Estimated Reading Time: 26-30 minutes ( 5,304 words)

Introduction

For decades, personal finance followed a familiar, almost rigid script — save money in banks, avoid risk when you’re young, invest only after stability, buy a house by your 30s, and retire at 60. This approach worked reasonably well in a slower, more predictable economy. But for Gen Z, that rulebook feels outdated — and often unrealistic.

Born into a world of smartphones, UPI payments, fintech apps, and global economic shocks, Gen Z has grown up watching inflation rise, jobs evolve rapidly, and technology disrupt entire industries overnight. Unlike previous generations, they didn’t transition into digital finance — they were raised inside it. As a result, money for Gen Z isn’t something you manage once a month at a bank branch; it’s something you track, move, invest, and optimize in real time — right from a mobile screen.

From making instant UPI payments in India and using cashback-driven wallets, to investing through global apps, experimenting with micro-investments, and building side hustles alongside full-time careers, Gen Z is reshaping every stage of the money lifecycle. They value flexibility over rigidity, transparency over tradition, and financial independence over long-term promises that may no longer hold true.

This article breaks down exactly how Gen Z is rewriting the rules of personal finance — backed by real-world data, India and global case studies, expert insights, and practical examples. More importantly, it explains what these shifts mean for the future of money, and why businesses, banks, and individuals who fail to adapt risk being left behind.

Who Is Gen Z?

Gen Z includes individuals born between 1997 and 2012, making them the first true digital-native generation. Unlike Millennials, who witnessed the transition from offline to online, Gen Z grew up in a world where internet access, smartphones, social media, and digital payments were already the norm. This upbringing has fundamentally shaped how they think about money, work, and financial security.

📅 In 2025:

- Oldest Gen Z: ~28 years

→ Already working professionals, entrepreneurs, freelancers, and early investors - Youngest Gen Z: ~13 years

→ Just entering their financial learning phase through apps, games, and digital wallets

This wide age range means Gen Z influences both current financial markets and future consumer behavior simultaneously.

Who Is Gen Z?

Gen Z includes individuals born between 1997 and 2012, making them the first true digital-native generation. Unlike Millennials, who witnessed the transition from offline to online, Gen Z grew up in a world where internet access, smartphones, social media, and digital payments were already the norm. This upbringing has fundamentally shaped how they think about money, work, and financial security.

📅 In 2025:

- Oldest Gen Z: ~28 years

→ Already working professionals, entrepreneurs, freelancers, and early investors - Youngest Gen Z: ~13 years

→ Just entering their financial learning phase through apps, games, and digital wallets

This wide age range means Gen Z influences both current financial markets and future consumer behavior simultaneously.

🌍 Population Snapshot

- Global Gen Z population: ~2.6 billion

→ Nearly one-third of the world’s population, making Gen Z the most influential demographic for future economic growth. - 🇮🇳 India Gen Z population: 375+ million (largest in the world)

→ India alone contributes a massive share of Gen Z consumers, workers, creators, and investors.

India’s Gen Z is uniquely positioned because it sits at the intersection of:

- Rapid smartphone adoption

- World-leading digital payment systems (UPI)

- Expanding fintech and startup ecosystems

- A young workforce entering capital markets earlier than ever

📌 Why This Matters:

India’s Gen Z will shape consumer spending patterns, fintech innovation, digital banking adoption, and capital markets for the next 30 years. Their preferences will determine:

- How banks design products

- How fintech apps monetize users

- How investment platforms simplify wealth creation

- How brands communicate trust and value

In short, understanding Gen Z isn’t optional anymore — it’s essential for anyone operating in personal finance, fintech, investing, or digital commerce.

Core Financial Traits of Gen Z

Gen Z’s financial behavior is shaped by technology, economic uncertainty, and access to information at an unprecedented scale. Unlike earlier generations that relied on banks, advisors, or employers for financial guidance, Gen Z prefers self-directed, tech-enabled, and on-demand money management. These core traits define how they earn, save, invest, and spend.

💡 Key Characteristics

📱 Mobile-first money management

For Gen Z, a smartphone is the primary financial hub. Budgeting, payments, investing, tracking expenses, and even borrowing happen through apps — often across multiple platforms. In India, UPI has made instant money transfers a daily habit, while globally, digital wallets and neobanks dominate usage. Physical bank visits are rare and often seen as inefficient.

🌀 Preference for flexibility over stability

Gen Z prioritizes financial flexibility — variable income, multiple revenue streams, and short-term commitments — over traditional long-term stability. Fixed deposits, lifelong jobs, or single-income dependence feel risky in a fast-changing economy. Instead, Gen Z values the ability to adapt, pivot, and access money when needed.

