Estimated Reading Time:12 – 16 minutes (2,554 words)

Introduction

Every festive season in India brings not just lights, sweets, and family gatherings, but also a digital shopping frenzy that has become as much a part of Diwali as firecrackers and rangoli. For over a decade now, Amazon’s Great Indian Festival and Flipkart’s Big Billion Days have gone head-to-head during this period, offering blockbuster discounts, cashback offers, and irresistible flash sales. What started as an experiment in online retail has today become India’s biggest e-commerce battleground, influencing shopping behavior across millions of households.

In 2025, the stakes are higher than ever before. India’s e-commerce market, which was valued at $14 billion during the 2024 festive season, is projected to surge past $18 billion in Gross Merchandise Value (GMV) this year. The growth is not just coming from metro cities like Bengaluru, Delhi, or Mumbai—it is increasingly driven by Tier-2 and Tier-3 shoppers, who now account for the majority of new online customers. Affordable smartphones, cheaper internet, and a surge in digital payments have made festive online shopping a national event cutting across income groups and geographies.

Key growth drivers are shaping this year’s battlefield:

- UPI adoption has exploded, with October 2024 alone recording 16.58 billion transactions (+45% YoY), making it the most preferred checkout option.

- Buy Now, Pay Later (BNPL) schemes and easy EMIs have made even premium gadgets and appliances accessible to middle-class shoppers.

- Same-day and next-day delivery innovations by Amazon and Flipkart, backed by kirana partnerships and stronger warehousing, are redefining customer expectations in both metros and smaller towns.

- Quick commerce platforms like Blinkit and Zepto are nibbling at last-minute festive gifting, creating new competitive pressure.

Globally, India’s festive sale season is now being closely watched as a case study of high-volume digital retail adoption. While US and European holiday sales are expected to grow at a modest 3–4% in 2025, India’s e-commerce sector is growing at double-digit rates, making it the fastest-expanding market worldwide. This contrast highlights how festivals like Diwali, Dussehra, and Navratri are no longer just cultural events but also powerful economic engines driving consumption.

So, the big question arises: Who wins the festive sale 2025—Amazon or Flipkart? Is it Flipkart with its aggressive bank tie-ups and budget-friendly deals? Or Amazon with its extended sale duration, vast seller network, and premium product dominance?This article dives deep into real data, market trends, category-wise analysis, and future projections. Whether you’re a buyer hunting for the best festive deals, a seller looking to maximize sales during the peak season, or an affiliate marketer aiming to monetize festive traffic, this guide will help you make the smartest, most profitable decisions in 2025.

India’s Festive E-Commerce Landscape in 2025

India’s festive shopping season has evolved into a mega digital retail event, growing larger year after year. In 2024, the festive e-commerce Gross Merchandise Value (GMV) reached around $14 billion, a 12% year-on-year increase, setting a new benchmark for the industry. Building on this momentum, 2025 is projected to hit $18–20 billion in GMV, reflecting a remarkable 25% YoY growth, one of the fastest rates globally for seasonal online retail.

Much of this growth is being fueled by high-ticket categories. Smartphone upgrades, premium televisions, large appliances, and wearables continue to be the biggest revenue drivers, as consumers increasingly choose the festive season for big-ticket purchases, thanks to bank discounts, exchange offers, and Buy Now, Pay Later (BNPL) schemes.

Another major shift is the rise of quick commerce platforms like Blinkit, Zepto, and Instamart, which are no longer limited to grocery delivery. In 2025, they account for nearly 10% of festive retail spending, tapping into impulse gifting, last-minute purchases, and convenience-driven shopping. This trend highlights how Indian consumers are embracing speed and convenience as much as discounts and deals.

📊 Stat Box (Festive 2024 → 2025)

- UPI Transactions (Oct 2024): 16.58B (+45% YoY), showing UPI’s dominance as India’s most preferred payment mode.

- Average Order Value (AOV): ₹4,700 (+18% YoY), indicating consumers are spending more per transaction, especially on premium items.

Amazon vs Flipkart: Head-to-Head

The rivalry between Amazon and Flipkart has shaped India’s festive e-commerce landscape for over a decade, but 2025 is witnessing an even sharper contest. Both platforms are innovating aggressively to capture shoppers, sellers, and market share. Let’s break it down by key performance areas:

Customer Reach

In 2024, Amazon India reported 1.4 billion customer visits during its Great Indian Festival, supported by a 34-day extended sale cycle that stretched offers well beyond Diwali. This long-duration strategy allowed Amazon to capture buyers across multiple festive moments—Dussehra, Navratri, Diwali, and even pre-Christmas sales.

