Estimated Reading Time: 14-16 minutes ( 2,760 words)

Introduction

Imagine transferring money across borders in seconds, paying for groceries without waiting for settlement, or a business receiving funds instantly after invoicing. This is the promise of real-time payments (RTP)—a system that processes transactions 24/7/365 in seconds, not days.From India’s UPI, which has redefined digital payments, to Brazil’s PIX and Europe’s SEPA Instant, RTP adoption is soaring. But what does this mean for businesses, banks, and consumers by 2030? And which countries are leading today? Let’s dive in.

This blog will give you a clear, data-driven understanding of real-time payments (RTP) — from global leaders like India’s UPI and Brazil’s PIX to upcoming systems like FedNow and SEPA Instant. You’ll learn why RTP matters, how it’s disrupting traditional payments, and what businesses must do to prepare for 2030. By the end, you’ll walk away with practical strategies to future-proof your company’s payment systems.

Traditional payment systems — cards, NEFT, ACH, and SWIFT — often come with high fees, delayed settlements, and outdated processes. In a fast-moving digital economy, these inefficiencies hurt both businesses and consumers. Delayed cash flow means lost opportunities. High fees eat into profits. Slow remittances weaken global trade. As digital adoption soars and cross-border commerce grows, the need for instant, reliable, low-cost payments has never been greater. RTP is emerging as the solution — but adoption, risks, and strategies vary by market, making it essential for decision-makers to stay informed.

What if every payment you sent — whether across the street or across the globe — settled instantly, with no delays, no hidden costs, and complete transparency? That future is no longer science fiction — it’s happening now with real-time payments, and by 2030, it could become the global standard for money movement.

What Are Real-Time Payments?

Real-Time Payments (RTP) are instant, digital transactions where money is transferred between two parties and settled within seconds—available 24 hours a day, 365 days a year. Unlike traditional payment methods (such as NEFT, ACH, or card settlements) that can take hours or even days, RTP ensures both the payer and the payee receive immediate confirmation.

RTP vs. Traditional Payments

| Feature | Traditional (ACH/NEFT/Checks) | Real-Time Payments (RTP) |

| Settlement Time | Hours to days | Seconds |

| Availability | Banking hours | 24/7/365 |

| Confirmation | Delayed | Instant |

| Cost per Transaction | Moderate to high (esp. cards) | Low to zero |

| Data Support | Limited | ISO 20022 (rich data) |

Latest Global RTP Market Trends (2025)