📉 High awareness of inflation & financial risk

Having grown up during global recessions, the COVID-19 pandemic, layoffs, and rising inflation, Gen Z is highly conscious of how quickly money can lose value. This awareness drives early investing, emergency fund creation, and interest in assets that can outpace inflation, such as equities, ETFs, and digital assets.

🎓 Learning finance via YouTube, Instagram & apps

Traditional financial education systems often lag behind real-world needs. Gen Z fills this gap by learning from:

- YouTube explainers

- Instagram reels & finance creators

- Podcasts and newsletters

- In-app learning on fintech platforms

This bite-sized, visual, and relatable content style resonates far more than textbooks or bank brochures.

🏦 Skeptical of traditional banks

Gen Z does not automatically trust legacy institutions. Long queues, hidden charges, rigid rules, and slow processes have pushed them toward fintech apps that offer:

- Zero-balance accounts

- Transparent pricing

- Instant onboarding

- Personalized insights

Trust is earned through experience, not brand legacy.

🧠 Expert Insight (McKinsey):

“Gen Z expects finance to be instant, transparent, and personalized — anything slower loses trust.”

This expectation is reshaping how banks, fintech companies, and investment platforms design products — from real-time notifications and AI-driven recommendations to simplified interfaces and gamified learning.

📌 Why This Matters:

These core traits explain why Gen Z adopts new financial tools faster than any generation before. Brands and platforms that fail to meet these expectations risk losing relevance in the next decade.

Digital Payments & Fintech: The Foundation

For Gen Z, digital payments and fintech tools are not optional add-ons — they are the foundation of everyday financial life. This generation expects money to move as fast as messages, and platforms that fail to deliver speed, transparency, and convenience quickly lose relevance.

🌐 Global Trends

- 90%+ of Gen Z globally uses digital banking apps or mobile wallets for daily transactions, bill payments, and peer-to-peer transfers. Cash usage among Gen Z continues to decline, especially in urban and semi-urban regions.

- Traditional bank branch visits are dropping sharply among under-30 users, as Gen Z prefers instant in-app services over paperwork, queues, and limited banking hours. Neobanks, digital-only accounts, and app-based customer support are replacing in-person interactions.

- Gen Z favors fintech platforms that offer:

- Real-time transaction alerts

- Spending insights and analytics

- Cashback and rewards

- Seamless integration with investments, credit, and savings

- Real-time transaction alerts

Globally, this has led to the rise of neobanks, super-apps, and wallet-based ecosystems designed specifically for younger users.

🇮🇳 India’s UPI Revolution

India stands out as a global benchmark for digital payments, and Gen Z is at the heart of this transformation.

- UPI processes over 10 billion transactions every month, making it the largest real-time payment system in the world. For Gen Z, UPI is the default way to pay — from street vendors and metro tickets to online shopping and subscriptions.

- Gen Z accounts for a major share of daily UPI usage across leading platforms:

- Google Pay — popular for simplicity and rewards

- PhonePe — widely accepted across merchants

- Paytm — integrated with shopping, bills, and travel

- Super.money — fast-growing among young users with cashback-led engagement

- Google Pay — popular for simplicity and rewards

UPI’s zero-cost, instant settlement model perfectly aligns with Gen Z’s expectation of fast, frictionless, and transparent transactions.

📊 Quick Fact Box

- 🇮🇳 India contributes over 40% of global real-time digital payment transactions, making it the world leader in instant payments.

- 📱 UPI usage among the 18–25 age group exceeds 85%, with many users making multiple transactions per day.

- 🚀 Gen Z is also driving innovation in:

- Voice-based payments

- Auto-pay subscriptions

- In-app micro-investments linked to wallets

- Voice-based payments

📌 Why This Matters:

Digital payments are Gen Z’s gateway into broader financial ecosystems. Once users trust a payment app, they are far more likely to adopt:

- Investments

- Credit products

- Insurance

- Budgeting tools

This is why fintech companies aggressively compete for Gen Z users early — payment habits often determine long-term financial relationships.

Saving vs Spending: The Truth About Gen Z

One of the most common misconceptions about Gen Z is that they are impulsive spenders driven by social media trends and instant gratification. While Gen Z does spend differently, the idea that they are financially careless is largely a myth.

❌ Myth: Gen Z spends recklessly

Social media often highlights viral shopping hauls, travel reels, and lifestyle upgrades, creating the perception that Gen Z prioritizes spending over saving.