Flipkart, on the other hand, continues to dominate the opening rush. Its Big Billion Days 2024 attracted 33 crore visits on Day 1 and during Early Access alone, reflecting Flipkart’s strength in hype-building and drawing customers into its platform for time-sensitive deals. While Amazon sustains momentum across weeks, Flipkart wins in short bursts with massive day-one traffic spikes.

Seller Growth

For sellers, the picture is equally competitive. Amazon India saw a 70% increase in the number of sellers crossing the ₹1 crore sales milestone compared to 2023, proving its ability to empower small businesses and niche categories. Its FBA (Fulfilled by Amazon) logistics network and Prime loyalty base remain a big draw for long-tail sellers.

Flipkart, meanwhile, delivered double-digit growth in topline seller revenue in 2024, riding on aggressive promotions in high-volume categories like smartphones, electronics, and fashion. Flipkart’s strategy of bank tie-ups and heavy exchange offers has made it the go-to platform for sellers targeting the mass market.

Delivery Speed

Speed is a critical differentiator, and here Flipkart is slightly ahead. Its same-day deliveries grew 2.5× in 2024, especially in metros and large Tier-2 cities, where customers now expect appliances and electronics to be installed within 24 hours.

Amazon continues to expand its 1-day and 2-day Prime deliveries, ensuring reliability and customer satisfaction nationwide. However, when it comes to ultra-fast fulfillment in metros and suburban clusters, Flipkart currently holds the edge, thanks to its widespread use of kirana partners and last-mile innovations.

Category Winners

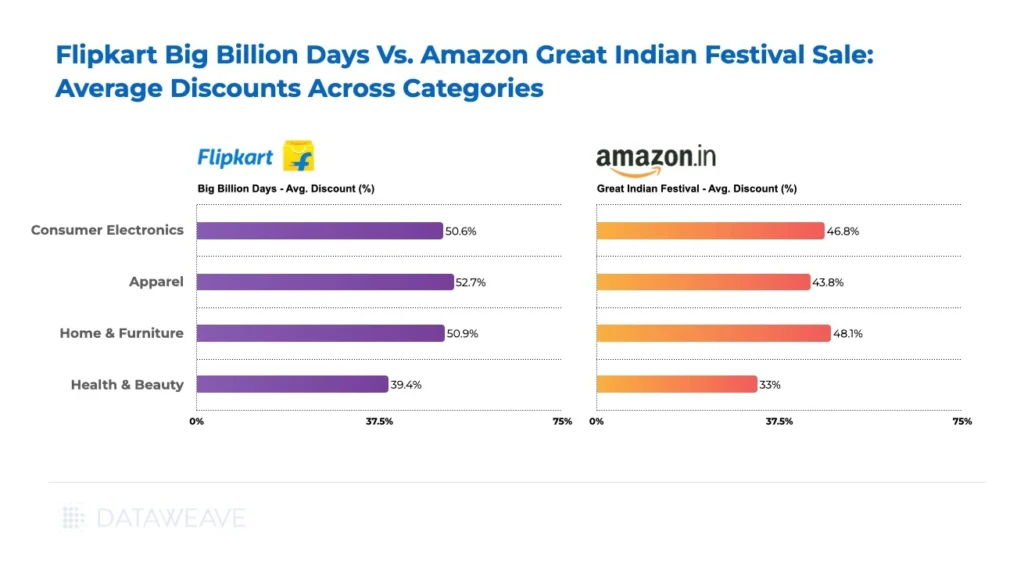

Different categories show clear winners when comparing Amazon and Flipkart in 2025.

- Smartphones: Flipkart continues to dominate the budget and mid-range smartphone market, thanks to aggressive exchange offers and bundled bank discounts. Amazon, however, leads in premium 5G flagships with stronger brand tie-ups and exclusive launches.

- Appliances: Flipkart has an edge in early-doorbuster deals on TVs, refrigerators, and washing machines, pulling price-sensitive shoppers in the first week of sales.

- Fashion & Lifestyle: Flipkart holds the lead with its value-focused collections and Myntra integration, making it the go-to platform for apparel and accessories.

- Electronics & Accessories: Amazon outshines with wider depth in laptops, tablets, and smart home devices, catering to tech-savvy urban buyers.

Payment Trends: UPI, BNPL & Bank Offers

Payment methods have become a decisive factor in festive sales, shaping both buyer behavior and platform strategy.

- UPI: Now the #1 checkout method, accounting for a majority of online transactions during sales. Its instant, zero-cost payments make it the preferred option across Tier-1 and Tier-2 shoppers.

- BNPL & EMI: Around 1 in 5 smartphone buyers uses BNPL or EMI schemes, showing how affordability solutions are driving upgrades to premium models and large appliances.