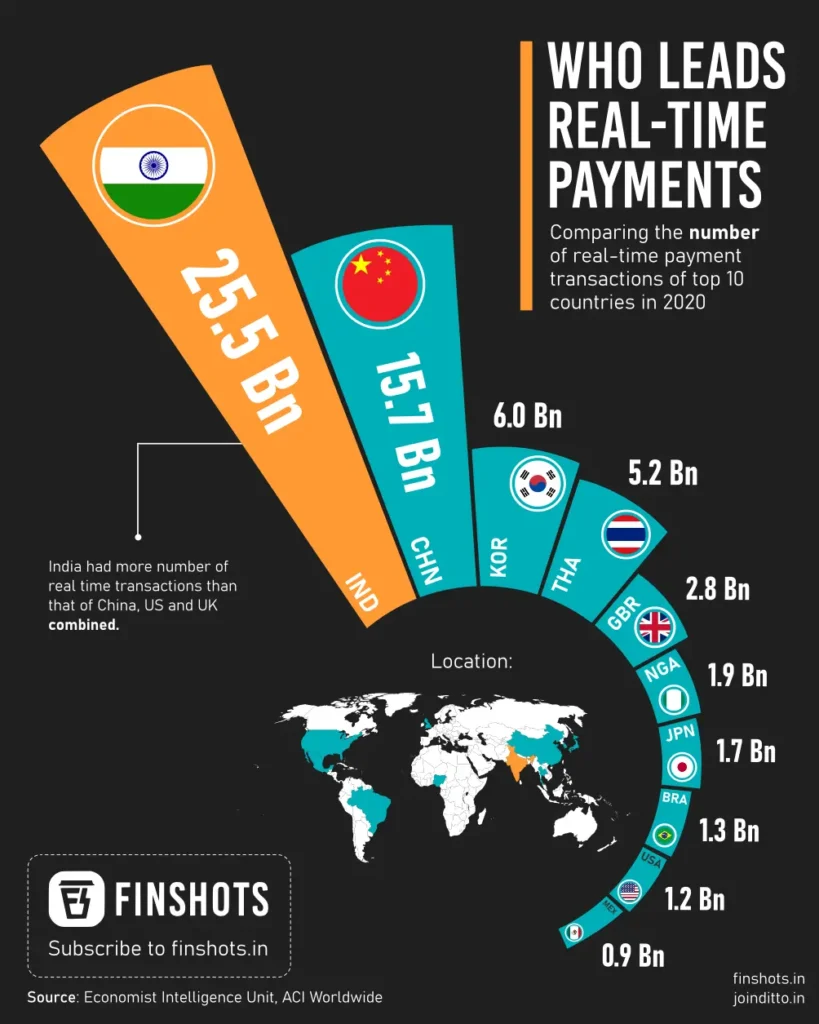

- Global Scale: RTP processed 266B+ transactions in 2023 (+42% YoY) and is projected to hit 575B by 2028; market size may reach USD 193B by 2030 (CAGR ~35%).

- India (UPI): Still the global leader, with 20B+ monthly transactions (Aug 2025) worth ₹24.8 lakh crore; accounts for ~49% of worldwide RTP volume.

- Brazil (PIX): Adopted by 150M+ users (~70% of adults) in under 5 years, becoming a model for emerging markets.

- China: Alipay/WeChat Pay dominate domestic RTP; digital yuan pilots expand reach.

- Europe & USA: SEPA Instant gaining traction; EU mandates by 2027. FedNow (USA) is still early but growing.

- Trends Driving Growth: Mobile/QR adoption, government mandates, low fees, credit-on-RTP (e.g., UPI Credit Lines), and cross-border corridors.

- Challenges: Fraud risk, regulation shifts, and interoperability remain key hurdles.

Quick Stat: India, Brazil, and China together handle ~75% of global RTP transactions in 2025.

India’s UPI: The Global Benchmark

- Volume: 20B transactions in Aug 2025 worth ₹24.8 lakh crore.

- Features: UPI Autopay, UPI 123PAY (feature phone), Credit on UPI, cross-border corridors.

- Global Expansion: Accepted in UAE, Singapore, Mauritius, France, Nepal, Bhutan, Sri Lanka.

Other Leading RTP Markets

While India’s UPI dominates, several other countries have built successful real-time payment systems that are shaping the global landscape.

🇧🇷 Brazil – PIX

- Launch & Adoption: Introduced by the Central Bank of Brazil in 2020, PIX is now a household standard.

- Users: Over 150 million Brazilians use PIX, representing ~70% of the population.

- Use Cases: From small P2P transfers to retail purchases and government payments.

- Impact: Cash use has dropped significantly; PIX has become the default digital payment option, even for street vendors.

🇨🇳 China – Alipay, WeChat Pay & Digital Yuan

- Market Penetration: Alipay and WeChat Pay together serve 1.3B+ users, effectively functioning as real-time payment ecosystems.

- Integration: Linked to everything — shopping, transport, utilities, even social media.

- Digital Yuan Pilot: The e-CNY (central bank digital currency) is being tested for retail and cross-border use, potentially blending CBDC with RTP networks.

🇪🇺 Europe – SEPA Instant Credit Transfer (SCT Inst)

- Coverage: Available across 29 European countries.

- Adoption: Still lower compared to Asia and LATAM, but growing steadily.

- Policy Push: The European Commission has mandated full RTP adoption by 2027, which will make instant payments standard for EU citizens and businesses.

- Business Angle: RTP expected to improve intra-EU trade efficiency and reduce reliance on card networks.

🇺🇸 United States – FedNow & The Clearing House RTP

- FedNow Launch: Introduced in July 2023 by the Federal Reserve.

- Adoption: Still in early stages, as banks and credit unions gradually onboard.

- Parallel System: The Clearing House RTP (2017) already serves some large banks, but adoption is limited.

- Outlook: By 2030, RTP volumes in the U.S. are projected to surpass 25B transactions annually, though the country lags Asia and LATAM in penetration.

Business Benefits of RTP Systems

Real-time payments are not just about convenience for consumers — they unlock major advantages for businesses, from small retailers to global enterprises.

1. Instant Liquidity & Cash Flow

- Benefit: Payments settle in seconds, so businesses don’t wait days for funds (unlike NEFT, ACH, or card settlements).

- Impact: Better cash flow management, reduced need for working capital loans, and faster reinvestment into operations.

- Example: E-commerce stores using UPI or PIX receive money instantly, enabling them to restock inventory faster.