✅ Reality: Gen Z saves intentionally

In reality, Gen Z approaches saving with clear goals, structure, and purpose. Instead of saving “just in case,” they save for something specific — financial security, freedom, or experiences that matter to them.

🌐 What Global Surveys Reveal

- ~58% of Gen Z actively saves money every month, a higher share than many older generations at the same life stage.

- A significant portion saves 20–30% of their income, especially those with fewer fixed responsibilities or multiple income streams.

- Many Gen Z users automate savings through:

- Round-up features

- Auto-debits

- Goal-based saving pots inside fintech apps

- Round-up features

This automation helps remove emotion from saving decisions and builds consistency.

🇮🇳 India-Specific Insight

In India, Gen Z faces unique financial pressures:

- Rising urban rents

- Increasing education and skill-upgrade costs

- Lifestyle inflation driven by social media

- Early career salary constraints

These factors often reduce the absolute amount Gen Z can save — but not the intent.

Despite these challenges, Indian Gen Z actively sets up:

- 🛡 Emergency funds to handle job loss, medical costs, or unexpected expenses

- 🎯 Goal-based savings for gadgets, higher education, certifications, or business ideas

- ✈️ Travel & experience budgets, reflecting a strong preference for meaningful experiences over long-term material accumulation

Rather than locking money away in low-yield accounts, Gen Z often uses liquid funds, recurring deposits, or short-term instruments that balance access with returns.

📌 Why This Matters:

Gen Z isn’t abandoning savings — they are redefining what saving means. The shift is from hoarding money to strategically allocating money based on life goals, flexibility, and inflation awareness.

Investing Early: A Major Rule Breaker

One of the biggest ways Gen Z is rewriting personal finance rules is how early they begin investing. Unlike previous generations who waited for job stability, home ownership, or higher salaries, Gen Z treats investing as a starting point — not a milestone.

🔄 What’s New?

- Previous generations invested in their 30s, often after marriage or long-term job security. Investing was viewed as complex, risky, and something to be done “later.”

- Gen Z starts investing in their early 20s — and in many cases, even in their teenage years.

Exposure to stock market apps, simplified onboarding, and bite-sized financial content has removed the intimidation factor.

For Gen Z, investing isn’t just about wealth creation — it’s about:

- Beating inflation early

- Learning by doing

- Building financial confidence

- Creating long-term optionality

📱 Why Early Investing Feels Natural to Gen Z

- Low entry barriers: Investments can start with as little as ₹100–₹500 in India

- App-based platforms: One-click onboarding, real-time tracking, and visual dashboards

- Social learning: Friends, creators, and online communities normalize investing conversations

- Market transparency: Access to data, charts, and performance history builds trust

This environment makes investing feel accessible, interactive, and part of daily financial life.

📊 Popular Investment Choices Among Gen Z

| Asset | Gen Z Interest |

| Stocks & ETFs | High |

| Mutual Funds (SIP) | Very High (India) |

| Crypto & Digital Assets | Medium–High |

| Gold (Digital) | Growing |

| Fixed Deposits | Low |

🇮🇳 India-Specific Investing Trends

- SIPs are the gateway investment for Indian Gen Z, offering discipline, low risk, and flexibility

- Stock investing through platforms like Zerodha, Groww, and Upstox is popular due to:

- Zero or low brokerage

- Educational content within apps

- Simple KYC and onboarding

- Zero or low brokerage

- Digital gold and sovereign gold bonds appeal as inflation hedges without physical storage issues

- Fixed Deposits are seen as:

- Safe but low-return

- Useful only for emergency or short-term needs

- Safe but low-return

⚠️ Risk Awareness: Not Blind Optimism

While Gen Z is willing to take risks, they are not entirely reckless:

- Many start with small amounts

- Portfolio diversification is encouraged through content creators

- There’s growing awareness of volatility, especially in crypto and high-growth stocks

However, overexposure to trending assets remains a challenge — making financial education crucial.

📌 Why This Matters:

By investing early, Gen Z benefits from time, compounding, and learning cycles — advantages that can outweigh higher income later in life. This shift is already expanding capital markets and redefining how investment products are designed.

Credit, BNPL & Debt: A New Approach

Gen Z’s relationship with credit and debt is fundamentally different from previous generations. Having grown up during periods of economic uncertainty, layoffs, and rising living costs, this generation approaches borrowing with caution, control, and clarity rather than blind dependence.

🔍 How Gen Z Approaches Credit

Unlike Millennials and Gen X, Gen Z:

- Avoids heavy, long-term credit card debt, viewing high interest rates and revolving balances as financial traps rather than convenience tools.