- Bank Tie-Ups: Flipkart leans on Axis and ICICI Bank for instant discounts, while Amazon partners strongly with SBI and HDFC, offering both cashback and EMI flexibility.

Together, these options not only fuel higher order values but also encourage repeat purchases throughout the festive cycle.

FAQs Section

1. Which sale is bigger—Amazon or Flipkart?

Both Amazon’s Great Indian Festival and Flipkart’s Big Billion Days are massive in scale, but they excel in different ways. Flipkart often dominates the opening days with blockbuster discounts on smartphones, TVs, and appliances, driving record-breaking early-day volumes. Amazon, meanwhile, runs a longer 30–34 day cycle, sustaining momentum across multiple festive events (Navratri, Dussehra, Diwali, and beyond). As a result, Flipkart frequently wins on volume in the first week, while Amazon edges ahead in long-tail GMV and overall customer reach.

2. Which platform has better smartphone deals?

If you’re shopping for budget or mid-range smartphones (₹10,000–₹30,000), Flipkart is usually the stronger choice. It aggressively pushes exchange offers, bank discounts, and flash sales that make popular models more affordable. Amazon, on the other hand, has an edge in premium 5G flagships (₹40,000+), thanks to exclusive brand tie-ups with Apple, Samsung, and OnePlus. Amazon also offers better EMI and BNPL financing options, making it easier for buyers to spread payments on premium devices.

3. Are bank offers safe to use?

Yes, bank offers on both platforms are completely safe. However, buyers must carefully read the terms and conditions. Some offers provide instant discounts at checkout, while others give cashback after 60–90 days, often as statement credits. Flipkart usually partners with Axis and ICICI, while Amazon works closely with SBI and HDFC. To maximize savings, savvy shoppers often stack UPI offers, card discounts, and platform coupons—but only if they’re clear about eligibility and timelines.

4. Which platform delivers faster in Tier-2 cities?

In Tier-2 and Tier-3 towns, Flipkart has a noticeable advantage due to its kirana delivery partnerships and localized last-mile logistics. This allows many orders, especially in categories like smartphones and appliances, to be fulfilled with same-day or next-day delivery. Amazon is highly reliable nationwide, but its Prime 1-day and 2-day shipping is stronger in metros than smaller towns. If you live outside the top 10 Indian cities, Flipkart often gets products to you faster.

5. Does Amazon have better return policies?

Yes, Amazon is generally more customer-friendly when it comes to returns and replacements. It typically offers 7–10 day return windows on most categories, with an easy pickup and refund process. Fashion and electronics buyers often rate Amazon higher for hassle-free replacements. Flipkart’s return policies vary more by seller, which sometimes causes confusion. To avoid issues on Flipkart, always shop from “Flipkart Assured” sellers with high ratings.

6. Which platform offers better EMI and BNPL options?

Both Amazon and Flipkart offer Buy Now, Pay Later (BNPL) and EMI schemes, but Amazon has the edge. It has wider integrations with banks, NBFCs, and fintech providers, offering no-cost EMI on a broader range of products. Flipkart’s BNPL is attractive for everyday purchases, but Amazon’s network is stronger for premium products like laptops, iPhones, and large appliances, making it easier to split payments across 6–12 months.

7. How do warranties differ between Amazon and Flipkart?

Both platforms honor manufacturer warranties, but Amazon tends to provide clearer warranty details on product pages. Many Amazon sellers include warranty registration instructions upfront. On Flipkart, warranty coverage can sometimes be buried in fine print. The safest approach: always check if the seller is brand-authorized or Flipkart Assured before buying. For high-value electronics and appliances, Amazon’s transparency often gives buyers more confidence.

8. Are delivery charges the same on both platforms?

Not exactly. Amazon Prime members enjoy free 1-day or 2-day delivery on most products, plus free standard shipping on others. Non-Prime buyers may pay a small fee on low-value orders. Flipkart offers free shipping on many festive deals, but in smaller towns or for lower-ticket items, it sometimes adds a nominal delivery charge (₹40–₹100). For frequent buyers, Amazon Prime provides better long-term value, while Flipkart wins with bundled free delivery during Big Billion Days.

9. Can I trust third-party sellers on both platforms?

Yes, but with caution. Both marketplaces have strict seller policies, yet Amazon’s A-to-Z Guarantee gives buyers a stronger sense of protection in case of fraud or product issues. Flipkart has Flipkart Assured, which screens sellers and ensures higher-quality service. As a rule of thumb:

- On Amazon → Look for “Fulfilled by Amazon” (FBA) for safe purchases.

On Flipkart → Choose Flipkart Assured sellers with high ratings.