2. Lower Transaction Costs

- Benefit: Many RTP systems (like India’s UPI or Brazil’s PIX) have zero or very low MDR (merchant discount rates).

- Impact: Saves businesses significant amounts compared to card networks that charge 1–3% fees.

- Example: A retail chain processing ₹10 crore monthly can save lakhs in fees by shifting transactions to RTP.

3. Better Customer Experience (CX)

- Benefit: Customers enjoy seamless, instant checkout and faster refunds.

- Impact: Higher trust, repeat purchases, and improved NPS (Net Promoter Score).

- Example: Instant refunds in travel bookings or e-commerce builds loyalty.

4. Cross-Border Trade Opportunities

- Benefit: Emerging RTP corridors (e.g., India–Singapore UPI link, EU’s SEPA Instant, China’s e-CNY pilots) reduce reliance on costly SWIFT transfers.

- Impact: Businesses save on forex fees and settlement delays, making international trade more efficient.

5. Data-Rich Transactions & Automation

- Benefit: RTP systems use ISO 20022 messaging, carrying invoice-level details.

- Impact: Automates reconciliation, reduces accounting errors, and strengthens compliance/audit processes.

- Example: Enterprises can match thousands of payments to invoices automatically, cutting manual effort.

6. Competitive Advantage & Innovation

- Benefit: Businesses offering RTP are perceived as modern and customer-friendly.

- Impact: Competitive edge over rivals sticking to older payment methods.

- Example: Food delivery apps in India prioritize UPI because it ensures instant pay-ins for drivers and frictionless checkout for users.

Challenges & Risks Ahead

While real-time payments (RTP) are revolutionizing money movement, they also introduce new complexities and risks. For businesses, banks, and policymakers, understanding these hurdles is critical for sustainable growth.

1. Fraud & Cybersecurity Threats

- Issue: Instant settlement leaves no time to reverse fraudulent transactions.

- Common Risks: Phishing scams, fake QR codes, social engineering, and account takeovers.

- Impact: Consumers may lose trust; businesses risk chargebacks and compliance issues.

- Example: In India, UPI-related fraud complaints are among the fastest-growing categories in digital crime reports.

2. Infrastructure & Scalability

- Issue: Not all countries have the robust digital and telecom infrastructure that systems like UPI or PIX rely on.

- Impact: Outages, transaction delays, and failed payments can undermine reliability.

- Example: Some U.S. banks were slow to adopt FedNow due to integration costs and legacy system limitations.

3. Interoperability & Cross-Border Barriers

- Issue: Most RTP systems are domestically focused and not fully interoperable across countries.

- Impact: Limits use in cross-border trade and remittances, where SWIFT and card rails still dominate.

- Progress: Initiatives like UPI–Singapore PayNow and EU SEPA Instant are promising, but coverage is still patchy.

4. Regulatory & Policy Uncertainty

- Issue: Governments regulate MDR fees, transaction limits, and data sharing. Sudden policy changes can disrupt growth.

- Impact: Businesses face uncertainty in pricing models and compliance costs.

- Example: India’s zero-MDR policy on UPI boosts adoption but limits merchant incentive for some players.

5. Business Model Sustainability

- Issue: Many RTP systems are low-fee or free at consumer level.

- Impact: Banks, fintechs, and payment providers must find alternative revenue models (e.g., lending, data services, premium APIs).

- Risk: Without sustainable economics, innovation may slow.

6. Consumer Awareness & Protection

- Issue: Many first-time digital payment users don’t fully understand fraud risks.

- Impact: Misuse can lead to financial losses, eroding confidence in RTP.

- Need: Stronger consumer education, transparent dispute mechanisms, and better fraud-detection tools.

10-Year Outlook: RTP in 2030

- RTP expected to become default for B2C + B2B payments.

- India, Brazil, and China remain growth leaders.

- Cross-border RTP corridors expand globally.

- CBDCs (digital rupee, yuan, euro) coexist with RTP, adding programmability.

- RTP transaction value projected >$15 trillion globally by 2030.

FAQs Section

1. What is the biggest real-time payment system in the world?

India’s Unified Payments Interface (UPI) is the world’s largest and most advanced real-time payment network.

- Scale: As of August 2025, UPI handled 20 billion+ monthly transactions, worth ₹24.8 lakh crore (~USD 300B+).

- Market Share: UPI accounts for nearly half of all global RTP volumes (~49%).