- Is less attracted to traditional credit cards unless they offer clear benefits such as cashback, travel rewards, or fee-free usage.

- Prioritizes understanding total repayment cost before borrowing — not just monthly affordability.

Credit, for Gen Z, is a utility, not a lifestyle enabler.

🛍 BNPL (Buy Now, Pay Later): Convenience Over Commitment

Gen Z has widely adopted BNPL services, especially for:

- Online shopping

- Gadgets and electronics

- Fashion and lifestyle purchases

- Travel bookings

BNPL appeals because it offers:

- Short-term, interest-free installments

- Minimal paperwork

- Clear payment schedules

- Easy in-app tracking

This aligns with Gen Z’s preference for predictable, bite-sized financial commitments.

💳 What Gen Z Prefers Instead

Rather than open-ended debt, Gen Z prefers:

- 📆 Short-term EMIs with defined end dates

- 🔍 Transparent repayment structures showing:

- Total payable amount

- Due dates

- Late payment penalties (if any)

- Total payable amount

- 📲 App-based reminders and alerts that prevent missed payments

Debt is treated as a temporary bridge, not a long-term crutch.

⚠️ Warning Box: The BNPL Reality Check

While BNPL feels safer than credit cards, misuse carries real consequences:

- Missed or delayed payments can negatively impact credit scores

- Multiple BNPL plans across apps can lead to repayment overload

- Young users may underestimate cumulative obligations

This is becoming a growing concern among Gen Z, especially for first-time borrowers without strong credit histories.

📌 Smart Rule for Gen Z:

If you can’t repay it comfortably within 1–3 months, reconsider using BNPL.

📌 Why This Matters:

Gen Z’s cautious, transparent approach to credit is pushing lenders and fintech platforms to redesign products — with clearer pricing, shorter tenures, and stronger in-app education. Over time, this could lead to a healthier credit culture compared to previous generations.

Side Hustles & Multiple Income Streams

For Gen Z, relying on a single paycheck feels risky in a fast-changing economy. Rising living costs, job uncertainty, and easy access to digital platforms have pushed this generation to diversify income early. Side hustles are no longer “extra money” — they are a core financial strategy.

🔥 Popular Side Hustles Among Gen Z

🎨 Freelancing (design, writing, coding)

Gen Z leverages digital skills to earn independently through global platforms. Freelancing offers:

- Flexible work hours

- Global clients

- Skill-based income growth

- Low startup costs

This makes it ideal for students and early professionals.

🎥 Content creation (YouTube, Instagram, short videos)

Social media is both a learning tool and an income engine. Many Gen Z creators monetize through:

- Ad revenue

- Brand collaborations

- Affiliate links

- Digital products

Even micro-creators with niche audiences generate consistent income.

🔗 Affiliate marketing

Gen Z favors affiliate models because:

- No inventory or logistics

- Performance-based earnings

- Scales well with content creation

Finance, tech, travel, and e-commerce affiliates are especially popular.

📈 Stock trading & reselling

Some Gen Z users actively trade stocks, flip products online, or resell limited-edition items. While risky, it appeals due to:

- Quick feedback loops

- Learning through real money

- Market exposure at low capital levels

🎓 Online tutoring & skill coaching

Teaching languages, coding, test prep, or niche skills through platforms or private channels is growing rapidly — especially in India, where education demand is strong.

📊 Stat Insight

- Over 50% of Gen Z globally reports having or planning a side income, signaling a shift away from single-income dependency.

- In India, gig economy platforms see the highest participation from Gen Z, driven by:

- Smartphone penetration

- English proficiency

- Skill-based opportunities

- Flexible schedules

- Smartphone penetration

Many Gen Z users start side hustles before their first full-time job, giving them a financial cushion and confidence early in life.

📌 Why This Matters:

Multiple income streams provide Gen Z with:

- Faster savings growth

- Better risk management

- Greater career flexibility

- Early exposure to entrepreneurship

This trend is reshaping how employers view loyalty, how platforms design creator tools, and how financial planning evolves for younger generations.

India vs Global: Gen Z Finance Comparison

While Gen Z worldwide shares common traits — digital-first behavior, early investing, and preference for flexibility — regional ecosystems strongly influence how these habits play out. India’s financial infrastructure, regulation, and fintech innovation have created a distinct Gen Z money culture compared to Western markets.