10. Which platform is better for festive appliance purchases?

For large appliances (TVs, refrigerators, washing machines, ACs), Flipkart is often preferred during the first week of festive sales because of its early-doorbuster discounts and fast installation services. Many shoppers report getting appliances delivered and installed within 24–48 hours. Amazon is highly competitive in the premium appliance segment, often bundling extended warranties, brand installation, and no-cost EMIs. So if you’re buying budget-friendly appliances, Flipkart usually wins; for premium or brand-specific models, Amazon might be a better bet.

Summary & Key Takeaways

The 2025 festive season marks another record-breaking year for India’s e-commerce industry, expected to cross $18–20 billion in GMV, up 25% YoY — one of the fastest growth rates globally. The Amazon vs Flipkart rivalry remains central to this surge, shaping consumer habits, seller strategies, and digital marketing trends.

Key Highlights:

- Market Growth: Festive e-commerce is now a nationwide phenomenon, with Tier-2 and Tier-3 cities driving the bulk of new shoppers, aided by affordable smartphones, UPI payments, and BNPL financing options.

- UPI Dominance: With 16.58 billion UPI transactions in Oct 2024 (+45% YoY), instant digital payments have become the preferred checkout mode across India.

- Platform Strategies:

- Flipkart wins in volume and velocity — attracting record Day-1 traffic through massive bank tie-ups, deep discounts, and lightning-fast deliveries.

- Amazon leads in premium and long-tail sales, extending its 34-day Great Indian Festival across multiple festive phases and maintaining consistent growth through a vast seller network.

- Category Winners:

- Smartphones & Appliances: Flipkart dominates mid-range smartphones and budget appliances.

- Premium Electronics & Laptops: Amazon leads with exclusive brand tie-ups and superior EMI/BNPL options.

- Fashion & Lifestyle: Flipkart’s Myntra integration continues to be a strong advantage.

- Logistics & Delivery: Flipkart excels in same-day and next-day deliveries in Tier-2 markets via kirana partnerships; Amazon retains leadership in nationwide reliability through its Prime network.

- Consumer Advantage: Competitive pricing, cashback stacking, and flexible payment options have made festive e-commerce more inclusive and rewarding than ever.

Bottom Line:

- Flipkart dominates the mass-market, value-driven segment with aggressive pricing and regional reach.

- Amazon leads the premium and consistency-driven segment, leveraging long-term brand relationships and superior post-sale experience.

- Together, they’re transforming India’s festive economy into a global case study of digital retail at scale — where the real winners are consumers, MSME sellers, and digital affiliates who capitalize on this annual shopping boom.

Conclusion

The Amazon vs Flipkart festive battle of 2025 is less about declaring a single winner and more about recognizing that each platform dominates in different arenas. Flipkart thrives on value-driven deals and lightning-fast deliveries, making it the go-to choice for budget-conscious buyers and Tier-2 shoppers. Amazon, with its wider seller ecosystem and premium product focus, captures steady growth across a longer festive cycle, appealing to brand-loyal and high-spending consumers.

For buyers, this season offers unmatched value—stacked discounts, UPI cashback, and faster delivery options than ever before. For sellers, the decision comes down to strategy: Flipkart for scale in mass categories, Amazon for premium reach and long-tail sales. And for marketers and affiliates, this is the biggest traffic and monetization opportunity of the year, as millions of Indians head online to shop.In the end, the real winners are the consumers and digital entrepreneurs who leverage this e-commerce boom to save money, drive growth, and build new revenue streams.

References & Sources

(All data and insights compiled from reputable industry reports, media coverage, and official releases as of October 2025.)

- RedSeer Consulting (2025) – Festive Season E-commerce Trends in India: GMV Outlook & Category Insights

- Statista India E-commerce Data (2024–2025) – Gross Merchandise Value and Consumer Behavior Reports

- NPCI (National Payments Corporation of India) – UPI Transaction Statistics, October 2024

- Amazon India Press Release (October 2024) – Great Indian Festival 2024 Performance & Seller Growth Metrics

- Flipkart Big Billion Days 2024 Report (Media Release) – Consumer Engagement, Sales Volume, and Partner Bank Offers

- ETtech / Economic Times – Festive Sale Battle: Flipkart vs Amazon Market Share Insights, 2024–25

- Business Standard & Mint Reports (2025) – E-commerce Growth and Tier-2 Penetration Trends

- Bain & Company India E-retail Report (2024) – Digital Adoption, Payment Trends & BNPL Evolution

- YourStory & Inc42 (2025) – Quick Commerce and Last-mile Delivery Innovations During Festive Season

- Deloitte India (2025) – Festive Shopping Consumer Survey and Spending Behavior