership and doubled its EV customer base within six months by offering authorized battery and software services.

Step 5: Offer Subscription & Fleet Services

EV maintenance is shifting from reactive repairs to predictive and subscription-based models:

- Predictive maintenance subscriptions: Charge customers a monthly fee to monitor battery health, motor performance, and software updates.

- Fleet services: Partner with delivery, ride-sharing, and corporate EV fleets for scheduled maintenance contracts, ensuring consistent revenue.

- Roadside assistance plans: Offer battery swap support, mobile diagnostics, and emergency services tailored to EV owners.

Insight: Subscription and fleet services not only provide stable recurring revenue but also increase customer loyalty and long-term retention.

🔑 Key Takeaways

- EV readiness requires specialized training, tools, and safety measures.

- Focusing on battery, electronics, and software services offers high-margin revenue streams.

- OEM partnerships are critical to accessing parts, licenses, and credibility.

- Subscription models and fleet contracts can stabilize income and differentiate your garage from competitors.

- Early adoption positions garages to capture the growing EV aftermarket before the market saturates.

FAQs Section

1. What is the EV aftermarket?

The EV aftermarket encompasses all post-sale services, repairs, and parts replacement for electric vehicles. Unlike traditional ICE vehicles, the EV aftermarket emphasizes battery health management, high-voltage systems, power electronics, regenerative braking, and software maintenance. It includes services from OEM-authorized centers, certified independent garages, and specialized service startups.

- Global Context: With over 150 million EVs projected worldwide by 2030, the EV aftermarket is becoming a critical revenue segment, estimated at USD 475 billion globally by 2033.

- India Focus: India’s EV aftermarket is expected to grow from USD 4.6 billion in 2024 to USD 22.1 billion by 2030, driven by two-wheelers, three-wheelers, and passenger EV adoption.

Insight: The EV aftermarket is less about oil and more about electronics, making knowledge-intensive services more valuable.

2. Are EV repairs more expensive than ICE vehicle repairs?

EV repairs can be initially more expensive, primarily due to high-voltage batteries, inverters, and electronic control units.

- Battery replacements: Can cost between USD 5,000–15,000, depending on capacity and brand.

- Inverter or motor repairs: Often require specialized tools and software, adding to labor costs.

- Recurring maintenance: EVs require fewer routine repairs—no oil changes, fewer brake pad replacements, and simplified drivetrains.

- Total Cost of Ownership (TCO): Over 5–10 years, EV owners may pay 20–30% less on maintenance than ICE vehicle owners.

Example: Tesla’s Model 3 service data shows 70% lower routine maintenance costs compared to comparable ICE sedans, despite higher repair costs for major components.

3. Can independent garages service EVs?

Yes, but it requires specialized infrastructure, training, and certifications.

- Training Needs: High-voltage safety, battery diagnostics, software troubleshooting, and regenerative braking systems.

- Tools Required: Insulated hand tools, EV-compatible lifts, diagnostic software, and safety equipment.

- OEM Limitations: Proprietary software and parts may restrict certain repairs; garages need authorized partnerships to perform warranty-covered services.

Case Study: A Bengaluru workshop partnered with an EV training institute, enabling it to service Nissan Leaf and MG ZS EVs; within a year, its EV service revenue grew by 35%, proving the business case for early adoption.

4. What parts are in high demand for EVs?

EVs rely on fewer mechanical parts but more electronic components, creating demand in:

- High-voltage batteries: Replacement, refurbishment, and second-life applications.

- Inverters and motors: Drive electric power conversion; failures are high-value repair opportunities.

- Regenerative braking components: Though wear is lower, periodic inspection is essential.

- Sensors & ECUs: Power electronics, battery management, and safety-critical systems.

- Software updates: Firmware patches, OTA updates, and feature unlocks increasingly contribute to recurring revenue.

Market Insight: Global EV battery replacement and recycling alone could generate USD 10–15 billion by 2030.

5. How will EV adoption affect ICE aftermarket businesses?

Traditional ICE revenue streams are declining sharply:

- Oil changes, fuel filters, exhaust, and transmission repairs are no longer needed.