- Adoption: UPI is supported by 688+ banks, integrated with top apps (PhonePe, Google Pay, Paytm), and expanding internationally (UAE, Singapore, France, Mauritius, Sri Lanka, Nepal, Bhutan).

- Benchmark: Because of its interoperability, low cost, and ecosystem (QR codes, Autopay, Credit on UPI), UPI is often cited as the blueprint for RTP worldwide.

2. Which country has the fastest RTP adoption?

Brazil’s PIX has set global records for adoption speed.

- Launch: Introduced in November 2020 by the Central Bank of Brazil.

- Adoption: Reached 150M+ users (70%+ of adults) within 5 years.

- Use Cases: Used for P2P, P2M, utility payments, and even taxes.

- Impact: PIX has rapidly replaced cash for everyday purchases — even street vendors and small shops now accept PIX.

- Lesson: Government-backed innovation + free access = explosive adoption.

3. Will cards disappear by 2030?

Cards will not fully disappear, but their relevance will decline significantly.

- Debit Cards: Most vulnerable, as RTP is faster, cheaper, and offers real-time settlement.

- Credit Cards: Likely to remain due to rewards programs, EMI features, and global travel acceptance.

- Hybrid Future: RTP rails (like UPI) are already enabling Credit-on-UPI, which combines the best of both worlds.

- Projection: By 2030, RTP could replace 40–60% of debit card transactions in markets like India and Brazil, while credit cards survive in premium/lending niches.

4. Is RTP cheaper than cards?

Yes, dramatically.

- Cards: Typically charge 1–3% MDR (merchant discount rate), cutting into margins.

- RTP Systems: Many operate with zero MDR (India’s UPI, Brazil’s PIX) or very low fees, making them much more merchant-friendly.

- Business Advantage: A retailer processing ₹10 crore/month via cards could save ₹20–30 lakh annually by shifting to RTP acceptance.

- Consumer Side: No hidden charges, instant settlement, and transparency make RTP more attractive.

5. How does RTP impact cross-border trade?

RTP is reshaping global commerce by enabling faster, cheaper remittances and reducing reliance on SWIFT.

- Examples:

- India–Singapore PayNow–UPI corridor allows instant transfers.

- EU’s SEPA Instant improves intra-Europe trade.

- China’s e-CNY pilots explore international CBDC settlements.

- Impact: Small exporters, freelancers, and gig workers gain from faster settlements and lower forex costs, while corporates benefit from improved working capital cycles.

6. What’s the role of CBDCs (Central Bank Digital Currencies)?

CBDCs will complement, not replace RTP systems.

- Programmability: Governments can set rules on how money is used (e.g., subsidies, welfare spending).

- Offline Payments: CBDCs can work without internet, filling RTP gaps.

- Cross-Border Potential: CBDC pilots (India’s e-rupee, China’s e-CNY, EU’s digital euro) aim to make remittances cheaper and interoperable.

- Integration: Most central banks plan for CBDCs to coexist with RTP rails, not replace them.

7. Which regions are lagging in RTP adoption?

- Africa: Nigeria (NIBSS Instant Payments) and Egypt are exceptions, but most African nations are still cash-heavy.

- USA: FedNow launched in 2023, but adoption is slow due to fragmented banking systems and legacy infrastructure.

- Europe: SEPA Instant exists but adoption is uneven; full coverage only expected by 2027 due to regulatory push.

8. How safe is RTP?

- Technology: RTP networks use end-to-end encryption and strong authentication.

- Risk: Fraud risk is higher because transactions are instant and irreversible.

- Common Threats: Phishing, QR code scams, social engineering, and account takeovers.

- Mitigation: Two-factor authentication, transaction alerts, AI-driven fraud detection, and user education are critical.

- Example: India’s UPI has rolled out UPI Lite and limits to minimize small-ticket frauds.

9. Will RTP replace SWIFT?

- Domestic: Yes — RTP has already replaced legacy rails like ACH, NEFT, and checks in many markets.

- Cross-Border: Not fully, at least not yet. SWIFT still dominates high-value, multi-currency corporate transfers.

- Future: A hybrid model is emerging — domestic RTP systems linked by cross-border corridors (e.g., UPI–PayNow, SEPA, PIX international expansion). Over time, RTP + CBDCs could reduce SWIFT’s monopoly in remittances.

10. What should businesses do today?

To stay ahead, businesses should:

- Integrate RTP acceptance (UPI, PIX, FedNow, SEPA Instant) into checkout and invoicing.

- Automate reconciliation using ISO 20022 data standards.

- Educate customers on fraud risks and safety measures.