🔍 Side-by-Side Comparison: How Gen Z Manages Money

| Area | India | Global (US, Europe, etc.) |

| Payments | UPI dominant — instant, free, and widely accepted from street vendors to e-commerce | Cards & digital wallets — debit/credit cards, Apple Pay, Google Wallet |

| Investing | SIP & direct stocks — low-ticket SIPs and app-based stock investing are common entry points | ETFs & robo-advisors — automated portfolios and index investing dominate |

| Credit | BNPL & short-term EMIs — preferred for predictable repayment and low perceived risk | Credit cards — widely used for rewards, credit building, and daily spending |

| Learning | Social media-led learning — YouTube, Instagram, Telegram communities, finance creators | Apps + schools — structured courses, robo-advisor education, and school programs |

🇮🇳 Why India Looks Different

India’s Gen Z financial behavior is shaped by:

- UPI’s zero-cost, real-time payment model, reducing dependence on cards

- Low minimum investment thresholds, making markets accessible early

- Cultural caution toward long-term debt, especially unsecured credit

- Limited formal financial education, pushing learners toward creator-led platforms

As a result, Indian Gen Z tends to be:

- More savings-conscious

- More cautious with credit

- More experimental with fintech apps

🌐 Global Context

In contrast, Gen Z in developed markets benefits from:

- Long-established credit systems

- Early exposure to credit cards and credit scores

- Institutional financial education

- Automated investing tools like robo-advisors

This leads to higher comfort with leverage but also higher debt exposure.

📌 Why This Matters:

Understanding these differences is crucial for:

- Fintech product design

- Financial education strategies

- Investment platform localization

- Content creators targeting India vs global audiences

There is no single “Gen Z finance model” — success lies in adapting to regional behaviors while serving global expectations.

Challenges Gen Z Faces

Despite being more financially aware and tech-savvy than any generation before, Gen Z operates in a far more complex and volatile economic environment. Their biggest challenges don’t come from a lack of intent — they come from structural, technological, and behavioral pressures.

📉 Rising inflation

Gen Z enters adulthood at a time when inflation directly impacts everyday life — from rent and groceries to subscriptions and travel. Money saved in low-interest accounts loses value quickly, forcing Gen Z to take investment risks earlier than they might be comfortable with.

💼 Job instability

Automation, AI, layoffs, contract work, and rapid industry shifts have made long-term job security uncertain. Many Gen Z workers experience:

- Shorter job tenures

- Contract or gig-based roles

- Delayed career stability

This uncertainty makes long-term financial planning harder and increases stress around emergency savings.

📚 Low financial literacy depth

While Gen Z has high financial awareness, deep understanding is often uneven. Many know what to invest in but lack clarity on:

- Risk management

- Tax planning

- Credit scores

- Long-term portfolio allocation

This gap increases dependence on social media advice, which can sometimes be misleading.

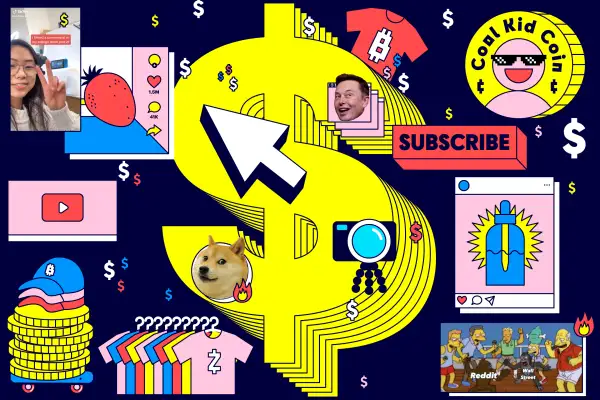

📊 Overexposure to risky trends

Constant exposure to trending stocks, crypto hype, and “quick money” stories creates pressure to chase returns. Without proper diversification or patience, some Gen Z investors face:

- Volatility shocks

- Loss aversion

- Burnout from frequent trading

📱 Lifestyle inflation via social media

Social platforms amplify comparison culture — luxury travel, gadgets, and experiences appear normal and frequent. This often leads to:

- Spending beyond means

- Delayed savings goals

- Emotional financial decisions

📌 Why This Matters:

These challenges highlight why education, discipline, and long-term thinking are critical for Gen Z’s financial success. Tools alone aren’t enough — sustainable money habits matter more than trends.

10-Year Outlook (2025–2035)

The next decade will be transformative for personal finance — and Gen Z will be at the center of this shift. As this generation moves from early careers into peak earning years, their digital-first expectations will reshape how money is managed, invested, and taught worldwide.