- Garages relying solely on ICE maintenance may face 20–40% revenue reduction as EV penetration rises.

- Opportunity for pivot: Focus on EV batteries, electronics, connected diagnostics, and predictive maintenance to maintain profitability.

Example: In Europe, independent garages that failed to adapt to EVs saw a decline in recurring service visits by 35% over 3 years.

6. Which countries lead in EV aftermarket development?

- USA & Germany: Strong OEM-supported networks and advanced software tools.

- China: Largest EV fleet globally, extensive independent service networks, and battery recycling initiatives.

- India: Emerging urban hubs (Delhi, Mumbai, Bengaluru) are developing OEM-authorized centers; two-wheeler and three-wheeler EV aftermarket is growing rapidly.

Insight: Countries investing in training, certification, and connected service infrastructure are setting benchmarks for global EV aftermarket readiness.

7. Is India ready for mass EV servicing?

Partially.

- Urban readiness: Delhi, Mumbai, Bengaluru, and Pune have OEM-supported service centers and some certified garages.

- Challenges: Tier-2 and Tier-3 cities lack trained technicians, diagnostic tools, and EV infrastructure.

- Opportunity: Early movers can establish service networks in underserved regions, capturing first-mover advantage.

Example: MG Motors and Tata Motors have partnered with local garages in Bengaluru and Delhi to expand EV servicing access.

8. Are EV repairs covered under warranty?

- Most EVs have battery and electronics warranties for 5–8 years, sometimes extending to 150,000–200,000 km.

- Routine service, software updates, and out-of-warranty repairs may require independent service centers or specialized garages.

- OEM-controlled software and parts limit independent servicing options but ensure safety and reliability.

Tip: Garages that become OEM-certified can handle warranty and out-of-warranty EV repairs, attracting more customers.

9. What is the 10-year forecast for the EV aftermarket in India?

- 2023 Market Size: USD 4.6 billion

- 2030 Forecast: USD 22.1 billion (~25% CAGR)

- Drivers: Growth in EV two-wheelers, three-wheelers, and fleet vehicles; increasing battery replacements; rising demand for diagnostics, software updates, and predictive maintenance.

Insight: Businesses that invest in EV-ready infrastructure today will be positioned to capture the majority of aftermarket revenue over the next decade.

10. How can garages pivot successfully?

- Invest in EV training: High-voltage safety, battery management, diagnostics, and software troubleshooting.

- Specialize in battery and electronics services: High-margin opportunities include battery replacements, regenerative braking maintenance, and inverter repairs.

- Partner with OEMs: Gain access to parts, software, and certifications for credibility.

- Offer subscription or fleet-based services: Predictive maintenance, battery monitoring, and roadside support ensure recurring revenue.

Upgrade infrastructure: EV-compatible lifts, insulated tools, diagnostic software, and high-voltage safety equipment.

Summary

- EV Adoption is Reshaping the Industry: Global and Indian electric vehicle sales are rising rapidly, changing the types of maintenance and services required in the automotive aftermarket.

- Traditional Services Are Declining: With fewer moving parts, EVs reduce demand for oil changes, fuel filters, exhaust repairs, and other conventional services, impacting revenue for independent garages.

- Skill and Infrastructure Gaps: Most garages, especially in India, lack trained mechanics, diagnostic tools, and high-voltage safety infrastructure needed for EV servicing.

- OEM Control Limits Independent Repair: Proprietary software and parts access restrict independent workshops, increasing reliance on authorized service centers.

- Emerging Opportunities: New revenue streams include battery replacement and recycling, connected car diagnostics, software updates, and specialized EV training programs.

- Actionable Business Adaptation: Garages and aftermarket businesses can thrive by investing in EV training, upgrading tools, forming OEM partnerships, and offering subscription or fleet maintenance services.

Conclusion

Electric vehicles are rapidly transforming the automotive aftermarket, both globally and in India. The shift from internal combustion engines (ICE) to electric drivetrains is reducing the demand for traditional maintenance services such as oil changes, fuel filters, exhaust repairs, and transmission overhauls. This change is creating a significant challenge for independent garages and parts suppliers that have long relied on these recurring revenue streams. Businesses that fail to adapt risk declining profitability as more vehicles on the road transition to electric powertrains.