- Explore cross-border RTP corridors for exports, freelancing, and gig payments.

- Prepare for CBDC pilots to stay future-ready.

Summary / Key Takeaways

The global payments ecosystem is undergoing a historic transformation with the rapid rise of real-time payments (RTP) — systems that enable instant money transfers, 24/7, across banks and borders. By 2025, RTP networks such as India’s UPI, Brazil’s PIX, China’s Alipay/WeChat Pay, and Europe’s SEPA Instant are setting new benchmarks for speed, inclusion, and affordability. India continues to dominate the RTP landscape, contributing nearly half of global RTP volumes, while Brazil’s PIX has achieved one of the fastest adoption rates worldwide. The U.S. is still catching up through FedNow, and Europe is expected to reach full RTP coverage by 2027.

For businesses, the implications are profound. Instant liquidity, lower transaction costs, and enhanced customer experience are driving adoption across sectors — from e-commerce and retail to cross-border trade. With ISO 20022 data standards, RTP also brings automation to reconciliation and compliance, creating operational efficiencies that older payment systems cannot match. Small and mid-sized enterprises especially benefit from real-time settlements that improve cash flow, enabling faster reinvestment and growth.

However, this new financial infrastructure also brings challenges. Fraud risk, interoperability gaps, and regulatory uncertainties remain key hurdles to global RTP expansion. Fraud prevention tools, stronger consumer awareness, and sustainable fee models will be critical as transaction volumes surge toward an estimated $15 trillion by 2030. The integration of CBDCs (Central Bank Digital Currencies) with RTP systems could further accelerate this transformation, creating programmable, transparent, and borderless payment ecosystems.

By 2030, real-time payments are expected to become the default mode of money movement worldwide, gradually reducing reliance on cards, checks, and legacy networks like SWIFT. Businesses that adopt RTP early will gain a decisive competitive advantage—unlocking liquidity, enhancing customer trust, and future-proofing operations for the next decade of digital finance.

Conclusion

Real-time payments (RTP) are no longer a fintech buzzword — they represent a fundamental shift in how money moves globally. What started as pilot projects in India, Brazil, and a handful of other markets has now grown into a worldwide transformation, reshaping how individuals, businesses, and governments exchange value.

By 2030, RTP will likely become the default payment method in many countries, reducing dependence on cards, checks, and slow settlement systems. For businesses, this isn’t just about faster transactions — it’s about:

- Unlocking liquidity through instant settlements.

- Building customer trust with smoother, safer payment experiences.

- Tapping into cross-border markets without relying solely on expensive legacy rails like SWIFT.

- Leveraging data-rich payments to automate accounting, compliance, and reconciliation.

At the same time, challenges like fraud risks, regulatory uncertainty, and interoperability remain. Businesses that act early will be in the best position to adapt to these hurdles while enjoying first-mover advantages.

If you’re serious about future-proofing your business, the time to adopt RTP is now. Whether you’re an e-commerce brand, a global exporter, or a local retailer, real-time payments will define how you scale in the digital economy of 2030 and beyond.

References & Sources

- ACI Worldwide & GlobalData (2024) – Prime Time for Real-Time Payments Report (Global RTP Transaction Data 2023–2024).

🔗 www.aciworldwide.com - National Payments Corporation of India (NPCI) – UPI Monthly Statistics & Credit on UPI Updates (2025).

🔗 www.npci.org.in - Central Bank of Brazil (Banco Central do Brasil) – PIX Usage Data and Adoption Reports (2020–2025).

🔗 www.bcb.gov.br - European Central Bank (ECB) – SEPA Instant Credit Transfer Framework & EU 2027 Mandate.

🔗 www.ecb.europa.eu - U.S. Federal Reserve – FedNow Service Launch and RTP Ecosystem Reports (2023–2025).

🔗 www.frbservices.org - World Bank & IMF Digital Payments Index (2024) – Real-Time Payments and Financial Inclusion.

🔗 www.worldbank.org - McKinsey & Company (2024) – Global Payments Report: The Rise of RTP & Instant Liquidity Models.

🔗 www.mckinsey.com - Capgemini (2025) – World Payments Report: The Future of Instant and Cross-Border Payments.

🔗 www.capgemini.com - Boston Consulting Group (BCG, 2025) – Real-Time Payments, CBDCs, and the Future of Money Movement.

- ISO 20022 Standards Body (SWIFT) – Next-Generation Messaging for Real-Time Payments & Automation.

🔗 www.swift.com