🚀 What’s Coming:

🤖 AI-powered personal finance advisors

AI-driven tools will replace one-size-fits-all advice with hyper-personalized financial guidance. Gen Z will rely on AI to:

- Track spending patterns in real time

- Suggest savings and investment adjustments

- Automate portfolio rebalancing

- Provide tax and credit insights

In India, AI-powered advisory tools will bridge the gap left by limited access to human financial advisors.

💸 Micro-investments as the default

Investing small amounts frequently will become standard. Micro-investments — starting as low as ₹100 — will:

- Normalize investing from teenage years

- Reduce fear of market entry

- Encourage long-term compounding

SIPs, fractional shares, and round-up investments will dominate Gen Z portfolios globally.

🎥 Creator-led financial education

Traditional financial education will give way to creator-driven learning ecosystems. Trusted finance creators will:

- Simplify complex topics

- Build communities around money habits

- Influence platform adoption and product trust

In India, vernacular finance content will expand financial inclusion at scale.

🏦 Fintech replacing traditional banking (for daily use)

While traditional banks won’t disappear, fintech apps will become the primary interface for daily financial activities:

- Payments

- Budgeting

- Investing

- Credit management

Banks will increasingly operate in the background as infrastructure providers, while fintech brands own the user relationship.

💰 Gen Z becoming the largest wealth-holding generation

As Gen Z benefits from:

- Early investing

- Digital entrepreneurship

- Global income opportunities

- Intergenerational wealth transfer

They are projected to become the largest wealth-holding generation by the mid-2030s. Those who build strong financial habits early will see exponential benefits from time and compounding.

📌 Why This Matters:

The 2025–2035 decade will define Gen Z’s financial legacy. Platforms, educators, and investors who understand these shifts today will be best positioned to grow alongside this generation tomorrow.

FAQs Section

1️⃣ Why is Gen Z better at money management than older generations?

Gen Z benefits from early exposure, better tools, and real-time learning. Unlike previous generations that relied on bank advisors, paper statements, or employer-led guidance, Gen Z manages money actively through apps that show spending patterns, net worth, and investment performance instantly.

They also grew up watching:

- The 2008 global financial crisis

- COVID-19 job losses

- Rising inflation and housing costs

These experiences created a generation that is risk-aware but proactive. Instead of avoiding money conversations, Gen Z discusses finances openly on social platforms, learns from mistakes quickly, and adapts faster.

👉 Key advantage: Early habits + tech + constant feedback loops.

2️⃣ Does Gen Z invest more than Millennials?

In absolute terms, Millennials still invest larger amounts. However, Gen Z invests earlier and more frequently.

Key differences:

- Millennials often waited for salary growth or stability

- Gen Z starts with small amounts (₹500 SIPs, fractional shares)

- Investing is treated as learning, not perfection

This means Gen Z benefits more from:

- Compounding

- Long-term market cycles

- Behavioral discipline

Even modest monthly investments started at 21–22 can outperform larger investments started at 30+.

3️⃣ What finance apps does Gen Z use in India — and why?

Gen Z chooses apps based on speed, simplicity, transparency, and rewards, not brand legacy.

Most-used categories:

- Payments: Google Pay, PhonePe (UPI dominance)

- All-in-one: Paytm (payments + commerce)

- Investing: Groww, Zerodha (clean UI + education)

- Credit tracking & rewards: Cred

These apps succeed because they:

- Require minimal paperwork

- Offer instant onboarding

- Provide visual dashboards

- Integrate learning into usage

👉 Apps that teach while users transact win Gen Z loyalty.

4️⃣ Is BNPL (Buy Now, Pay Later) actually safe for Gen Z?

BNPL is structurally safer than credit cards, but behaviorally risky if misused.

Why Gen Z likes BNPL:

- Short tenure (1–3 months)

- Often interest-free

- Transparent payment schedules

Where problems arise:

- Multiple BNPL plans across apps

- Forgetting due dates

- Treating BNPL as “free money”

Missed payments can:

- Reduce credit scores

- Limit future loan access

- Increase long-term borrowing costs

👉 Rule of thumb: If you wouldn’t buy it in cash next month, don’t BNPL it.

5️⃣ Does Gen Z trust traditional banks at all?

Gen Z doesn’t hate banks — they simply don’t tolerate friction.

Banks lose trust when they:

- Have hidden charges

- Require branch visits

- Offer slow customer support

Fintech wins because it offers:

- Real-time notifications

- Transparent pricing

- In-app customer service

- Personalization

Banks that modernize digitally (UPI, apps, instant KYC) still retain Gen Z users — but the relationship is no longer exclusive.

6️⃣ Are Gen Z savings actually increasing, or is that a myth?