However, the EV revolution is also creating new and lucrative opportunities for those willing to evolve. Services related to battery replacement and recycling, high-voltage diagnostics, regenerative braking maintenance, and firmware/software updates are becoming increasingly important. Additionally, training and certification programs for mechanics specializing in EVs represent a growing niche. Garages and service centers that invest in the right infrastructure, acquire specialized skills, and build partnerships with OEMs can tap into these emerging revenue streams, ensuring long-term competitiveness.

In India, the aftermarket opportunity is particularly compelling due to the country’s rapid adoption of electric two-wheelers, three-wheelers, and passenger cars. Early adopters in the service industry can position themselves as trusted EV maintenance providers, catering to both urban and semi-urban markets. By embracing innovation, focusing on EV-specific services, and adopting predictive or subscription-based maintenance models, aftermarket businesses can not only survive but thrive in the evolving automotive ecosystem.

References

- Electric Vehicle Aftermarket Industry (Global)

– Fortune Business Insights – Electric Vehicle Aftermarket Industry Size, Share & Trends

🔗 https://www.fortunebusinessinsights.com/electric-vehicle-aftermarket-industry-113507 Fortune Business Insights - Global EV Aftermarket Report (IMARC Group)

– IMARC Group – Global Electric Vehicle Aftermarket to Grow at 20.52% During 2025–2033

🔗 https://www.imarcgroup.com/global-electric-vehicle-aftermarket IMARC Group - India EV Aftermarket Market (IMARC Group)

– IMARC Group – India Electric Vehicle Aftermarket Size, Share, Trends, Report, 2033

🔗 https://www.imarcgroup.com/india-electric-vehicle-aftermarket IMARC Group - India EV Aftermarket Growth Forecast (Grand View Research)

– Grand View Research – India EV Aftermarket Market Highlights

🔗 https://www.grandviewresearch.com/horizon/outlook/electric-vehicle-aftermarket-market/india Grand View Research - Automotive Aftermarket Industry Trends (S&P Global)

– S&P Global – Automotive aftermarket industry trends 2025: Key insights

🔗 https://www.spglobal.com/automotive-insights/en/blogs/automotive-aftermarket-industry-trends-2025 S&P Global - EV Aftermarket Market Forecast & Trends

– ResearchAndMarkets – Electric Vehicle Aftermarket Market 2025–2033

🔗 https://www.researchandmarkets.com/reports/6101957/electric-vehicle-aftermarket-market-global Research and Markets - EV Maintenance Trends & Impact on Aftermarket

– Diamond Auto Spare Parts – The Future of Electric Vehicles and How It Will Affect the Aftermarket Spare Parts Industry

🔗 https://diamondautospareparts.com/the-future-of-electric-vehicles-and-how-it-will-affect-the-aftermarket-spare-parts-industry/ diamondautospareparts.com - EV Aftermarket Size & Growth Forecast (Market & CAGR)

– ForInsights Consultancy – Electric Vehicle Aftermarket Market 2025 Size, Emerging Trends

🔗 https://www.forinsightsconsultancy.com/reports/electric-vehicle-aftermarket-market forinsightsconsultancy.com

🧠 Additional Contextual Resources (Optional)

(Helpful if you want to add more depth or visual data in your blog)

- Future of EV Maintenance & Aftermarket Services

– PDMAutomotive – Impact of Electric Vehicles on the Automotive Aftermarket Industry

🔗 https://pdmautomotive.com/rise-of-electric-vehicles-will-alter-the-automotive-aftermarket-industry/ PDM Automotive - EV Aftermarket Global Forecast to 2030 (Alternate Report)

– Grand View Research – Electric Vehicle Aftermarket Industry

🔗 https://www.grandviewresearch.com/industry-analysis/electric-vehicle-aftermarket-industry-report Grand View Research - Automotive Aftermarket Industry Overview – Fortune Business Insights – Automotive Aftermarket Size & Growth Report 🔗 https://www.fortunebusinessinsights.com/automotive-after-market-102613 Fortune Business Insights