Saving intent is high. Actual savings are constrained.

Gen Z wants to save, but faces:

- High urban rents

- Education & upskilling costs

- Lifestyle inflation

As a result:

- Emergency funds are prioritized

- Long-term locked savings are avoided

- Liquid, flexible savings tools are preferred

Automation (round-ups, auto-debits) helps Gen Z save consistently even with limited income.

7️⃣ What types of financial assets does Gen Z usually avoid?

Gen Z tends to avoid assets that feel:

- Illiquid

- Opaque

- Low growth

- Long-term restrictive

Commonly avoided:

- Long-term high-interest debt

- Traditional low-interest savings accounts

- Complex insurance or investment products

Preferred assets are simple, transparent, and app-friendly.

8️⃣ Is financial literacy among Gen Z truly improving?

Yes — awareness is high, depth is uneven.

Gen Z understands:

- Investing basics

- Inflation

- Digital payments

But often lacks clarity on:

- Taxes

- Insurance planning

- Credit score mechanics

- Risk-adjusted returns

This creates a strong opportunity for:

- Educational platforms

- Creator-led courses

- Blogs, tools, and calculators

👉 Financial education will be one of the biggest Gen Z-focused growth sectors.

9️⃣ Will Gen Z really become the wealthiest generation by 2035?

Projections suggest yes — but unevenly.

Drivers:

- Early investing

- Digital entrepreneurship

- Global income access

- Intergenerational wealth transfer

However, wealth will concentrate among those who:

- Control lifestyle inflation

- Stay invested long-term

- Avoid excessive debt

Gen Z’s financial future will depend more on behavior than opportunity.

🔟 What can Gen Z do right now to improve personal finances?

Immediate actions with long-term impact:

- Track expenses for 90 days

- Start SIPs, even at ₹500

- Build a 3–6 month emergency fund

- Add one side income stream

- Avoid debt for lifestyle spending

Consistency matters more than income level.

1️⃣1️⃣ Is Gen Z too influenced by social media for financial decisions?

Social media is Gen Z’s primary financial classroom — both good and bad.

Pros:

- Easy access to information

- Financial topics feel less intimidating

- Community learning

Cons:

- Hype-driven investing

- Unrealistic expectations

- Misinformation

The smartest Gen Z users:

- Cross-check advice

- Follow credible educators

- Avoid “get rich quick” content

1️⃣2️⃣ How is Gen Z changing the future of banking and investing?

Gen Z is forcing the industry to become:

- Digital-first

- Low-cost

- Transparent

- Education-driven

Products are shifting from:

❌ Complex & long-term

➡️ Simple, flexible & modular

This will redefine banking, fintech, and investing globally over the next decade.

1️⃣3️⃣ Why is Gen Z obsessed with financial independence?

Gen Z equates money with freedom, not status.

Financial independence means:

- Ability to leave bad jobs

- Freedom to travel

- Control over time

This mindset fuels:

- Early investing

- Side hustles

- Skill monetization

1️⃣4️⃣ Is Gen Z anti-home ownership?

Not anti — just realistic.

Gen Z delays buying homes due to:

- High prices

- Career mobility

- Preference for flexibility

Many prioritize:

- Renting + investing

- Experiences over assets

- Location independence

Home ownership may happen later, not earlier.

1️⃣5️⃣ What’s the biggest financial risk for Gen Z?

The biggest risk is behavioral, not economic:

- Lifestyle inflation

- Overtrading

- Chasing trends

- Ignoring fundamentals

Those who manage behavior will outperform peers regardless of income.

Summary

- Gen Z is truly digital-first with money

From UPI payments to investing apps, Gen Z manages nearly every financial activity on smartphones. Speed, transparency, and seamless user experience matter more than traditional banking relationships. - Early investing has become the new normal

Unlike earlier generations, Gen Z begins investing in their early 20s—or even as teenagers—using SIPs, stocks, ETFs, and micro-investments to harness long-term compounding. - Fintech platforms dominate financial decisions

Gen Z prefers fintech apps over traditional banks for payments, savings, investing, and credit, pushing financial institutions to become more digital, transparent, and user-centric. - Side hustles are no longer optional—they’re essential

With income uncertainty and rising costs, Gen Z actively builds multiple income streams through freelancing, content creation, gig work, and online businesses to achieve financial security. - Financial independence matters more than status

For Gen Z, money represents freedom and flexibility—not just wealth. This mindset drives smarter spending, goal-based saving, and a strong focus on long-term financial control. - India is leading the global digital finance shift India’s UPI ecosystem, fintech adoption, and mobile-first population have made Indian Gen Z a global benchmark for how digital finance can scale rapidly and inclusively.

Conclusion

Gen Z isn’t merely adapting to the existing financial system — they are rebuilding it from the ground up. Armed with smartphones, fintech apps, and instant access to information, this generation approaches money with speed, transparency, and personalization that older generations could only dream of. From UPI-led digital payments in India to global investing platforms, Gen Z is creating financial habits that prioritize flexibility, informed risk-taking, and early wealth building.

This generation’s approach to saving, investing, credit, and income diversification is fundamentally different. Early investing, multiple income streams, and reliance on digital-first tools are creating a financial ecosystem where technology, education, and user experience define trust and adoption. Social media, creator-led learning, and micro-investments are not just trends—they are the building blocks of how Gen Z thinks about money, goals, and long-term security.

For India and the world, the ripple effects are immense. Gen Z’s money habits will reshape banking, fintech, investing, and wealth management over the next decade, driving innovation and inclusivity. Financial institutions, educators, and policymakers must recognize that this generation isn’t just participating in the economy — they are defining the rules, setting new benchmarks, and shaping the future of finance itself.

References & Sources

- Reserve Bank of India (RBI) – Payments System Data & Digital Trends

The RBI’s official reports track the explosive growth of digital payments in India, including UPI’s share of total transactions and infrastructure developments.

🔗 RBI Payments & Digital Trends — https://www.rbi.org.in Reserve Bank of India - National Payments Corporation of India (NPCI) – UPI Product Statistics

NPCI publishes up‑to‑date transaction volumes, value, and user data for UPI, the real‑time payment system driving India’s digital finance revolution.

🔗 NPCI UPI Product Statistics — https://www.npci.org.in/product/upi/product-statistics NPCI - McKinsey – Gen Z Financial Attitudes & Behavior

McKinsey’s insights help explain how Gen Z thinks about money, spending, digital adoption, and financial services — valuable for understanding larger trends.

🔗 McKinsey on Gen Z & Finance — https://www.mckinsey.com/featured-insights/generation-z McKinsey & Company - McKinsey – What Is Gen Z? (Definition & Demographic Context)

A foundational explanation of Gen Z, their formative experiences, and how they differ from other generations — useful for framing financial behavior.

🔗 McKinsey: What Is Gen Z? — https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-gen-z McKinsey & Company - Investopedia – Gen Z Money Habits & Savings Behavior

A 2025 study showing that Gen Z and Millennials are increasing savings and prioritizing financial security more than older generations.

🔗 Gen Z & Millennials Lead Savings Goals — https://www.investopedia.com/gen-z-and-millennials-lead-savings-goals-11865817 Investopedia - Economic Times – Youth Finance Trends in India

Articles highlighting real Indian user behavior around digital finance tools, UPI adoption, and the financial balancing act faced by young consumers.

🔗 How India’s Young Are Rewriting the Money Script — https://economictimes.indiatimes.com/opinion/et-commentary/millennial-financing-meets-gen-z-ways-how-indias-young-are-rewriting-the-money-script/articleshow/122032525.cms Economic Times - FinTech Weekly – Gen Z Fintech & BNPL Trends (Global + India)

Industry analysis of Gen Z’s rapid adoption of digital wallets, Buy Now Pay Later services, and fintech preferences.

🔗 How Gen Z Is Changing Personal Finance Habits — https://www.fintechweekly.com/magazine/articles/how-gen-z-is-changing-personal-finance-habits-in-2025 FinTech Weekly – Home Page - LiveMint – Gen Z & Fintech Usage in India

Reports on how fintech products are being tailored to young users in India, including innovative reward systems and payment behaviors.

🔗 Gen Z Keeps Fintechs on Their Toes — https://www.livemint.com/companies/start-ups/gen-z-financial-services-products-fintechs-banking-investments/amp-11755060171245.html mint - Statista (General Gen Z Consumer Behavior)

Statista offers validated data on Gen Z’s digital adoption, payment preferences, and financial attitudes. (Direct link requires subscription; search for “Gen Z financial behavior Statista”)

🔗 https://www.statista.com/ Search: “Gen Z finance behavior” — Data source hint only - World Economic Forum / Global Research on Gen Z Finance

Broader global insights into Gen Z’s financial priorities, digital habits, and how they differ from previous generations.

🔗 World Economic Forum: Gen Z Banking & Finance Trends — https://www.weforum.org/stories/2023/11/gen-z-banking-finance-money-trends/ World Economic Forum